Tracy Hunt

Executive Vice President and General Manager, Skanska

Florida

Chuck Jablon

Senior Vice President of Construction, Skanska

Florida

Over the last several years, the greater Tampa Bay region has been growing significantly, with both its population and construction economy showing steady increases. Skanska, with its longtime presence in the area, has kept more than busy delivering projects such as the $59-million Second District federal Court of Appeals Courthouse in St. Petersburg, which is targeted for completion later this fall.

“Our team is incredibly proud to build this landmark courthouse strategically positioned to better serve the community,” says Chuck Jablon, Skanska Florida senior vice president of construction.

Throughout the region, multiple construction markets are “booming” thanks to the surging population, says Tracy Hunt, executive vice president and general manager for Skanska Florida, who notes that Tampa Bay’s population growth of roughly 7% from 2020 to 2025 added more than 270,000 residents and is thereby “fueling demand for hospitals, schools, housing, airports and transportation,” he says.

“Florida’s rapid growth has made health care and K-12 education Skanska’s fastest-growing sectors, with major metros showing strong activity,” Hunt says. “However, high interest rates have slowed new housing and multifamily projects, though migration sustains demand in key areas.”

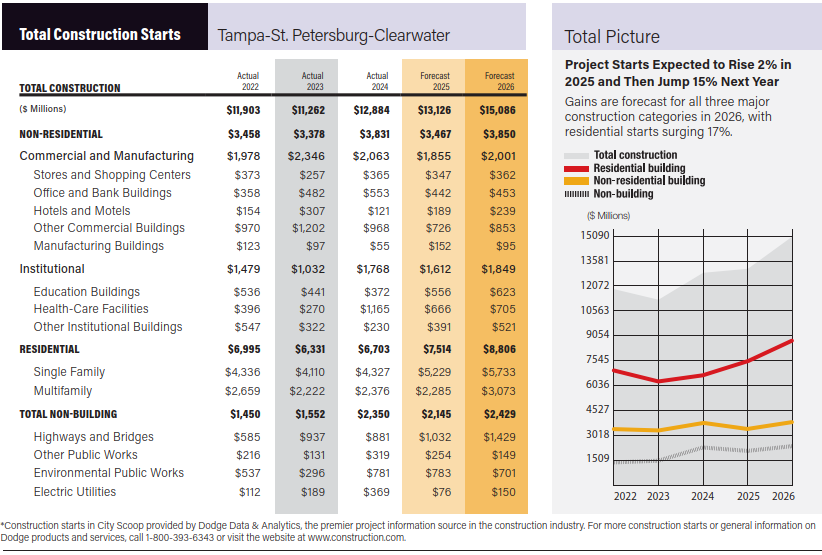

Data Courtesy of Dodge Data & Analytics

At the same time, Hunt says, “K-12 construction is booming with renovations, expansions and retrofits. Skanska, collaborating with Hillsborough County Public Schools—the nation’s seventh-largest district—for over 20 years, delivers upgrades and new facilities to meet demographic growth demands. These projects reflect the district’s commitment to future-ready education.”

Noting that Skanska has completed more than 160 K-12 projects in Florida in the last 20 years, Hunt explains that “more densely populated counties like Hillsborough and Pinellas focus on repurposing or demolishing older schools to meet modern standards, while counties with more land prioritize new builds for growing populations.”

With the Tampa Bay area’s continuing population surge, Skanska’s Construction Market Trends Report for Spring 2025 says that, despite this growth, “Overall costs, lead times and supply chains have stabilized,” adding that “trade participation in pricing is increasing.”

“As Orlando’s theme park construction slows, labor shortages are easing, improving workforce availability.”

—Tracy Hunt, Executive Vice President and General Manager, Skanska Florida

Presently, the Skanska report adds, while “the higher education project pipeline seems to be stabilizing … single and multifamily housing, health care and K-12 projects show no signs of slowing and continue to put pressure on the existing shortage of skilled trade workers.”

Nevertheless, Skanska’s report states that “construction pricing and inflation remain steady within traditional indices, with annual increases typically under 3% when planning projects over a one- to two-year period.”

Still another project trend that Hunt is seeing is the rising demand for technical career centers, such as Skanska’s recent $41-million, 52,000-sq-ft Plant City Technical College project—designed and built to serve 900 students—that will train adults and high schoolers for skilled trades and tech careers.

“This addresses a statewide shortage, with 94% of construction firms struggling to fill onsite roles,” Hunt says. “The college helps narrow the skills gap and boosts economic growth.

Overall, he continues, “Tampa Bay’s construction market remains resilient, with modest growth expected in 2025, led by health care, education and data centers.

“As Orlando’s theme park construction slows, labor shortages are easing, improving workforce availability,” Hunt continues. “Workforce development centers like Plant City Technical College and Dr. Michael A. Grego Pinellas County Leadership Institute are addressing labor challenges by training a stronger local construction workforce for long-term stability.”

Forecasts by Dodge Data & Analytics, shown above, project that both the non-residential and total non-building construction sectors will increase slightly in 2025, followed by healthy gains in 2026.

Meanwhile, the residential construction sector should see increased activity in both 2025 and 2026, with both single-family and multifamily starts showing sizeable gains in both years.