California Water Service Group (CWT) has reported Q2 2025 revenue growth, launched a significant wastewater project in San Bernardino County, and announced a special dividend. The company is also seeking higher revenues through its 2024 rate case.

See our latest analysis for California Water Service Group.

California Water Service Group’s recent moves, including expanding its infrastructure footprint and declaring a special dividend, have caught investors’ attention, and that momentum is showing up in the numbers: the 30-day share price return sits at 6.8%, helping push the year-to-date share price up by over 8%, even as the 1-year total shareholder return remains in negative territory. Volatility aside, the company’s combination of capital investments and rate case prospects is fueling renewed optimism for long-term growth.

If you’re looking beyond utilities, now’s a great time to expand your watchlist and discover fast growing stocks with high insider ownership.

The real question for investors now is whether California Water Service Group’s recent advances signal untapped value at today’s price, or if the market has already priced in all of the company’s forward growth potential.

Most Popular Narrative: 12.5% Undervalued

California Water Service Group’s fair value is set at $55.50, which is above its last close at $48.54. This gap highlights the potential future impact of ongoing infrastructure expansion and regulatory developments.

Accelerating capital investment in water infrastructure and modernization, driven by increasing water scarcity, climate adaptation needs, and urban population growth, positions Cal Water to expand its regulated rate base by a projected approximately 12% CAGR. This is expected to support sustained long-term revenue and cash flow growth. Expansion into high-growth areas such as Texas and the development of large-scale reuse projects like Silverwood create a pathway for customer base expansion and incremental capital deployment, which is expected to drive future top-line and earnings growth.

Want to know what kind of growth targets justify that price? Behind this valuation are bold forecasts for both earnings momentum and margin upside. The narrative relies heavily on strong long-term expansion opportunities. Explore further to see the detailed assumptions supporting these expectations.

Result: Fair Value of $55.50 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, ongoing regulatory delays and rising compliance costs could still challenge California Water Service Group’s growth outlook. These factors may potentially limit future margin improvements.

Find out about the key risks to this California Water Service Group narrative.

Another Perspective: Multiples Paint a Cautious Picture

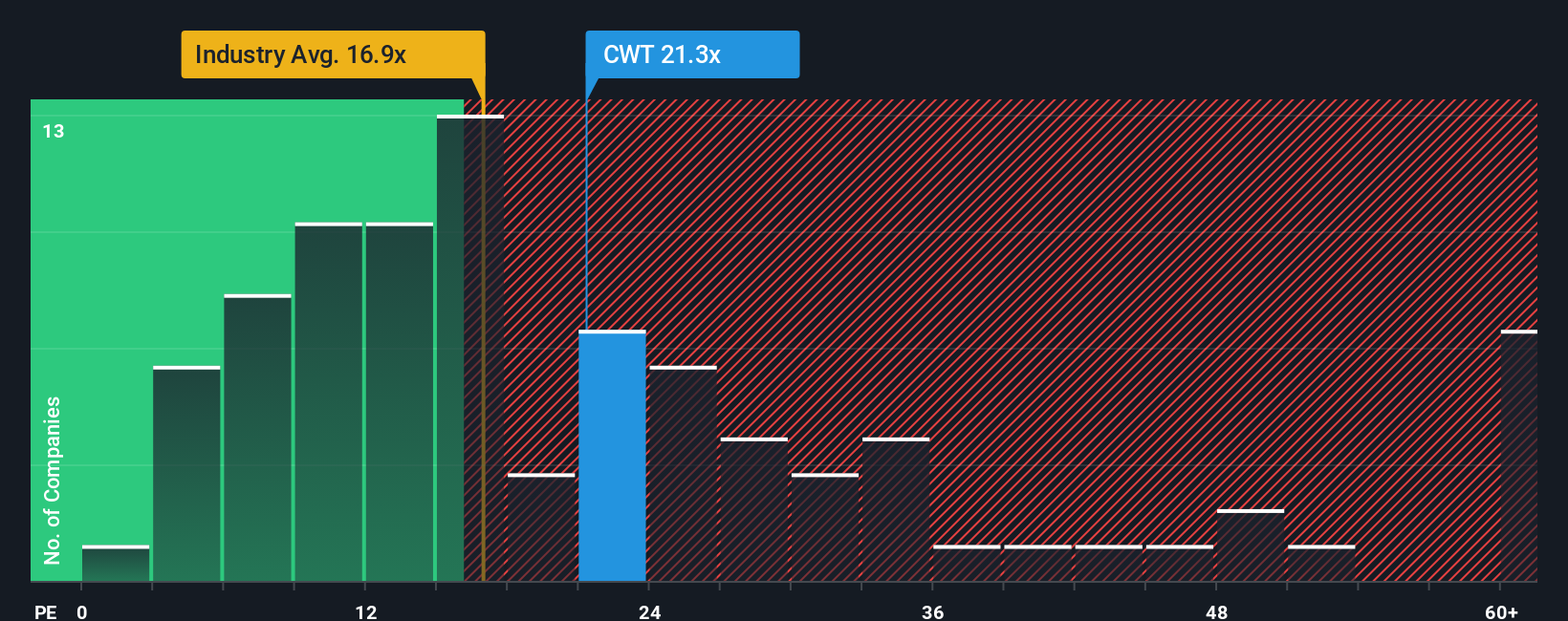

While the consensus view values California Water Service Group well above its current market price, our comparison of its price-to-earnings ratio offers another angle. At 21.3 times earnings, it is more expensive than both its peer average (20.7x) and the global water utilities industry (16.9x), and stands above its fair ratio of 19.5x. This signals the market may already be factoring in considerable optimism. Could that mean less margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:CWT PE Ratio as at Oct 2025 Build Your Own California Water Service Group Narrative

NYSE:CWT PE Ratio as at Oct 2025 Build Your Own California Water Service Group Narrative

If you see a different story emerging from the data or want to test your own assumptions, you can build your perspective in just a few minutes with Do it your way.

A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Elevate Your Watchlist?

Don’t let other investors get the jump on you. Expand your horizon with fresh sectors and find hidden gems now using the Simply Wall St Screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com