A New York-based private equity investor paid $25.2 million for industrial property in Orlando’s Sunport Technology Center.

The deal, which closed Oct. 31, included a 159,788-square-foot flex warehouse building at 100 Sunport Lane and the adjacent parking lot. The buyer was an affiliate of Ivaylo Ninov, founder and CEO of Mactaggart & Co., who was making his first Central Florida acquisition. Ninov secured a $19.165 million loan from Emerald Creek Capital.

Built in 1986 and renovated in 2007, the two-story building has four existing dock-high doors with a 200-foot exterior dock and 10 knock-outs.

Jared Bonshire, leasing agent for Cushman & Wakefield, told GrowthSpotter the building is currently 95% leased, with Penske Logistics as a major tenant. The new parking lot at 203 Sunport Lane has 248 spaces, with half leased to Penske.

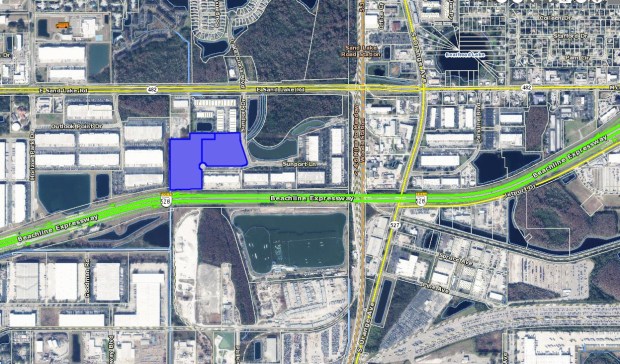

The sale included Lots 1-4 in the Sunport Technology Center, just north of S.R. 528. (Orange County Property Appraiser)

The sale included Lots 1-4 in the Sunport Technology Center, just north of S.R. 528. (Orange County Property Appraiser)

Rick Colon, with C&W’s Capital Markets Group, said his team marketed the property on behalf of the seller, Penn-Florida Companies, which originally purchased it in 2004 for $5.7 million. The location in Orlando’s highly desirable airport submarket and its easy access to S.R. 528 and Florida’s Turnpike generated strong interest. Colon said they received multiple offers.

“It’s a good location,” he said. “It’s an infill site with an extra 3.8 acres that the owner can develop for more parking or outdoor storage,” Colon said.

Just this week, global investment firm CenterSquare Investment Management paid $14.5 million for a two-property, small-bay industrial portfolio in Orlando totaling 65,185 square feet.

Colliers Executive Managing Director Joe Rossi represented the seller, Helanco Properties, in the transaction.

Global real estate investment firm CenterSquare Investment Management purchased two small bay industrial assets in Orlando’s Vineland Road corridor with a combined total of 65,185 square feet. (Courtesy of Colliers)

Global real estate investment firm CenterSquare Investment Management purchased two small bay industrial assets in Orlando’s Vineland Road corridor with a combined total of 65,185 square feet. (Courtesy of Colliers)

Helanco Properties is a private capital owner and developer of small-bay industrial properties in the Orlando MSA. This marks the third and fourth properties Rossi and his team have sold for Helanco since 2021. Previously, he represented Helanco in the sale of LaQuinta I & II — a portfolio featuring dock-high, grade-level and self-storage units — which sold for $10.1 million in December 2021.

“The Vineland and 34th & Val Business Centers were in excellent physical condition, with minimal office build-out — key factors that attracted the buyer,” said Rossi. “Small-bay industrial assets like these are in exceptionally high demand.

The properties’ central location in the Southwest Orange submarket, with immediate access to Interstate 4, Florida’s Turnpike and the 408 Expressway, offers tenants convenient connectivity throughout Metro Orlando. While lease structures posed a minor challenge during marketing, investor enthusiasm remained strong due to the properties’ quality and market fundamentals.

The 34th & Val Business Center, was built in 2008 and totals 28,600 square feet. (Courtesy of Colliers)

The 34th & Val Business Center, was built in 2008 and totals 28,600 square feet. (Courtesy of Colliers)

The deals are further evidence that Orlando’s industrial market is on the rebound, with total market absorption nearing 2 million square feet year-to-date and rents on the upswing.

The Orlando Economic Partnership reported that industrial vacancy fell to 7.8% in the third quarter, its lowest level in a year after Ryder Logistics occupied 1.2 million square feet in Apopka. Sustained strong leasing — up 62% year-to-date from 2024 — and a slowdown in speculative construction should help the industrial market continue to rebalance in the coming quarters.

Have a tip about Central Florida development? Contact me at lkinsler@GrowthSpotter.com or (407) 420-6261. Follow GrowthSpotter on Facebook and LinkedIn.