Orange County Commissioners will allocate $58.5 million over the next three years to help finance and preserve thousands of affordable housing units as part of the county’s ongoing effort to combat the housing crisis.

On Tuesday, the board unanimously approved the future funding for the county’s Affordable Housing Trust Fund for fiscal years 2026 to 2028. According to county staff, the expectation is that the funding will directly contribute to the construction or preservation of 3,570 affordable units over that period. The county also anticipates that approximately 1,500 affordable units will be delivered through federal, state, or alternative funding sources, bringing the total number of affordable residences created or preserved to around 5,000.

There is an emphasis on providing housing for residents earning between 30% and 80% of the area median income (AMI). In Orange County, an individual making $59,050 would meet the 80% threshold, as would a household of four that earns $84,300 per year. To meet the 30% mark, an individual would earn $22,150, and a household of four would bring in $31,600 annually.

County commissioners initially established the housing trust fund at the end of 2019 upon the approval of a 10-year action plan that sought to create or preserve 11,000 affordable units in Orange County by 2030. The trust fund provided financing for 2,367 units between 2020 and 2025, and an additional 2,590 units were created using federal, state, or alternative funding sources, for a total of nearly 5,000 units in five years.

Most of the units that the trust fund will help create will come from gap financing, a strategy that allows the county to provide a portion of the financing for an affordable project to fill in funding gaps.

Last year, for example, county commissioners selected five developers to split a combined $20.85 million in financing for affordable apartment projects located throughout the county in a process that started with a request for proposals (RFP) from developers with affordable projects in the pipeline in unincorporated and incorporated Orange County.

“This closes the funding gap on projects to secure the production and acquisition of affordable housing units. We use this funding to provide extra leverage for projects that may be funded by the state or federal resources, and we just kind of fill in that gap to make the project viable,” said Alyssa Henriquez, Assistant Project Manager for Orange County’s Housing and Community Development Division.

Banyan Development Group was one of five developers to receive county financing last year. The financing is for Mariposa Grove, a planned 138-unit tower proposed for 410 Mariposa St. in downtown Orlando. (Rendering by FK Architecture)

Banyan Development Group was one of five developers to receive county financing last year. The financing is for Mariposa Grove, a planned 138-unit tower proposed for 410 Mariposa St. in downtown Orlando. (Rendering by FK Architecture)

Last year, Orange County voters approved a charter amendment to make the affordable housing trust fund permanent. The fund started with a $10 million investment in 2020, and the financing was set to increase by 10% annually through 2030. Based on this growth trajectory, the county would invest about $17.7 million in 2026, followed by about $19.5 million in 2027 and roughly $21.3 million in 2028 into the trust fund.

“We have been able to close the affordability gap in this community, and we will continue to be able to close the gap in this community. That takes all of us, including the private sector and the public sector, to be able to do that,” Orange County Mayor Jerry Demings said.

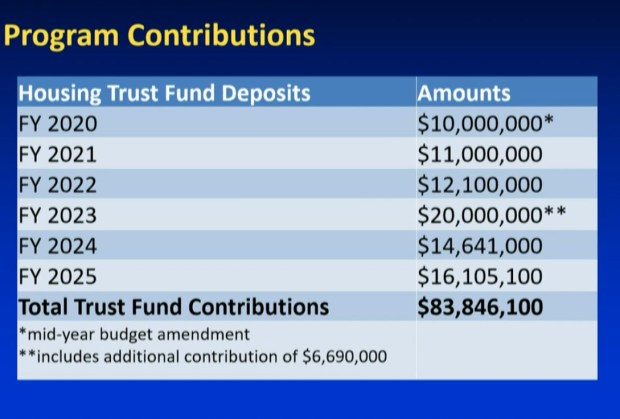

Orange County has committed to increasing funding for the affordable housing trust fund by 10% every year, but there are opportunities to increase annual financing by even more. For example, the county provided an extra $6,690,000 in financing during FY 2023. (Graphic provided by Orange County)

Orange County has committed to increasing funding for the affordable housing trust fund by 10% every year, but there are opportunities to increase annual financing by even more. For example, the county provided an extra $6,690,000 in financing during FY 2023. (Graphic provided by Orange County)

In 2021, the county code was amended to exempt developers who are building certified affordable housing projects from having to pay the county’s impact fees, a one-time tax that developers pay to account for the impact a development will have on local infrastructure and schools. This exemption provides big savings that allow affordable housing projects to move forward in a timely manner.

For example, the county approved a $2.2 million impact fee exemption for Banyan Development Group‘s Barnett Villas, a 156-unit apartment community nearing completion in Pine Hills. Archway Partners also received a $1.3 million exemption for its 104-unit Enclave at Canopy Park, which recently broke ground earlier this year in Holden Heights.

Archway Partners received county funding last year for Enclave at Canopy Park, as did Banyan Development Group for another affordable housing project called Mariposa Grove, a 12-story tower that would deliver 138 units in downtown Orlando. The project hasn’t broken ground, and Banyan Development Group is currently seeking $10 million in additional funding from the City of Orlando so that it can begin construction.

Denver-based Ulysses Development Group also received county financing last year for the 100-unit Osprey Sound community, which will rise just off Orange Blossom Trail at 5453 Rio Grande Ave. The developer is set to hold a groundbreaking event for the community later this month.

Tampa-based Southport Financial Services also received financing for a 100-unit building in Apopka that is still seeking approval, and Tennessee-based Elmington received funding for a 131-unit apartment project at 30 S. Ivey Ln. near Pine Hills.

Have a tip about Central Florida development? Contact me at (407)607-8160 or TyWilliams@GrowthSpotter.com. Follow GrowthSpotter on Facebook and LinkedIn.