A

CoStar report says the market will benefit from the big game, but it may be more muted than it was 10 years ago.

SAN

FRANCISCO — While the San Francisco hotel market is expected to benefit from

hosting the Super Bowl next February, forecasts are conservative compared to

when the city hosted the event 10 years ago, which highlights the market’s

struggles post-COVID, according to analysis from CoStar.

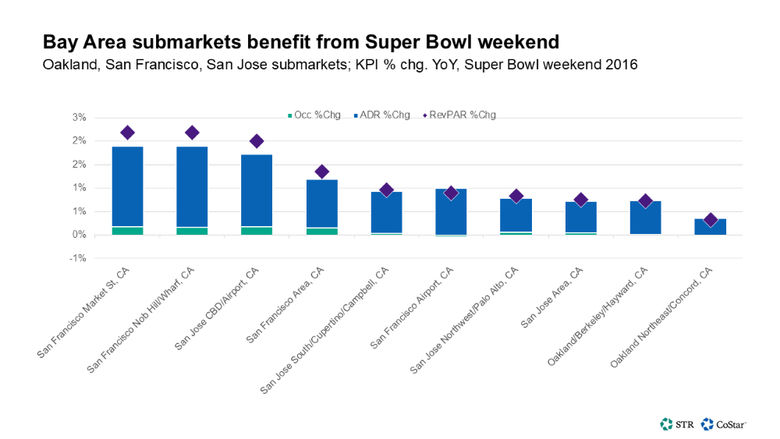

San

Francisco last hosted the Super Bowl at Levi’s Stadium in Santa Clara,

California, in 2016 and saw a significant lift in hotel performance with a

reported 30% increase in RevPAR ($198), occupancy hitting 81%, and ADR climbing

to $244.36. Those numbers jumped even higher over the weekend of the game in

occupancy (82%), ADR ($453) and RevPAR ($370).

Because

Levi’s Stadium sits about 40 miles from San Francisco’s downtown, the analysis

said nearby cities such as San Jose benefited even more from the Super Bowl,

with the city’s ADR surging 139% the day before the game and RevPAR increasing

162%.

While San

Francisco hotels are expected to deliver strong results in February, the week

of the game, the forecasts have been more muted this year. Room rates are projected to rise 37% year-over-year, which would fuel a 47% RevPAR increase.

That increase would translate to an ADR of $293.69 and RevPAR of $192.81 for

the month. While those numbers would be beneficial, they would reflect a 19%

decrease in occupancy and a 3% decrease in RevPAR compared to 2016, while ADR

would increase by 20%.

San

Francisco has struggled as a market post-COVID. Still, there have been many

signs of optimism this year that the hotel market is starting to rebound after

bottoming out last year, as illustrated by a JLL study earlier this year. The

study showed that the rebound was driven by improved convention center

performance, a resurgence of international demand and big upcoming events. The

burgeoning AI sector in the city also has many experts and investors optimistic

about the city’s hospitality future.

The CoStar

analysis said San Francisco has seen a strong rebound this year and is leading

the top 25 U.S. markets through October year-to-date with impressive gains in

occupancy (+4.9%), ADR (+5.9%) and RevPAR (+11.3%).

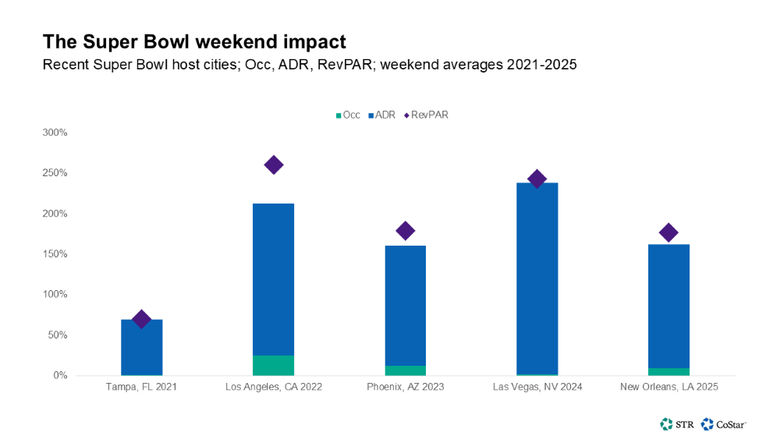

The analysis

says supply can also play a key role in occupancy projections. For example, New

Orleans, last year’s Super Bowl host city, saw a 51% RevPAR increase YOY and a

nearly 96% actualized occupancy on game night, resulting in an ADR of $810. San

Francisco has a supply roughly 20% larger than New Orleans (and a more spread-out

area), which can make demand benefits harder to concentrate.