This article is the first in a series exploring the founding and history of the Piedmont Education Foundation. As PEF celebrates its 50th Anniversary, we’re taking a look back at how it all began—why a group of dedicated parents and community members came together to create an organization that would help sustain and enrich Piedmont’s public schools. Over the years, PEF has grown and evolved, but its mission has remained the same: to support excellence in education and strengthen our community for generations to come.

In the 1960s, property taxes in California were distributed in proportion to amounts collected locally; affluent communities paid more and received more in return. Two statewide actions changed that: The Serrano v. Priest California Supreme Court decisions of the 1970s, and voter passage of Proposition 13 in 1978.

John Serrano, parent of a student in the Los Angeles school system, sued California State Treasurer Ivy Baker Priest, saying that funding disparities between school districts violated the equal protection clause of the U.S. Constitution and the California Constitution.

He filed his first case in 1968 in the Superior Court of Los Angeles County and won it on appeal to the California Supreme Court in 1971. Affluent communities, including Piedmont, took note, but no one knew how much things might change, or when.

Amidst this uncertainty, on December 10, 1975, the Piedmont Educational Foundation (PEF) was incorporated to “provide new and improved educational opportunities.” Tax-deductible donations could be made to PEF, and the foundation made small grants in response to applications from teachers and school district personnel.

The first meeting was held in February 1976 in the home of C. Lee Emerson, and he was elected president. Helen Breck was the second president, and Steffi Mooers the third.

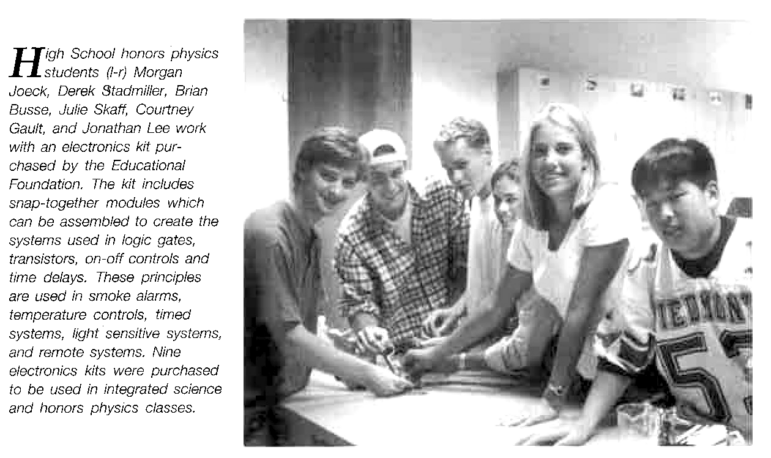

Image from the 1998 PEF Patron

Image from the 1998 PEF Patron

In 1977, the second Serrano court decision held that California’s legislative response to the first Serrano decision had been too weak and required that wealth-based funding disparities between school districts be reduced to less than $100 per student by 1980.

Around the same time, California businessman Howard Jarvis led a campaign to limit property taxes on homes and businesses. Proposition 13, passed on the 1978 ballot, limited California property taxes to 1% of the purchase price as a base, plus 2% annual increases. Proposition 13 reduced the amount of property tax being collected and Serrano v. Priest leveled its distribution.

By 1980, the City of Piedmont and the Piedmont Unified School District (PUSD) both felt the pinch. The City put a parcel tax on the ballot, but because of the Serrano decision, PUSD thought they were not allowed to do the same. Instead, in conjunction with PEF, a district-wide fundraising campaign was undertaken. PEF appointed a Steering Committee co-chaired by Cameron Wolfe and Gerry Stahl.

The School Board held public hearings and made a list of potential cuts based on community priorities. A large thermometer was erected in the middle of town and weekly fundraising progress was painted red on the thermometer. By law, layoff notices had to be sent to teachers and staff by March 15 if they were not to be offered employment the following September. The notices were rescinded as donations came in, the red line on the thermometer rose, and programs were “bought back.” The campaign was successful, and all cuts were avoided.

Image from the 2005 PEF Patron

Image from the 2005 PEF Patron

It was eventually determined that the School District could put a parcel tax on the ballot if it listed the specific programs the tax would cover. Under the leadership of the Steering Committee, the first Piedmont school parcel tax was passed in 1985 with 76% approval, comfortably above the two-thirds approval required. Every precinct exceeded the two-thirds requirement, with half of the precincts exceeding 80%.

Piedmont valued education and wanted to remain a strong, college-preparatory school district. It remains one to this day, with the school parcel tax continuing, and PEF still contributing to the school district’s budget.

Ann Chandler served on PEF’s Board of Directors from 1991-1999. Ann was responsible for the publicity of the original parcel tax campaigns, created PEF’s Patron, and the PEF Student Directory. Ann is currently an Honorary Director of PEF’s Board.