A Sacramento father of three has a simple worry: If Congress doesn’t act before year-end, keeping his health insurance may mean losing time with his children.

Clyde Sharikova-Sudarma, a local veterinarian who undergoes expensive annual MRIs for an ongoing medical condition, said his premiums could double next year.

“I have to consider how I want to work financially with my family, either working more, spending less time with them, or … maybe I could go without the diagnostics, without the monitoring,” the 35-year-old said. “I talked to my wife about that, and it’s a true consideration.”

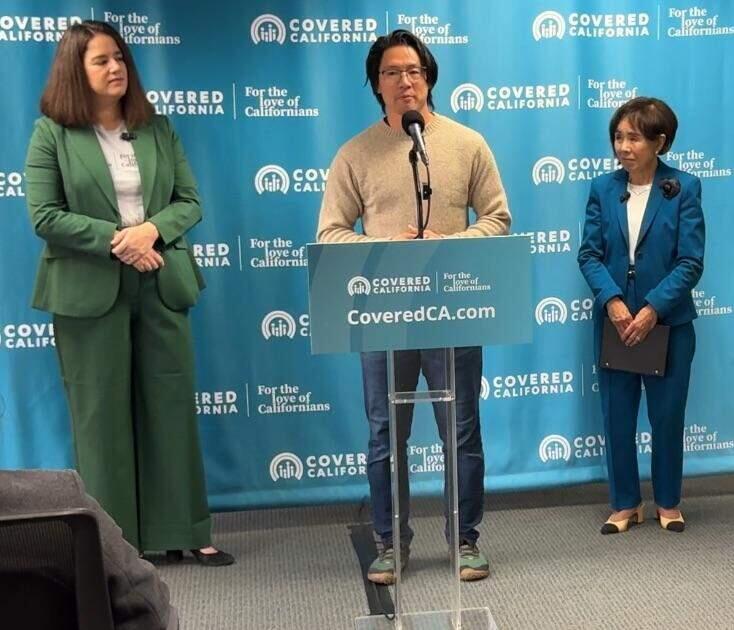

Sharikova-Sudarma’s dilemma mirrors that of thousands of Californians who rely on enhanced premium tax credits to make coverage affordable. His story underscored the urgency of what’s at stake if Congress fails to extend this financial assistance as Covered California leaders gathered Friday to mark the start of the state’s 13th open enrollment.

The enrollment window opened Nov. 1 and runs through Jan. 31. Executive Director Jessica Altman and Congresswoman Doris Matsui, D-Sacramento, used Friday’s event to highlight the importance of affordable health coverage.

Families already faced sticker shock over premium increases without the enhanced tax credits, Matsui said. She added that Republicans, who control the House and Senate, have chosen chaos over negotiating a bipartisan agreement.

“A family of four making the median family income here in Sacramento would see their premiums rise from $850 a month to $2,100 a month,” she said. “That’s $15,000 more they’re spending on health care each year. That’s groceries. That’s child care.”

Altman added that 1.7 million Californians receiving help could see average increases of 97%, and about 160,000 could lose subsidies entirely. More now than ever, she said, her agency is leaning upon health navigators and community partners to help guide consumers through plans and renewals.

“It is genuine connection that gets Californians covered,” Altman said. “The connection between a consumer and a navigator …, between a doctor and a patient, between someone uninsured and the friend, neighbor or family member they rely on to give them advice.”

She chose to hold Friday’s kick-off event in the offices of Community HealthWorks, one of the local nonprofits connecting people to health care, housing, food and other essential services. The organization worked with nearly 40,000 local residents last year.

“We help people renew, enroll and change their health coverage through Covered California,” said Chris Ascencio, director of strategic initiatives for Community HealthWorks. “We also provide support on learning how to use their health benefits, like scheduling a doctor’s appointment or even getting a prescription filled.”

Covered California, a health insurance marketplace made possible by passage of the Affordable Care Act in 2010, offers coverage to people of many different income levels. About half of all ACA marketplace enrollees are small business owners or employees of small businesses, said Bianca Blomquist, California director of Small Business Majority, an advocacy and education group.

Before the ACA marketplaces, Blomquist said, “too many entrepreneurs were locked out of coverage because of sky-high premiums or pre-existing conditions. The ACA changed all of that, and it gave people without job-based insurance a fair shot at affordable, high-quality insurance.”

While this is certainly true for California, Altman said, it’s even more true for states that rely upon the federal ACA marketplace. California expanded Medicaid coverage under the ACA, she said, but Texas, Florida and eight other states did not.

Residents in those states rely solely on marketplace plans and are more vulnerable to federal funding lapses.

To insulate the lowest income households from the impact of the lapsing federal aid, Altman said, California has earmarked $190 million to blunt the cost of soaring premiums if Congress doesn’t reach a deal..

Covered California estimates that 92% of enrollees will still receive some financial help in 2026, Altman said, and almost half of them will be able to find a health plan for $10 or less per month.

Still, as many as 400,000 Californians could drop coverage due to rising costs, Altman said. That leaves many people like Sharikova-Sudarma facing difficult choices.

To determine what type of coverage is available, consumers can visit coveredca.com. They will be able to compare health plans and see the type of financial help available. Even if you already have a plan, Altman urged users to still compare a current choice to other plans to ensure they’re getting the best deal.

Free, confidential enrollment assistance is available in multiple languages from more than 14,000 certified agents and community organizations statewide. To ensure coverage that starts Jan. 1, Altman said, Californians must select a plan by Dec. 31.

Open enrollment, however, continues through the end of January.