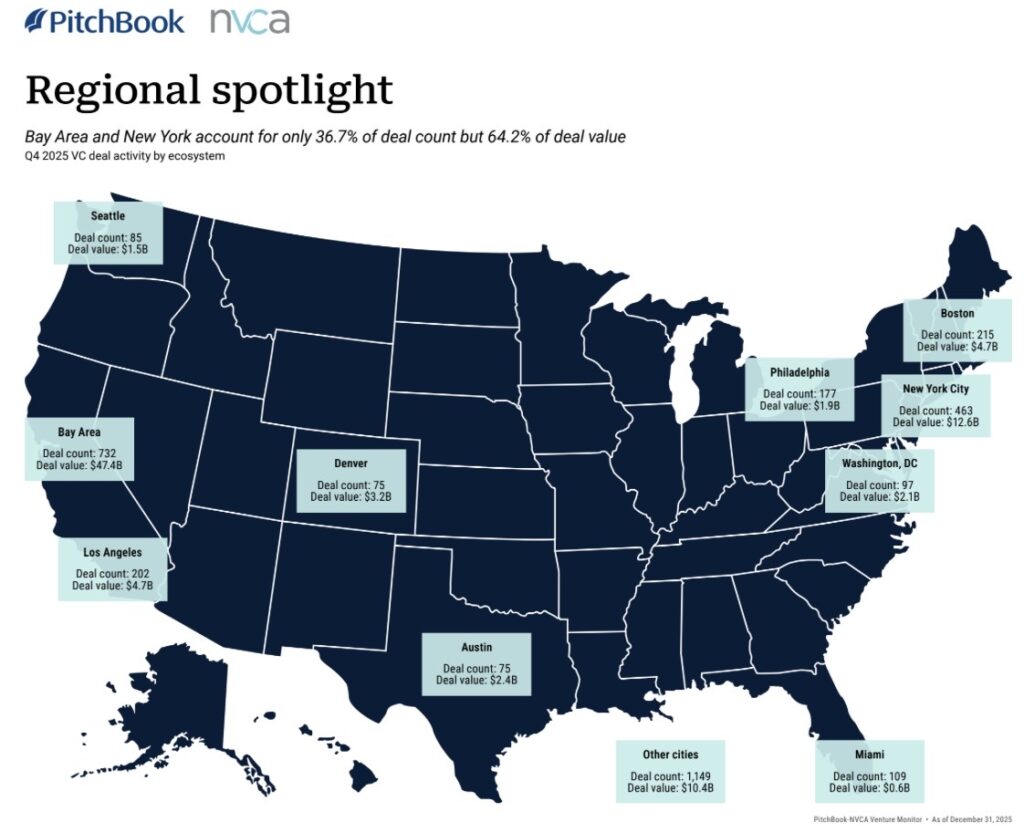

While venture capital activity rose in Q4 nationally, in the Miami-Fort Lauderdale metro area it slowed. But despite that, the metro area retained its position as a top 10 US VC hub for deal count, coming in at No. 6, ahead of Austin, Seattle, Denver, and Washington, DC., according to the Q4 PitchBook-NVCA Venture Monitor report out today.

Let’s take a deeper look at local, state and national trends and top deals.

The South Florida picture

It wasn’t a stellar quarter for South Florida. For Q4 2025, PitchBook reported that the Miami-Fort Lauderdale metro area pulled in $612.7 million across 109 deals, according to the Venture Monitor. Although deal count was an aforementioned bright spot, deal value was down from a revised $779.2 million raised across 100 deals in Q3. The average deal size in Q4 was $5.6 million, down significantly from Q3.

However, for the year, the story is brighter. In this story, we are focusing on Q4, but according to my ongoing research, the Miami-Fort Lauderdale metro area is on track to log between $3.5 billion and $4 billion for the year. That would be the metro area’s best year since the records set during the pandemic, and a healthy rise from 2024’s $2.77 billion. Stay tuned for our deep dive into 2025 venture capital coming out early this year for all the specifics. Now back to the highlights of Q4.

Q4 top deals: According to PitchBook’s data, here were the top 10 rounds by companies headquartered in the Miami-Fort Lauderdale metro area in Q4, and Refresh Miami covered most of them:

Exowatt, a Miami-based next-generation renewable energy startup, Series AI: $120 million. This includes $50 million of new funding announced in Q4 and $70 million announced earlier in the year.

Lighter, a Miami-based decentralized chain, Series B: $68 million.

Flex, a Miami -based AI-native private banking platform for business owners, Series B: $60 million

GoTu, a Miami-based n on-demand marketplace that connects dental professionals with practices to fill temporary shifts, Series A,: $45 million

OneImaging, a Miami Beach-based radiology care management platform intended to reduce medical imaging costs, Series A: $38 million

Letterhead, a Miami-based newsletter execution platform, Series A: $34 million

Odyssey Functional Energy, a Fort Lauderdale-based beverage maker: $18.4 million

DermaSensor, a Miami-based maker of an FDA-cleared, AI-powered skin cancer detection device, Series B: $16 million

Boom, a Miami-based AI-powered hospitality management system, Series A: $12.7 million

Katalyst & Co., a West Palm Beach-based healthcare transformation platform for advisory services: $10 million

Not included at this time by PitchBook among Q4 top deals was the $200 million funding of OpenEvidence that closed in October, which valued the “ChatGPT for clinicians” startup at $6 billion. OpenEvidence relocated to Miami from Cambridge, Mass., in July. What’s more, at the end of the year the company was reportedly closing another $250 million. And that is not all the news on healthcare technology, one of Miami tech’s strongest sectors. Refresh Miami also reported that Boca Raton-based BioBeat Technologies, which developed the first FDA-cleared, 24-hour ambulatory blood pressure monitoring (ABPM) system, raised a $50 million Series B in Q4.

There were also some smaller Q4 raises not tracked by Pitchbook so far. To be sure, venture capital data lags; PitchBook and other sources revise their data constantly because new reporting comes in, rounds get reopened, startups relocate, etc.

On the exit front, there were 8 exits for South Florida companies in Q4, with an exit value of $260 million disclosed, according to Pitchbook. Corellium, a Delray Beach software provider, exited for $170 million, and Dynamic, a Miami-based financial technology company, exited for $90 million, according to revised data from Pitchbook. For the year, the Miami-Fort Lauderdale metro area logged 32 exits and just over $ 1 billion in exit value for the year.

The Florida picture

Statewide, according to data underlying Pitchbook’s new report, Florida companies drew $882.3 million across 161 deals in Q4 2025, down from $1.04 billion across 158 deals in Q3.

Still, just like for the Miami metro, the state is also on track to log one of the highest totals on record, behind 2021 and 2022. South Florida continues to drive in most of the state’s venture activity, representing 69% of deal value and 67% of the deal count. Stay tuned for my upcoming eMerge Insights full-year report on statewide trends.

Also according to PitchBook’s data, top deals around the state outside South Florida in Q3 included r.Potential, a Jacksonville-based software maker that raised a $33 million Series A. Also attracting sizable rounds was RAHM, a New Port Richey company that raised a $28 million Series A, and Catalyst OrthoScience of Naples, a therapeutic device maker that bagged a $19.1 million Series G.

As for Florida’s other metro areas in Q4, Orlando attracted $40.55 million across 10 deals, down from a revised $81 million across 14 deals in Q3. The Orlando area’s top venture capital deal according to PitchBook was a $14 million seed round for Attuned Intelligence. For the year, the Orlando metro area companies pulled in more than $497.4 million across 52 deals. Companies in the nearby Space Coast pulled in $500,000 million in two deals in Q4, and $31.3 million across 13 deals for the year.

The Tampa metro area attracted $86.3 million across 20 deals in Q4, down from $175.4 million across 22 deals in Q3, and over $455 million across 70 deals for the year, according to PitchBook’s data. The top Q4 venture deal was a $47.4 million later stage deal to Climate First Bank. Separately, the nearby Sarasota metro, also typically considered part of Tampa Bay, logged another $8.82 million across 5 deals in Q4, and for the year, $39.6 million.

In Q4 across the state, there were 12 exits valued at $260 million, but values weren’t provided. Across the state, there were 54 exits with a total exit value of nearly $4.8 billion in 2025, according to Pitchbook.

The national picture

The year 2025 ended with a strong rebound, with Q4 recording the highest number of completed deals since Q1 2022. With Q4 exceeding $91 billion in deal value, 2025 finished with the second-highest annual deal value ever at over $339 billion and just $18.8 billion behind 2021, reported by Kyle Stanford, PitchBook’s Director of US venture research in PitchBook’s First Look report.. In total, 16,707 deals were completed in the U.S. last year, up 9.6% over 20204.

In Q4, as is usually the case, the big four markets — Silicon Valley, New York, LA and Boston — accounted for three-quarters of deal value and half of the deal count.

And in another surprise to no one, the boom was led by AI companies that attracted nearly two-thirds of total capital invested. Overall, AI companies took in 64.4% of the total deal value for the year and 39.4% of completed deals, setting new record highs for AI investment in each category. Since the launch of ChatGPT in late 2022, AI investment has grown from $73.0 billion that year to $222.1 billion in 2025, with deal counts increasing 24% over that time period, Stanford said.

The strong finish to 2025 was driven by two forces – the dominance of AI and a highly concentrated slate of megadeals, said Nizar Tarhuni, Executive VP of Research and Market Intelligence at Pitchbook. “We saw record investment in megadeals nearly every quarter, despite far fewer transactions than in prior peak years, underscoring how a small number of large rounds are propping up headline figures,” he said.

There was notable activity at the earlier stages though: “More than $5 billion was invested into pre-seed and seed stage deals each of the past three quarters, a strong signal that early stage investors are ready and willing to put money to work again. And at $25.7 billion, Q4 early-stage deal value reached its highest point since Q4 2021,” Stanford said.

Exit value in the U.S. nearly doubled from 2024, although PitchBook notes liquidity remains well below peak levels and continues to weigh on fundraising expectations heading into 2026. There were 1,636 exits, up 28.5% from 2024, and total exit value came in at $297.8 billion, up 92.7% year-over-year. However, that figure represents just 34.5% of the annual record from 2021, “leaving a lot for investors to desire,” Stanford said.

READ MORE IN REFRESH MIAMI:

I am a writer and editor with extensive media experience and a passion for journalism and serving the community. Most of my career has been spent with the Miami Herald in business news, and my expertise is writing about tech and entrepreneurs. I love hosting this blog for Refresh Miami and we aim to be the go-to site for South Florida startup and tech news, features and views. Have news? Contact me at [email protected]. Thanks for reading!

I am a writer and editor with extensive media experience and a passion for journalism and serving the community. Most of my career has been spent with the Miami Herald in business news, and my expertise is writing about tech and entrepreneurs. I love hosting this blog for Refresh Miami and we aim to be the go-to site for South Florida startup and tech news, features and views. Have news? Contact me at [email protected]. Thanks for reading!  Latest posts by Nancy Dahlberg (see all) Miami area startups raised $613M in Q4, PitchBook reports. What were the top deals? – January 15, 2026 8+ things to know in #MiamiTech: Yes, the Larry Page news, plus a new defense-tech company is making 2 big moves, and the latest from Florida Council of 100, FII, ServiceNow, Panther Coffee, job opportunities & more – January 9, 2026 Biobeat raises a $50M Series B for its US expansion – December 31, 2025

Latest posts by Nancy Dahlberg (see all) Miami area startups raised $613M in Q4, PitchBook reports. What were the top deals? – January 15, 2026 8+ things to know in #MiamiTech: Yes, the Larry Page news, plus a new defense-tech company is making 2 big moves, and the latest from Florida Council of 100, FII, ServiceNow, Panther Coffee, job opportunities & more – January 9, 2026 Biobeat raises a $50M Series B for its US expansion – December 31, 2025