Stand, an insurtech startup targeting properties most at risk from natural disasters, has closed a $35m Series B round.

Eclipse led the financing, with continued backing from Inspired Capital, Lowercarbon Capital, and Equal Ventures.

The company is barely over a year old yet already writes insurance for homes in wildfire-exposed regions, starting with California.

Its approach ties coverage to physical upgrades – the more a homeowner strengthens their property, the more favorable the insurance terms become.

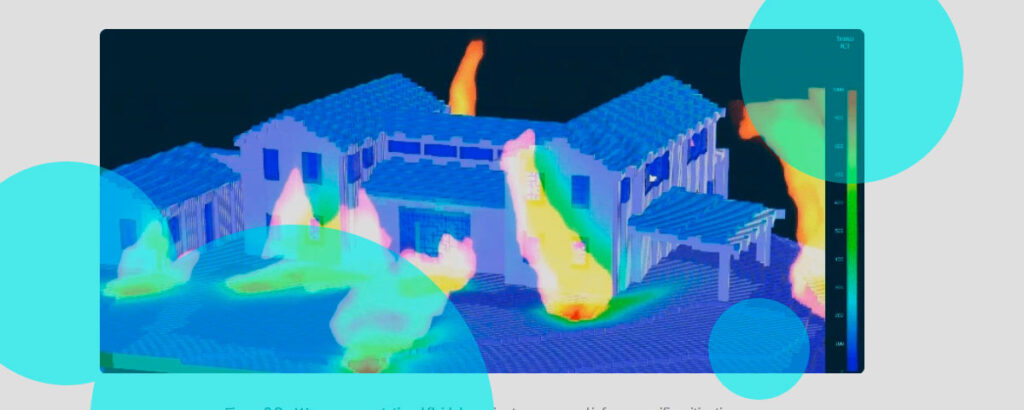

This resilience-linked model is built on physics-based underwriting, measuring how structures hold up to extreme events. What began with wildfire modeling has now stretched into wind exposure.

The new funding fuels a planned expansion into Florida, where catastrophe risk is both systemic and severe.

NOAA data shows the state has endured 94 separate bn-dollar disasters since 1980, with the most recent seven alone producing over $1tn in damage.

Citizens Property Insurance Corporation, Florida’s state-backed insurer of last resort, now holds close to $300bn in exposure, underscoring the fragility of the market and the need for viable private alternatives.

Stand has moved quickly in California, already underwriting $1 bn in insured value. Management believes the same model can work in Florida, encouraging homeowners to harden properties against windstorms while receiving coverage that reflects those efforts.

CEO and co-founder Dan Preston framed the company’s mission as more than financial protection. “Insurance should play a central role in creating resilient communities,” he said, noting the urgent need for a system that directly links coverage to home improvements. Expansion into Florida, he argued, is the test of scale for that vision.

The scale of risk in Florida demands a new model that links coverage to hardening homes against windstorms. That is what Stand is building. By expanding into the largest catastrophe market in the country, we are working hard to make this a reality for property owners everywhere.

Dan Preston, Stand co-founder and CEO

Eclipse partner and Stand board director Aidan Madigan-Curtis pointed to a national trend driving urgency.

Over the past decade, U.S. weather disasters have inflicted over $1.4 tn in losses, less than half of which were insured.

Rising costs and shrinking coverage are leaving American families exposed. Eclipse’s $30 mn investment in Stand reflects our belief that resilience is the future, giving property owners the tools to safeguard their homes and their financial security.

The expansion into Florida’s volatile market marks the next chapter for Stand – one where technology-driven risk assessment and resilience incentives attempt to rewrite catastrophe insurance economics.

Stand treats every home as unique. Startup analyze properties in obsessive detail – down to the placement of a single tree – to create a customized resilience plan that keeps homes safe but preserves their beauty. Stand reward the work owners have done to protect their homes by valuing the impact of new measures and technologies that reduce the likelihood of loss or damage to one’s property.

Stand treats every home as unique. Startup analyze properties in obsessive detail – down to the placement of a single tree – to create a customized resilience plan that keeps homes safe but preserves their beauty. Stand reward the work owners have done to protect their homes by valuing the impact of new measures and technologies that reduce the likelihood of loss or damage to one’s property.

The Stand team is purpose-built for this problem. “We are fortunate to have brought together an exceptional team of applied physicists, computer scientists, insurance professionals, and product leaders— across companies such as SpaceX, AIG, Pure, SLAC, and more,” Dan Preston said.

“Over the life of our business, we intend to incentivize billions of dollars of resiliency infrastructure globally, while making a substantial dent in the cost and availability of insurance. In doing so, we will create a fundamentally safer future”.

Insurance products available through Stand and risk mitigation services we offer help customers make their properties safer and protect the things they care about at competitive rates.

“Our first market is high value homes in wildfire-prone areas. This is a highly distressed market, with little state program support. It allows us to “start small”: for these homes, we can act solely on an individual property and have a direct impact, without having to also alter surrounding regions. With that foundation, we can scale up to support businesses, communities, and beyond,” Dan Preston sayd.