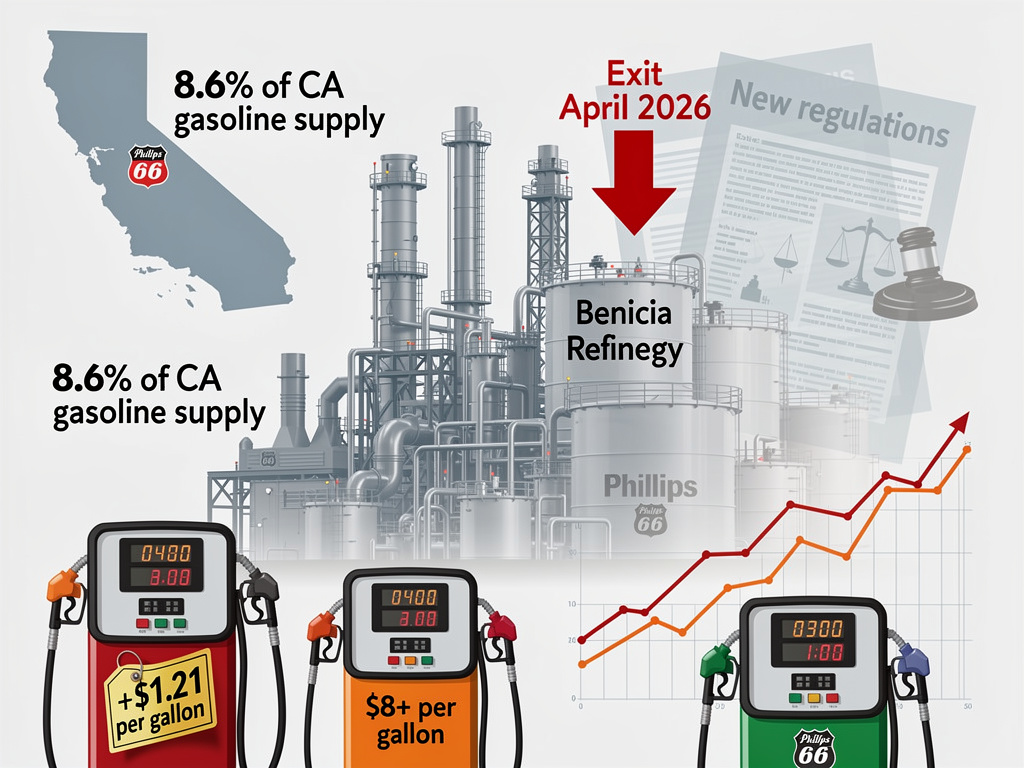

California’s energy sector is reeling from Valero Energy Corp.’s decision to shutter its Benicia refinery by April 2026, a move that underscores the mounting toll of stringent state regulations on the industry’s viability. The Texas-based refiner announced it would absorb a staggering $1.1 billion write-down rather than navigate Governor Gavin Newsom’s escalating mandates, citing prohibitive costs and regulatory pressures. This closure eliminates 8.6% of the state’s gasoline production capacity overnight, threatening severe supply disruptions and price surges for drivers already burdened by the nation’s highest fuel costs.

The Benicia facility, processing 145,000 barrels of crude oil daily into gasoline, diesel, jet fuel, and asphalt, has been a cornerstone of Solano County’s economy since Valero acquired it in 2000. Its impending idling will axe 400 direct jobs and 200 contractor positions, while slashing 17% of Benicia’s municipal budget. Local leaders, including City Manager Mario Guiliani, expressed shock, likening the blow to the devastating Mare Island naval shipyard closure in nearby Vallejo. “I would have been more prepared for a sale. I am surprised that they are suggesting a complete closure and ceasing operations,” Guiliani told ABC7 News.

Assembly Republican Leader James Gallagher lambasted the development as a direct consequence of Newsom’s policies. “Once again, Californians are paying the price for Newsom’s incompetence and self-serving attacks on energy producers. Unless the state changes course, the job losses and gas price increases are only going to get worse,” Gallagher stated. This sentiment echoes across the state as Phillips 66’s parallel closure of its Los Angeles-area Wilmington refinery this December compounds the crisis, erasing another chunk of refining capacity.

Regulatory Onslaught Pushes Refiners to the Brink

Valero’s retreat stems from years of intensifying oversight, including an October fine of nearly $82 million—the largest ever levied by the Bay Area Air Quality Management District—for violations dating back to 2003. Inspectors uncovered unreported toxic emissions, including cancer-causing benzene from the refinery’s hydrogen system, which management allegedly knew about for two decades. Such penalties, coupled with a recent lawsuit settlement over environmental infractions, have rendered operations untenable. “This follows years of regulatory pressure, significant fines for air quality violations, and a recent lawsuit settlement related to environmental concerns,” Valero stated in its announcement to ABC7 News.

Newsom’s administration has championed aggressive carbon-neutrality goals, including the California Air Resources Board’s (CARB) measures that impose escalating fees on fuel producers to deter fossil fuel reliance. These policies, enacted without voter approval, are projected to add 65 cents per gallon by design. Critics argue they prioritize ideology over reliability, forcing refiners into a corner where multimillion-dollar compliance upgrades pale against the profitability of exit. Phillips 66’s Wilmington shutdown, set for December 2025, similarly reflects this exodus, as detailed in a UC Berkeley Energy Institute at Haas analysis warning of an 18% statewide capacity drop.

The governor’s response has been swift but defensive. At a press conference, Newsom vowed an “all hands” effort to mitigate “market disruption,” yet offered no concessions on the regulatory framework driving the closures. Benicia Mayor Steve Young emphasized community collaboration, stating, “Valero has long been a part of Benicia’s identity and economy, and today’s news is deeply impactful for our entire community.”

Economists Forecast Price Shockwaves

University of California, Davis economists project an immediate 40-cent-per-gallon hike upon Phillips 66’s closure, followed by 81 cents more when Valero pulls the plug—totaling $1.21 extra per gallon by August 2026. For a typical 15-gallon tank, that translates to a leap from $70 to at least $95 per fill-up. Stanford Energy Institute models paint an even grimmer picture, forecasting spikes to $8 per gallon amid supply interruptions in California’s isolated market, which relies heavily on in-state refining due to limited pipelines.

UC Berkeley’s Severin Borenstein, a veteran tracker of state energy markets, cautions of “severe gasoline shortages with unprecedented price increases.” His warnings align with U.S. Energy Information Administration projections of West Coast vulnerabilities, as noted in their Today in Energy report. These closures reduce California’s refining slate by 17% within months, per OPIS data in their insight piece, amplifying risks from any global crude volatility or refinery outages elsewhere.

Posts on X from industry watchers amplify the alarm. One highlighted Valero’s $1.1 billion loss as evidence of a “seriously broken” system, noting the refinery’s role in 9% of state gasoline output. Broader sentiment ties this to Democratic policies, with users decrying Newsom’s CARB expansions as tyrannical overreach.

Local Economies Brace for Fallout

In Benicia, the refinery’s footprint extends beyond payroll. It funds school events, youth sports, and local businesses like Elviarita’s Cantina, where manager Brittany Hodgkinson relies on worker patronage. “Just hoping that someone comes in and buys the refinery and keeps us going. That’s about it,” she told ABC7 News. Guiliani warned of a budget crisis starting May 2026, potentially mirroring Vallejo’s post-Mare Island decline into fiscal distress.

Statewide, the dual closures signal a refining desertification. Reuters reports a rush to build fuel pipelines to the West Coast, with Phillips 66 and Kinder Morgan proposing a line from Missouri by 2029 to offset imports, as covered in their dispatch. Yet near-term gaps loom large, with lawmakers invoking national security amid potential shortages.

Politico’s deep look inside Phillips 66’s shutdown reveals ripple effects on laid-off workers and communities, underscoring how closures transcend balance sheets into human costs, per their newsletter.

Rush to Mitigate Impending Shortages

Governor Newsom’s team is scrambling for import alternatives, but California’s geographic isolation—lacking robust interstate pipelines—means reliance on costlier marine shipments prone to delays. SFGate warns the Benicia exit alone could deliver a “huge blow” to drivers, with experts eyeing 2026 as a tipping point, as in their coverage.

Inside Climate News probes Phillips 66’s Los Angeles cleanup liabilities, advocating pre-funded decommissioning plans amid community distrust over pollution legacies, detailed here. Republican voices, including those in ABC10 reports, frame it as an “affordability and national security crisis,” per their article.

As California’s refining muscle atrophies under regulatory strain, the path forward hinges on policy reversal or painful adaptation. With economists unanimous on the price pain ahead, the state’s energy future hangs in precarious balance.