There has been a dramatic rise in foreclosure filings across the US in the last year — the latest piece of bad news for the housing market.

In July through September there were a total of 101,513 US properties with foreclosure filings, according to the latest report from real estate data company ATTOM.

This is a huge 17 percent rise from the same period in 2024.

In September alone, there were 35,602 homes with foreclosure filings across the US — up 20 percent from a year ago.

Foreclosure is when a bank or lender takes back a home because the owner has fallen behind on their required mortgage payments.

Florida has been hit especially hard this year, with residents grappling with soaring insurance costs and homeowners association fees.

‘In 2025, we’ve seen a consistent pattern of foreclosure activity trending higher, with both starts and completions posting year-over-year increases for consecutive quarters,’ said Rob Barber, CEO at ATTOM.

‘While these figures remain within a historically reasonable range, the persistence of this trend could be an early indicator of emerging borrower strain in some areas.’

Foreclosure activity has been trending higher in 2025, said ATTOM CEO Rob Barber

Across the country, one in every 1,402 housing units had a foreclosure filing in the third quarter of 2025.

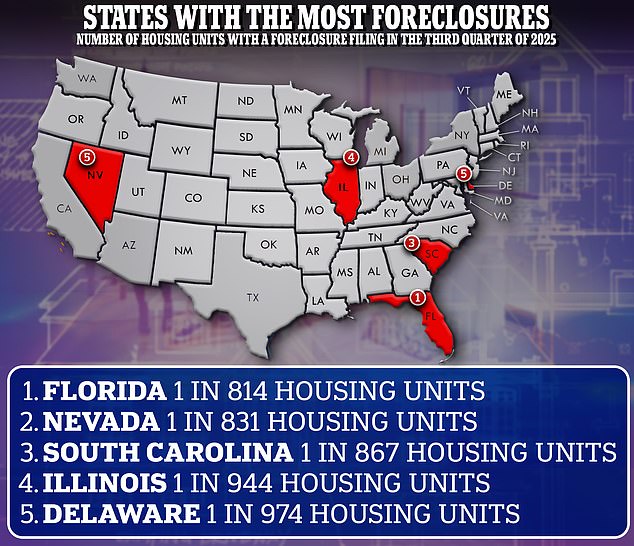

Florida had the worst foreclosure rate, at one in every 814 housing units.

Homeowners in the Sunshine State are facing an onslaught of higher costs and a growing condo crisis, which worsened after the state was ravaged by Hurricane Milton in October 2024. Rising costs are particularly tough for the senior population in the state.

‘A huge percentage of Florida’s residents are retired on fixed incomes, and such [HOA] increases are completely unaffordable,’ real estate investor Jameson Tyler Drew told Realtor.com.

‘This has led to a fire sale of condos as elderly residents look for places to live, all while losing their equity.’

Hannah Jones, senior economic research analyst at Realtor.com added: ‘Foreclosure rates in Florida may be relatively high due to some combination of surging insurance premiums, climbing HOA fees, and falling buyer demand.

‘Additionally, many homeowners who were protected by pandemic-era forbearance or relief programs are now facing resumed payments they can’t afford in light of rising HOA and insurance costs.’

Among the worst hit cities with populations of more than 200,000 people, three out of five were in Florida.

Lakeland was worst affected, with one in 470 housing units with a foreclosure filing, followed by Cape Coral and Ocala. Columbia, South Carolina, and Cleveland, Ohio, also made the top five.

Across the country, one in every 1,402 housing units had a foreclosure filing in the third quarter of 2025. Florida topped the list, with one in every 814 homes facing foreclosure — the highest rate in the nation. Naples in the state is shown in the photo

Lakeland was the worst affected city in Florida, with one in 470 housing units with a foreclosure filing

In September alone, there were 35,602 homes with foreclosure filings across the US — up 20 percent from a year ago

There are many reasons why foreclosure rates in Florida may be higher, said Hannah Jones, senior economic research analyst at Realtor.com

Nevada saw the second largest number of foreclosure filings between July and September, at one in every 831 housing units.

Leading the downward spiral for the state is Las Vegas, which has seen tourist numbers plummet and unwanted homes pile up on the market.

The city is particularly vulnerable to foreclosures, according to Jones.

‘The local economy’s dependence on tourism and hospitality makes incomes volatile when travel or consumer spending slows. With home prices softening slightly, some owners no longer have the equity cushion to sell before defaulting,’ she said.

Rounding out the top five worse affected states were South Carolina (one in every 867 housing units); Illinois (one in every 944 housing units); and Delaware (one in every 974 housing units).

As well as potentially being devastating for individuals if they lose their home, foreclosures can also have a negative effect on whole communities.

Foreclosed homes are usually sold below market price — lowering the value of surrounding properties as well.

‘Widespread foreclosures can also drag down neighborhood property values, increase vacancy rates, and place additional strain on local services and infrastructure,’ Barber, from ATTOM, previously told the Daily Mail.

Growing numbers of homeowners falling into foreclosure is the latest sign of distress for Las Vegas

As well as potentially being devastating for individuals if they lose their home, foreclosures can also have a negative effect on whole communities if homes are left vacant (Pictured: An abandoned house on Route 66 in Oklahoma)

‘Vacant or poorly maintained homes also attract crime and reduce overall neighborhood appeal,’ he continued.

‘You’re likely to see a spike in foreclosures after there’s been a rise in unemployment and a period of high mortgage rates.

‘This is because homeowners tend to default on their mortgages after a period of sustained economic hardship or a loss of income.’

Investors, however, might see foreclosures as an opportunity to buy cheaper properties.