California’s economy has split between higher-growth areas such as Los Angeles benefiting from venture capital spending — and other areas hard hit by tariffs, uncertainty and the government crackdown on immigrant labor.

That’s the finding of the winter UCLA Anderson Forecast released Wednesday, which predicts the state’s economy as a whole will muddle through the coming months before growth picks up in the latter half of next year.

“California has now entered another bifurcated economy phase, not one between East and West, but one between AI, Aerospace, and the like, and the rest of the economy,” wrote Jerry Nickelsburg, senior economist with the forecast.

The report notes that in the first half of this year, nearly 70% of all U.S. venture capital spending came to California, while in the third quarter seven of the top 10 investments nationwide were here.

Los Angeles and Orange counties in particular are benefiting from investment in aerospace and defense firms, while the Bay Area has been the recipient of artificial intelligence investments, Nickelsburg said in an interview.

However, Silicon Valley itself has experienced job losses, the report notes, amid a weakening demand for software engineers who code — a dynamic The Times has reported on as big tech firms cut payroll while they sharply raise their investments in AI.

It was initially estimated that AI-related capital expenditures would total $250 billion this year, but already the amount has topped $400 billion, the report noted.

Another positive indicator has been an increase in air cargo at state airports, reversing a decline that began early in the pandemic, the report said.

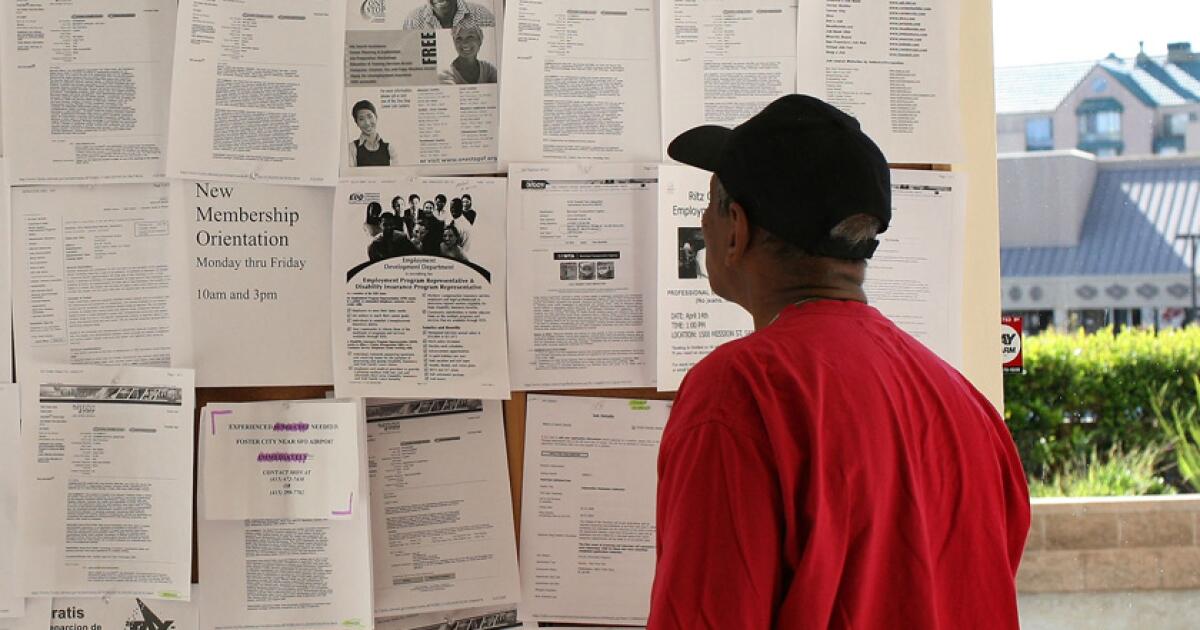

At the same time, the Trump administration’s immigration policies have begun to dampen employment in California counties with a higher concentration of jobs in agriculture, construction as well as leisure and hospitality — with the San Joaquin Valley experiencing the largest number of job losses.

This is consistent with past episodes of restrictive immigration policies — deportations in 1930s under President Franklin Delano Roosevelt, in the 1950s under President Eisenhower and last decade through the Secure Communities program under President Obama, the report said.

“So what we do know from past data is that communities that see a significant loss of population due to immigration policy are communities where the unemployment rate of those who are left tend to go up, housing prices go down, income goes down,” Nickelsburg said.

Another drag on the state’s economy has been the housing market, which has been buffeted by deportations that will reduce the number of workers skilled in drywall, flooring, roofing and other specialities. At the same time, tariffs have raised the cost of building supplies from China, Mexico and Canada.

“That the home construction sector is in the doldrums is evidenced by the continuation of depression level sales volume for single-family detached housing and continued increases in median prices,” the report said.

Overall, the state lost 21,200 payroll jobs in the first eight months of the year, the first sustained decline since the pandemic. It left the state with a 5.5% unemployment rate in August, more than a percentage point higher than the nation. The rate has stayed above 5% for more than 19 consecutive months.

The forecast predicts that California’s unemployment rate will peak at 5.9% early next year but average at 5.5% before dropping to an average of 4.6% in 2027. Employment growth is expected to be 0.7% next year and 2% in 2027. Real personal income is similarly expected to rise just 1.1% next year before picking up to 2.6% in 2027.

The national forecast also notes that the economy is benefiting from investment in AI and rising income among wealthy households, even as tariffs, a weak jobs market and uncertain federal policies weigh on it.

That is expected to change early next year when Trump’s One Big Beautiful tax-and-spending bill stimulates growth — though the fluctuating policies and delays in economic data due to the federal shutdown make that uncertain.

“We continue to live in an era of elevated economic uncertainty regarding the economic trajectory,” the national report concludes.