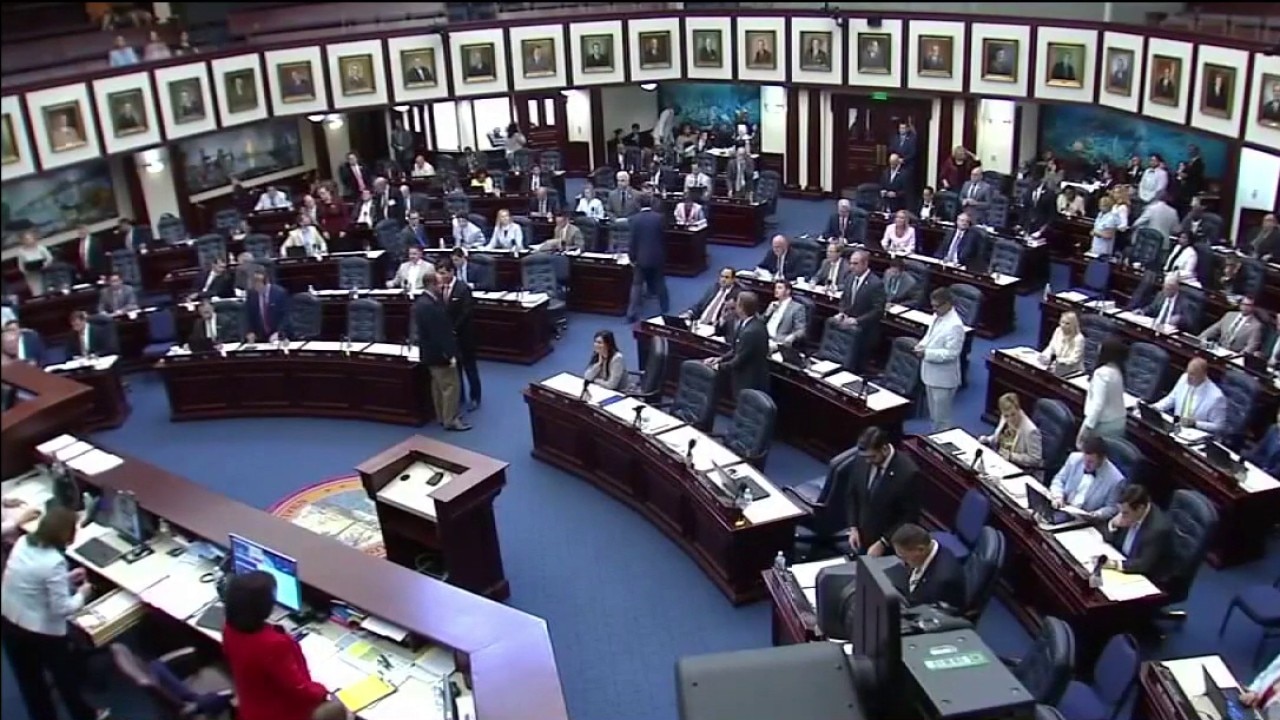

TALLAHASSEE – Lawmakers from across Florida are heading to Tallahassee to begin a new legislative session, the final one under Governor Ron DeSantis, who is serving his second and last term.

One of the biggest issues drawing attention this year is property taxes.

Nearly a dozen bills have already been filed, all proposing some version of the property tax relief Governor DeSantis has repeatedly called for to help make homeownership more affordable.

The governor has said homeowners should not have to pay property taxes on homesteaded property.

The idea has proven popular with many voters, but it has also sparked strong opposition from local governments, renters, and businesses across the state.

Why local leaders are concerned

City and county leaders say property tax revenue is essential to funding core services like police, fire, EMS, and schools.

Local governments have told lawmakers that more than 90% of their property tax revenue goes toward public safety.

The bills currently under consideration would prohibit local governments from cutting funding for police or schools.

Local leaders warn that if property taxes are reduced or eliminated, they will be forced to find new sources of revenue and unprotected services like fire rescue could end up feeling the burn of budget cuts.

The impact of lost revenues from property taxes would not be felt equally. Some local governments have warned they would need to raise funds in other ways, which could mean significantly higher taxes on businesses or sales taxes rising into the double digits.

READ: Wanted Tennessee child abuse suspect may be in Tampa, police say

Smaller communities that are largely made up of homesteaded properties say they would struggle to stay financially viable.

The governor has proposed backfilling the budgets of those smaller, rural communities to the tune of hundreds of millions in state dollars.

What they’re saying:

Governor Ron DeSantis addressed his vision for property tax relief while speaking about the issue.

“You know, I’ve said to a Florida resident, you have a home, it should be homesteaded, you should own it. You shouldn’t be taxed. It shouldn’t be an ATM for the local government and that’s the vision that we want to see.”

State Senator Tina Scott Polsky, a Democrat from Boca Raton, described how eliminating property taxes could impact communities like hers.

“If you’re familiar with Parkland, there’s no apartments. Most people that live there, it’s their only home. It’s not like second homes like you have in Palm Beach, so almost all of the properties are homesteaded and there’s no commercial activity, almost none whatsoever, so we have nowhere to go.”

In a letter to constituents, St. Pete City Council Rep. Lisset Hanewicz highlighted how dependent public safety funding is on property taxes.

According to the city, 97.5% of property taxes collected fund police and fire services.

That revenue currently covers 91.6% of St. Petersburg’s total public safety costs.

“When we need our first responders, we need them — period,” Hanewicz wrote.

What’s next:

If lawmakers agree on a specific plan, the proposal would not become law without voter approval.

The state constitution would need to be amended in order to reduce or eliminate property taxes.

A ballot measure would require at least 60-percent voter approval during the November election.

Governor DeSantis has already said he believes lawmakers will likely need a special session to continue working on a clear and concise ballot proposal.

Unlike other citizen-led constitutional amendments, the legislature would have until August to finalize language for a ballot initiative for voters to consider.

The Source: Information in this article comes from remarks made by Governor Ron DeSantis, comments from state lawmakers, and previous reporting from FOX 13.