A federal investigation into homelessness funding fraud has led to the arrest of a Beverly Hills man and felony bank fraud charges for a Brentwood man, in two separate cases.

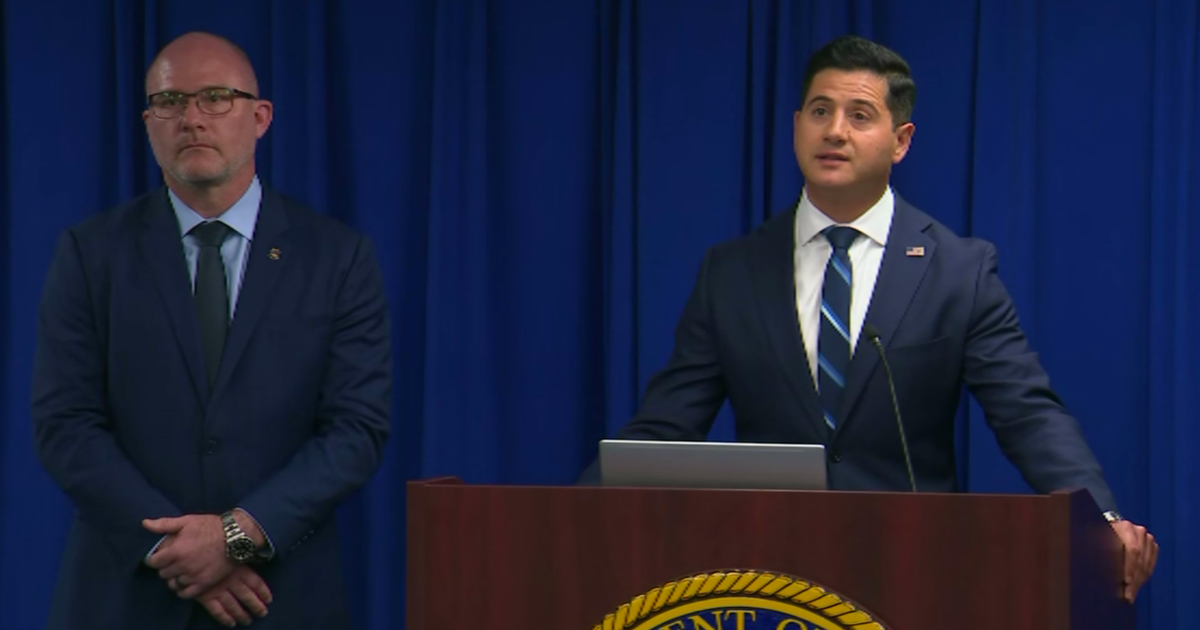

Acting U.S. Attorney Bill Essayli said, “Accountability begins today,” as he announced the two criminal cases on Thursday related to what he called the misappropriation of millions of state funds intended to combat homelessness.

He noted that “California has spent more than $24 billion over the past five years to address homelessness,” and the recently formed Homelessness Fraud and Corruption Task Force is investigating where the tax dollars intended to solve homelessness ultimately ended up.

Cody Holmes, 31, of Beverly Hills, was arrested Thursday morning on a federal criminal complaint charging him with mail fraud. As CFO of a downtown Los Angeles-based developer of affordable housing, Holmes is accused of fraudulently obtaining $25.9 million in state grant money for the company, Shangri-La Industries.

Federal officials said Holmes, as Shangri-La’s CFO, knowingly submitted inflated, fake bank records to the California Department of Housing and Community Development, to falsely prove the company had the capacity to fulfill the homeless housing projects, one of which was in Thousand Oaks.

In fact, the bank accounts that Shangri-La and Holmes said contained these funds did not exist. Holmes is accused of using more than $2 million of state grant money to pay credit card bills that he was associated with, which included purchases at well-known luxury retailers.

In a separate case, Steven Taylor, 44, of Brentwood, is charged with seven counts of bank fraud, one count of aggravated identity theft, and one count of money laundering.

According to the indictment, from August 2019 to July 2025, Taylor used fake bank statements and false cash representations to obtain loans and lines of credit to operate his real estate business.

Taylor is also charged with lying to lenders about his intended use of various properties, including lying to the lender funding his purchase of a Cheviot Hills property, misleadingly telling the lender he intended to renovate and use the property himself.

He had already contracted to sell the property, which he originally acquired for $11.2 million, by way of a loan acquired through fake bank statements, to a homeless housing developer purchasing it with public funds from the City of Los Angeles and the State of California for $27.3 million in a double-escrow transaction hidden from the victim lender and others.

If convicted, Taylor would face a statutory maximum sentence of 30 years in federal prison for each bank fraud count, up to 10 years in federal prison for a money laundering count, and a mandatory consecutive two-year prison sentence for the aggravated identity theft count.

The investigations that led to the arrest and indictment are just the beginning, Essayli said. “We will continue to go where the evidence takes us.”