The cost of living is steadily increasing for students at Long Beach State and beyond, as the U.S. faces an affordability crisis with higher housing, food and personal expenses.

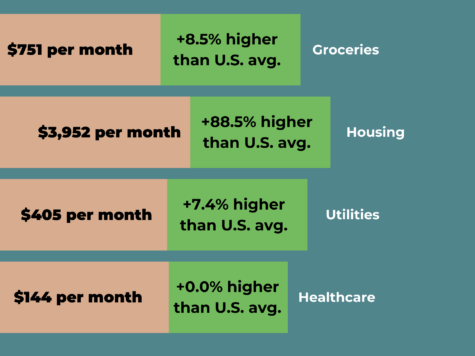

This comes as the cost of living in Long Beach ranks 49.8% higher than the national average, according to a report by apartments.com.

According to a 2024-25 Student Expenses and Resources survey by the California Student Aid Commission, total expenses for California college students have risen by 4% for students living with parents, 18% for students living on campus and 8% for students living off campus during the 2024-25 school year.

In addition, CSU tuition costs have increased by 6% since 2024 and will continue to increase through the end of the 2028-29 school year. This is part of the California State University Board of Trustees’ payment plan to fix budget shortfalls.

Alongside higher tuition, students are facing steep housing costs. The average rent for a Long Beach studio apartment is $1,475 a month, while the average for a one-bedroom apartment is $1,810.

The cost of living off campus is beyond higher education’s control, however, said director of the Basic Needs Program, Danielle Muñoz.

Source: Apartments.com cost of living in Long Beach, CA. Information based on the Cost of Living Index by the Council for Community and Economic Research. Graphic by Dante Estrada | Long Beach Current

Located in Peterson Hall, Room 127, Basic Needs aims to assist students with food, housing, budgeting and unexpected emergencies.

Muñoz said Basic Needs works in a three-tier framework by helping students one-on-one, connecting them to existing resources and advocating for broader economic change by sharing collected data and students’ testimonials with elected state and federal officials.

“We’re seeing a lot of food and housing costs rise quicker than wages,” Muñoz said. “So folks are working, and they’re just wondering, ‘Why can’t I make ends meet?’ And I first like to tell everyone, it’s not your fault. It’s not anything you’re doing wrong.”

Housing resources

To help students with rising housing costs, Basic Needs offers emergency housing, grants to avoid eviction and to pay for housing costs and rapid rehousing for students who suddenly lose their homes or live in unsafe environments.

Students like Alexandra Martinez, 24, a second-year graduate student in the Counseling Psychology program, said there is less financial support for graduate students at CSULB than for undergraduates.

“I think that adds an extra layer of financial burdens on me, and the way that I’m seeing its effects is … rent increases almost every year,” Martinez said.

Although she receives some university loans, Martinez balances her budget by managing her rising rent, food, utilities and other necessities as a student.

Martinez is employed as a Graduate Student Lead at Basic Needs as part of her paid practicum internship.

Since she started at CSULB in fall 2024, Martinez said Basic Needs has helped her with basic expenses like groceries and transportation, and she is happy to use her position to help other students who are struggling

“I think so far, at least with the students that I’ve met so far, they’ve been very grateful that there is support like this on campus,” Martinez said.

Food assistance

Muñoz said the best place to get free food on campus is the Lauren Chalmers ‘83 Beach Pantry.

The pantry is located in the Student Health Services building, Room 115-A, and is open Monday to Friday from 10 a.m. to 5 p.m.

Students and their families can also get help buying groceries through CalFresh, the USDA-funded Supplemental Nutrition Assistance Program, or SNAP, in California.

Students can apply through CSULB’s website and may be eligible for up to $292 per month in grocery assistance.

For student parents, Muñoz said they can also use the California Work Opportunity and Responsibility to Kids program. Muñoz said CalWORKs provides students with minor children child care, transportation, grocery, housing and mental health benefits.

Budgeting help

Muñoz said Basic Needs can help teach students how to budget their finances in person or online with members of Basic Needs.

Students can use the CSULB Virtual Financial Wellness Center, a resource with tips to improve their finances and access the Financial Literacy 101 course, which is free for life. The course offers advice on budgeting, student loans, credit and other financial decisions.

Martinez said Basic Needs is impactful in helping students access important necessities.

“Take advantage of the resources and services that’s already available to you,” Martinez said. “Some of the programs will only be available for you because you are a student. After you leave college [and] university life, a lot of these services are just not accessible.”

Muñoz advises students to use any free resource available to them, including Basic Needs.

“We have something for everyone, whether you’re not in a crisis, but you’re caught up in the crosshairs of this economic hardship we are in, and you want someone to sit with you and get power over your budget,” Muñoz said. “Or you are in a crisis and you’ve used all your money, [and] you don’t have anything left, we can help on both ends.