TAMPA, Fla. — Owning a home is part of the American dream, but for many, with the way prices are heading, that dream is feeling unattainable.

What You Need To Know

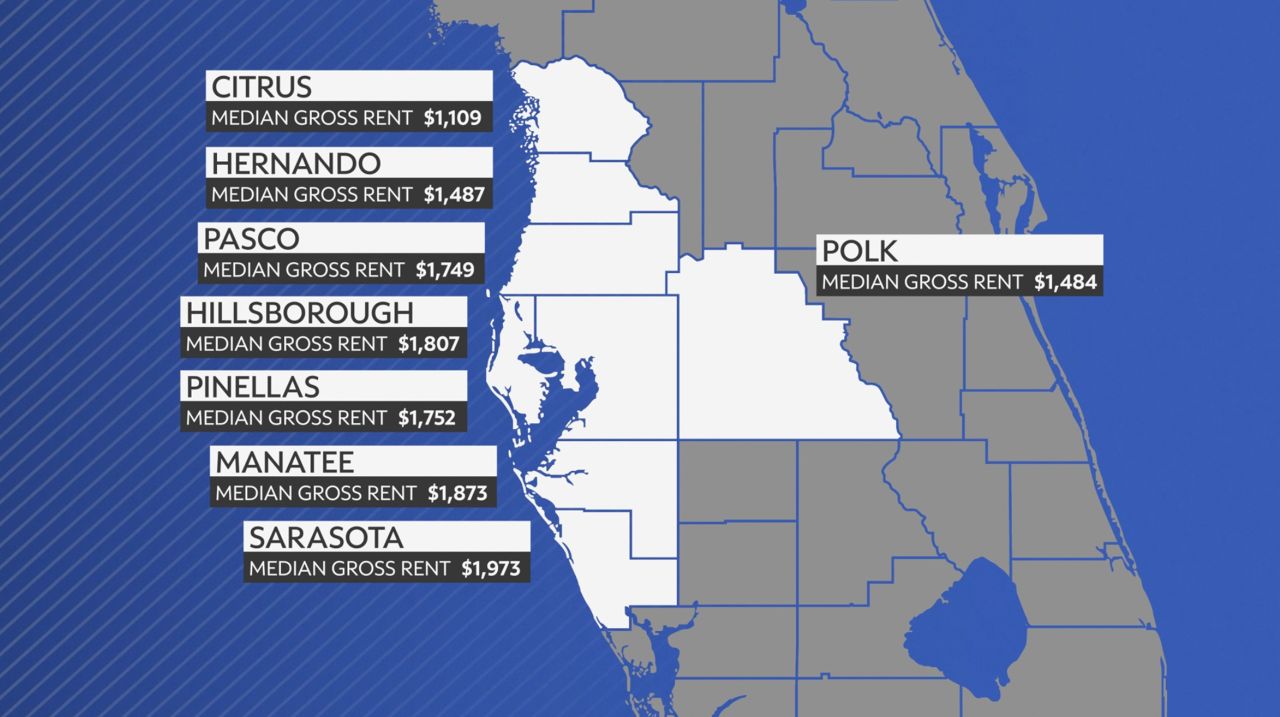

According to data from the U.S. Census, rent is nearly 20% cheaper than buying a home across the Tampa Bay area

Many younger Americans, without the ability to pay a down payment, aren’t sure when or if they’ll be able to purchase their own home

The average down payment in Florida is $73,000, according to a USF economics professor

It’s simple for 33-year-old Garrett Wilhelm.

“I rent because I don’t want to deal with maintenance concerns, it is cheaper, and if I did buy, it’d be more likely an investment than a personal home, to be honest,” said Wilhelm.

Numbers from the U.S. Census Bureau support Wilhelm’s thinking.

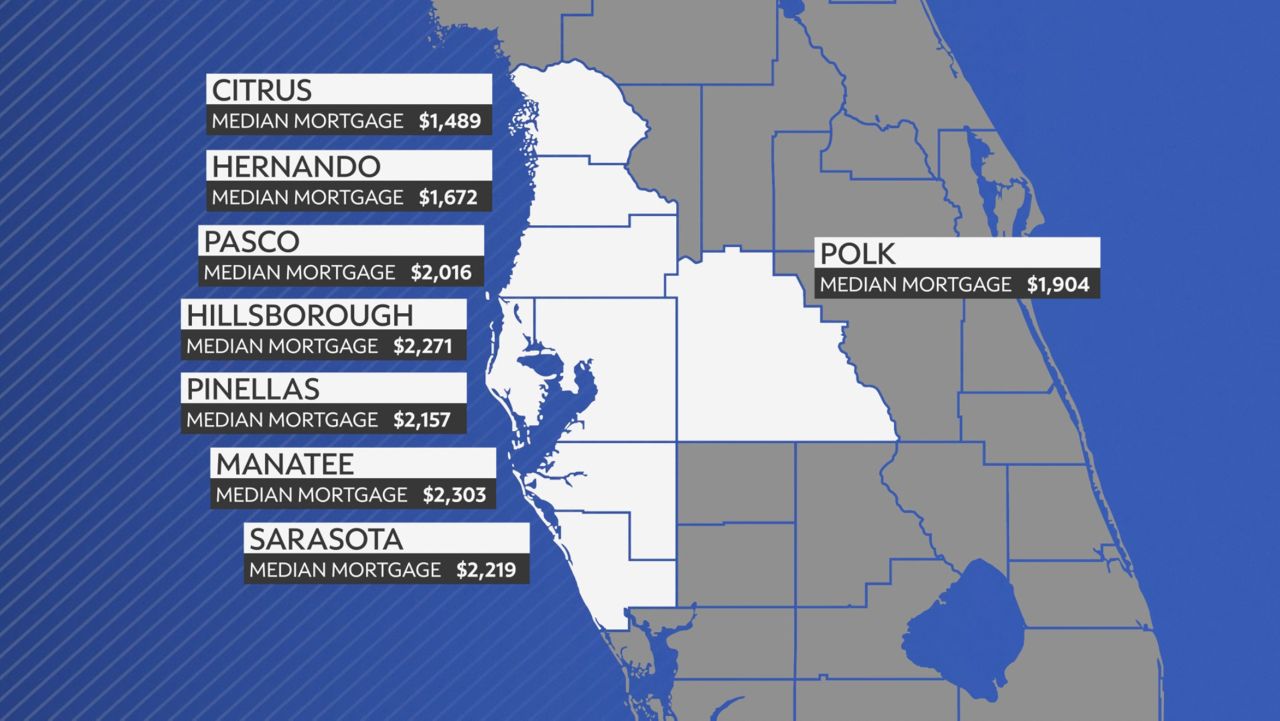

This map shows the median mortgage payment across the Tampa Bay area:

This map shows the median rent price across Tampa Bay:

“That makes a big dent in the decision process, especially for the younger individuals, who, again, are doing everything they can to stay ahead of food costs and all the other prices that seem to outpace income growth,” Chris Jones, economics professor at the University of South Florida, said.

Jones says the average down payment for a home in Florida can now top $70,000, putting ownership out of reach for many buyers.

“It would honestly take a pretty catastrophic collapse of the economy overall to see a 15 to 20% decrease. And even if we get a 15-20% decline, you’re still talking about very expensive homes,” said Jones.

Stanley Blacker is a homeowner and a mortgage broker. He strongly believes in buying over renting and says long-term home ownership can still pay off.

“You have to understand and be motivated to do something to buy that house,” said Blacker.

But he acknowledges the reality that many people face.

“The income is key. If you’re living paycheck to paycheck, and you don’t have the income to support it, then you have no choice,” Blacker said.

For Wilhelm, that choice has already been made. Like many younger Americans, he says the barrier isn’t desire — it’s cash.

“It’s hard because home ownership is so far out of reach. I feel like a lot of the joys of setting up that home and family are very out of reach. So, we compensate for it in video games, but we’re craving for it in real life,” Wilhelm said.

If home prices stay high, experts say more renters may be left asking not when they’ll buy, but whether they ever can.