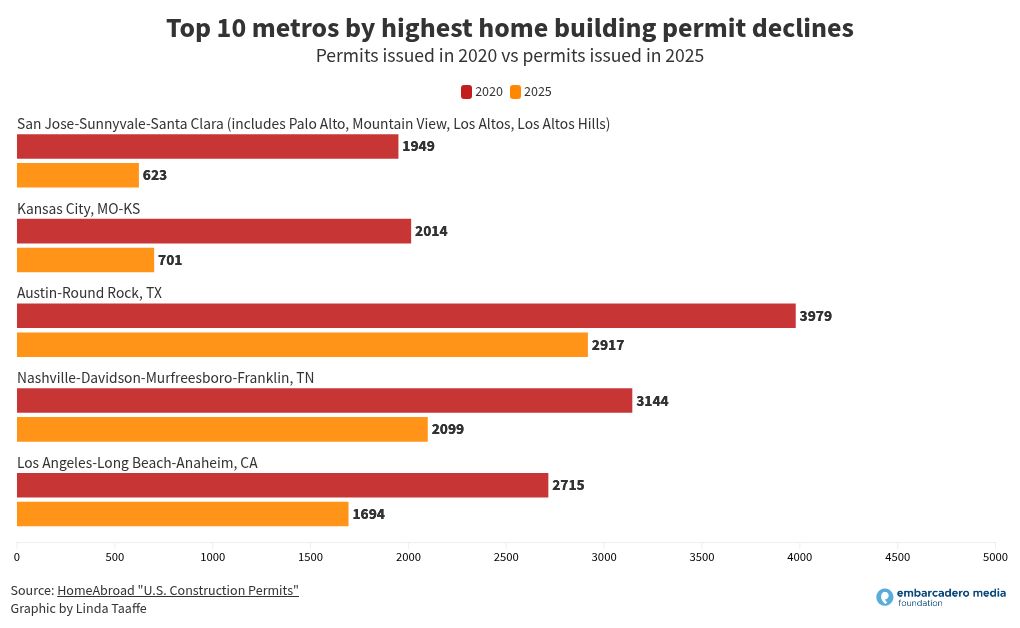

Home building Permits in San Jose’s greater metro area dropped from 1,949 to 623 between July 2020 and July 2025, marking the largest downturn compared to the nation’s biggest metro areas in the same timeframes. Photo courtesy Getty Images.

Home building Permits in San Jose’s greater metro area dropped from 1,949 to 623 between July 2020 and July 2025, marking the largest downturn compared to the nation’s biggest metro areas in the same timeframes. Photo courtesy Getty Images.

Key highlights

61 of 100 metros nationwide permitted fewer total units in 2025 vs 2020; among those decliners, the median drop was 32.3%.

Permits in San Jose’s greater metro area dropped 68%, from 1,949 to 623, marking the largest downturn nationwide.

1-unit permits rose in only 31 metros (median 39.8% among risers), highlighting concentrated single-family activity.

5+ unit permits declined in 46 metros (median 70.7% drop), signaling a substantially thinner multifamily pipeline.

San Jose and its greater metro region that includes Palo Alto, Mountain View, Los Altos and Los Altos Hills has taken the top spot in housing — but the data is nothing to brag about.

The San Jose-Sunnyvale-Santa Clara metro area, which encompasses Santa Clara and San Benito counties, took the No. 1 spot for the biggest decline in home building permits at 68% when comparing data from July 2020 and 2025, according to a recent report from New York-based HomeAbroad. Permits dropped from 1,949 to 623, the largest downturn compared to the nation’s biggest metro areas in the same timeframes.

The Kansas City area ranked second with 2,014 permits in 2020 to 701 permits in 2025, Austin-Round Rock ranked third at 3,979 to 2,917, the Nashville area came in fourth at 3,144 to 2,099 and the Los Angeles area ranked fifth at 2,715 to 1,694.

The analysis examined U.S. Census Bureau building permits survey data for the top 100 metropolitan areas by population.

Developers say high market prices, city fees to blame

Silicon Valley advocates and developers said the drop is indicative of high market prices and city fees leading to less housing development in a region that needs it.

Erik Hayden, founder of Urban Catalyst, said the data isn’t surprising because Silicon Valley is one of the most expensive places to build, with city fees costing between $50,000 and $120,000 per market-rate home. He said that means the breaks cities give developers aren’t really breaks when the area charges 10 times the rest of the country. Coupled with high inflation and interest rates after the pandemic, he said it leads to fewer permit submittals.

“Cities went, ‘These developers are making all the money … We’ll solve the housing crisis by making them pay for it,’” Hayden told San José Spotlight. “All that does is make it so our projects don’t pencil out, we don’t build any units and now you’re in double trouble. Now there’s no market or below-market (homes built).”

The data emphasizes those challenges.

The report also places the San Jose metro area in the No. 1 spot for the highest declines in five-plus multifamily home building permits, dropping drastically from 1,697 permits in July 2020 to 449 in 2025, or 74%. The Los Angeles metro area ranked second, dropping from 1,728 permits to 556, or a 68% decline.

Marika Krause, spokesperson for San Jose’s planning, building and code enforcement department, said the city has implemented some breaks for developers, including the multifamily development incentive programs that reduced construction taxes and inclusionary housing and parks fees. She said the city will focus on housing in its general plan review, adding market conditions and costs make it difficult to spur development.

“It’s created a perfect storm that makes it tough for investors to make projects pencil out,” Krause told San José Spotlight. “The study … shows this isn’t just happening in our city. It’s something our region is grappling with. We’re committed to doing everything we can to make it easier and more appealing to build here.”

Building incentives ‘not enough’ to address crisis

Housing advocates said giving developers incentives is good, but it’s not enough to address the housing crisis. San Jose, Sunnyvale and Santa Clara, the three largest cities in Santa Clara County, need to build 62,200, 11,966 and 11,632 homes respectively by 2031 to meet state housing mandates. Palo Alto is required to plan for 6,086 new housing units by 2031, and Mountain View is required to plan for over 11,000.

Alex Shoor, executive director of nonprofit Catalyze SV, said cities must do more than offer the financial breaks they’ve already given to combat poor market conditions.

“Local governments need to do as much as they can to build the amount of housing needed because the problem continues to get worse,” he told San José Spotlight. “It’s getting harder and harder every single day, every single year we don’t build the housing.”

Beyond Santa Clara County

The San Jose metro area isn’t the only region struggling with housing production in California.

Ali Sapirman, Housing Action Coalition advocacy and policy manager, said housing production and permitting has slowed statewide because of the market. They said that means now is a time to improve governmental processes needed for development so when the market returns, it’s easy to push housing through. They added San Jose has been a leader on that front, using artificial intelligence to assess backyard homes.

“That’s really the next path, meeting the moment of where we are with technology — not to replace or displace workers, but to supplement the technology that staff and planners have in order to streamline permitting,” Sapirman told San José Spotlight.

It’s not all doom and gloom in local housing. Hayden said he sees signs the market is bouncing back, including banks calling him to invest in projects.

“Real estate typically goes in cycles,” he said. “Hopefully two years from now, permits (will) have shot up, and we credit cities for streamlining permitting and doing small fee reductions to make it happen.”

Contact Annalise Freimarck at annalise@sanjosespotlight.com or follow

@annalise_ellen on X.

Embarcadero Media Real Estate Editor Linda Taaffe contributed to this story.

Most Popular