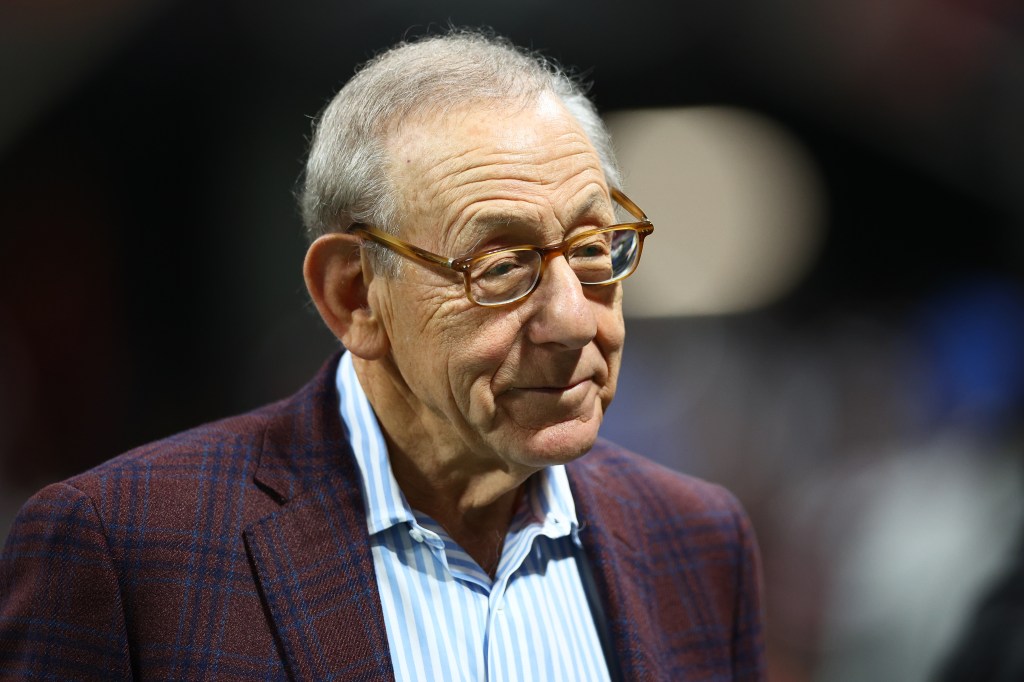

Miami Dolphins owner Steve Ross publicly stated his succession plan for the franchise and presented a stunning number of an offer received for the franchise and surrounding assets in a fireside chat with Bloomberg on Wednesday.

Ross, 85, affirmed he wants to keep the Dolphins within the family and pointed to son-in-law Daniel Sillman to run the franchise after him.

The Dolphins owner, who also owns Hard Rock Stadium and the F1 Miami Grand Prix, said he has turned down an astonishing offer of close to $15 billion for what is presumed to be all three assets. In 2024, the Dolphins alone were valuated at more than $7.5 billion.

It has been clear Sillman has had a growing influence within the Dolphins as he was the point man of a group of six in the general manager search early this offseason, which landed Miami former Green Bay Packers executive Jon-Eric Sullivan.

Sullivan, Ross, Sillman, president and CEO Tom Garfinkel, senior vice president of football and business administration Brandon Shore and Hall of Fame quarterbacks Dan Marino and Troy Aikman are now conducting interviews for the Dolphins’ head coaching vacancy after firing former coach Mike McDaniel.

Sillman, 37, is CEO of Relevent, a global sports and media rights organization. He has worked for Ross since 2014, when he joined RSE Ventures, a private investment firm owned by Ross, where he served as director of business development.

In December 2024, the Dolphins and Ross announced a landmark deal of a limited interest sale of the team and related assets to Ares Management and Brooklyn Nets owners Joe Tsai and Oliver Weisberg.

Ares acquired a 10 percent stake, while Tsai and Weisberg together took a 3 percent interest in the Dolphins, F1 Miami and the stadium. The deal granted Ross liquidity for continued investment into the Dolphins, additional sports assets and South Florida real estate.

With all his financial success and continued growth with the Dolphins, Ross was asked by Bloomberg what’s missing for him.

“What’s missing?” Ross replied. “Winning.”