BOCA RATON, Fla. (CBS12) — Florida Lieutenant Governor Jay Collins says it’s time to rethink what it means to truly own a home in the Sunshine State.

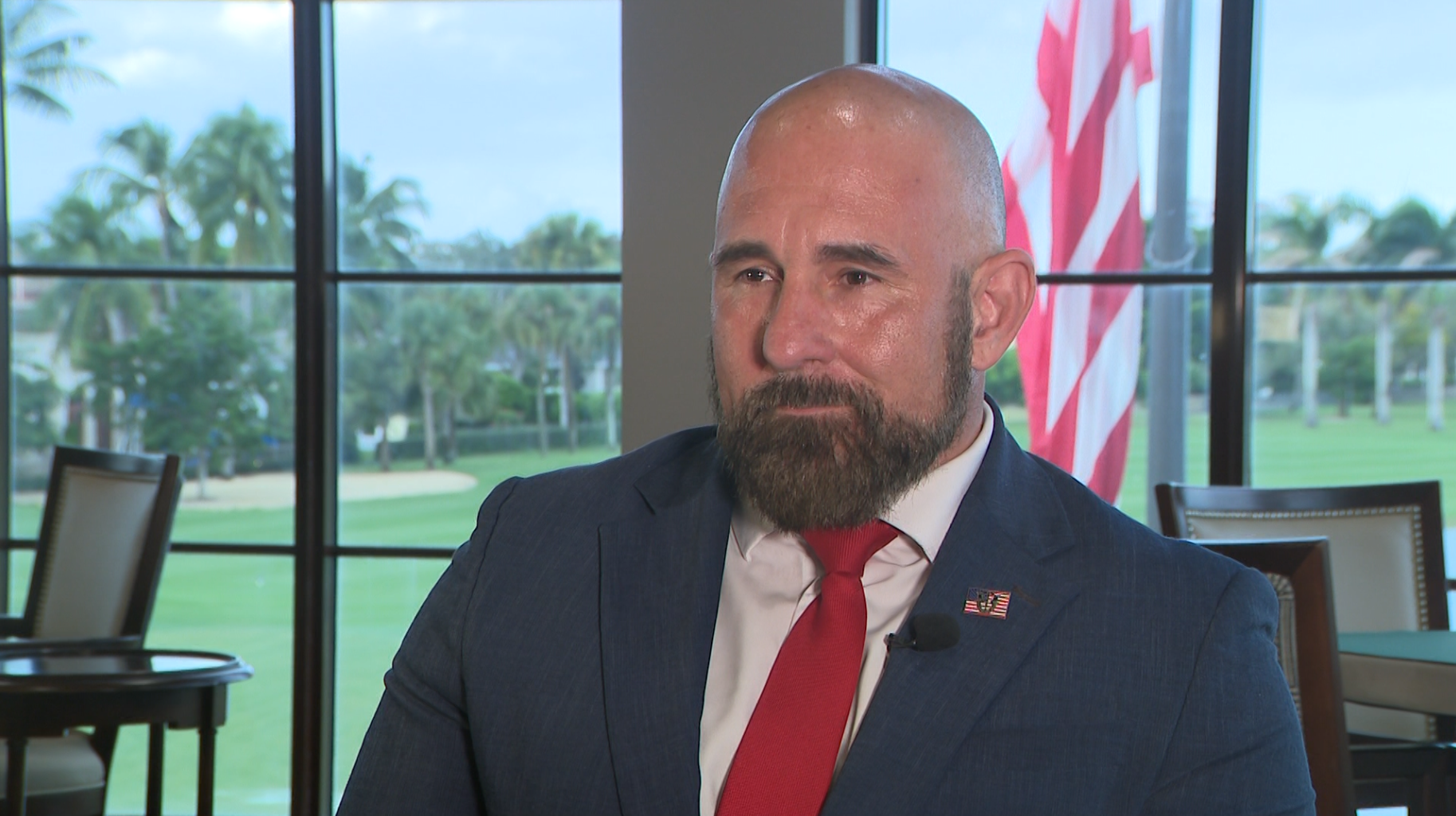

In an exclusive interview with CBS12 News reporter Katie Bente, Collins defended Governor Ron DeSantis’ push to eliminate property taxes for homesteaded properties — arguing it’s about preserving the American dream of homeownership and keeping government out of people’s pockets.

“Do you really ever own your home if you’re paying taxes to the government?” Collins asked. “If the government can take it, you don’t own it.”

Collins says the proposal — expected to become a 2026 ballot initiative — would exempt homeowners’ primary residences from property taxes, if approved by 60 percent of Florida voters. He described the measure as a defining issue for the state’s future.

“This is the American dream,” he said. “Everybody wants to own their home. My parents told me, ‘You need to own your home — that’s where your family is going to grow up.’ I want that for my kids too.”

How it would work

Collins says homesteaded properties — those used as a person’s permanent residence — account for roughly 3 to 11 percent of property tax collections, depending on the county. He believes that portion could be replaced by cutting government waste and consolidating local spending.

“Those numbers are solvable,” he said. “I live in Hillsborough County — it was $200 million in a single year of wasted taxpayer dollars. We can find solutions there.”

The Lieutenant Governor says Florida can also save money by bulk-purchasing items like fire trucks and buses and pursuing more public-private partnerships to offset costs.

“There’s plenty of meat on the bone,” Collins said. “We can do more with our insurance rates for first responders, and we can cut down on redundant spending. We’re looking at everything.”

Addressing funding fears

Critics argue eliminating property taxes would gut school budgets and emergency services. Collins pushed back, saying the state will not shortchange police, firefighters, or teachers.

“Nobody is going to take anything away from our men or women in law enforcement or firefighters,” he said. “You have to prioritize what people spend on — education, those who serve our community, and common needs like roads.”

He also dismissed speculation that Florida might raise sales taxes to make up for the lost revenue.

“No one’s going to increase your sales tax — that’s nuts,” he said. “We’re not going to harm the number one industry that draws people in. Tourists already pay far more in taxes than anybody else. That should stay that way.”

Government waste and priorities

Collins said cutting “nonessential” or “pet projects” is key to funding the proposal without hurting public services.

“It’s not the government’s money — it’s the taxpayers’ money,” he said. “In some counties, there were poet laureates being paid for with taxpayer dollars. Why are we doing that? That’s not essential.”

Insurance, inflation, and cost of living

Collins also linked the property tax proposal to Florida’s broader affordability crisis, noting that homeowners are being “double hit” by rising values and millage rate increases.

“Your home value goes up every single year, and then when they raise the millage rate, it goes vertical,” he said. “You’re getting hit twice — double dipping. You’ve got to stop that merry-go-round.”

See also: Waste Watch: Property Taxes in FL could go away

He said property tax reform is the next step after the state’s tort reform law, which he credits with stabilizing Florida’s insurance market.

“We had 77 percent of the litigated cases in America coming from Florida — that’s crazy,” Collins said. “Now we have 16 insurance companies writing policies here. Rates are starting to hold or drop.”

Political alignment and timing

Collins said both DeSantis and President Donald Trump share similar philosophies on reducing government waste.

“It’s pretty incredible to see a President and Governor aligned on the same issues,” he said. “If it’s not benefiting our citizens, why are we spending our money on it?”

He confirmed multiple versions of bills are circulating in Tallahassee but said there needs to be one unified ballot initiative to avoid confusing voters.

“Anything more than that is going to confuse the voter base,” he said. “Democrats, Republicans, independents — they all tell me, ‘I love the idea of property tax relief. Just don’t mess with my cops or my firefighters.’ This is solvable.”

The Governor’s detailed plan to eliminate property taxes for homesteaded properties is expected to be released in the coming weeks. Collins said when it does, he plans to return to CBS12 News to go over the numbers.

“When the Governor puts it out, let’s come back here and talk in detail about what he releases,” he said. “Sound good?”

Background

Florida’s property taxes fund schools, fire and police departments, roads, and local governments, generating more than $43 billion statewide each year. Removing or reducing that revenue would require major changes to how cities and counties fund basic services.

Any constitutional amendment to eliminate property taxes would need 60 percent approval from Florida voters to pass.

Find more ways to stay up to date with your latest local news. Sign up for our newsletter to get the day’s top headlines delivered right to your inbox. Subscribe to our YouTube channel for the biggest stories and can’t miss video.