More than half of homes in the United States lost value in the past year. New data from Zillow shows that 53% of all homes are worth less than they were 12 months ago. It is the highest level of value loss since 2012.

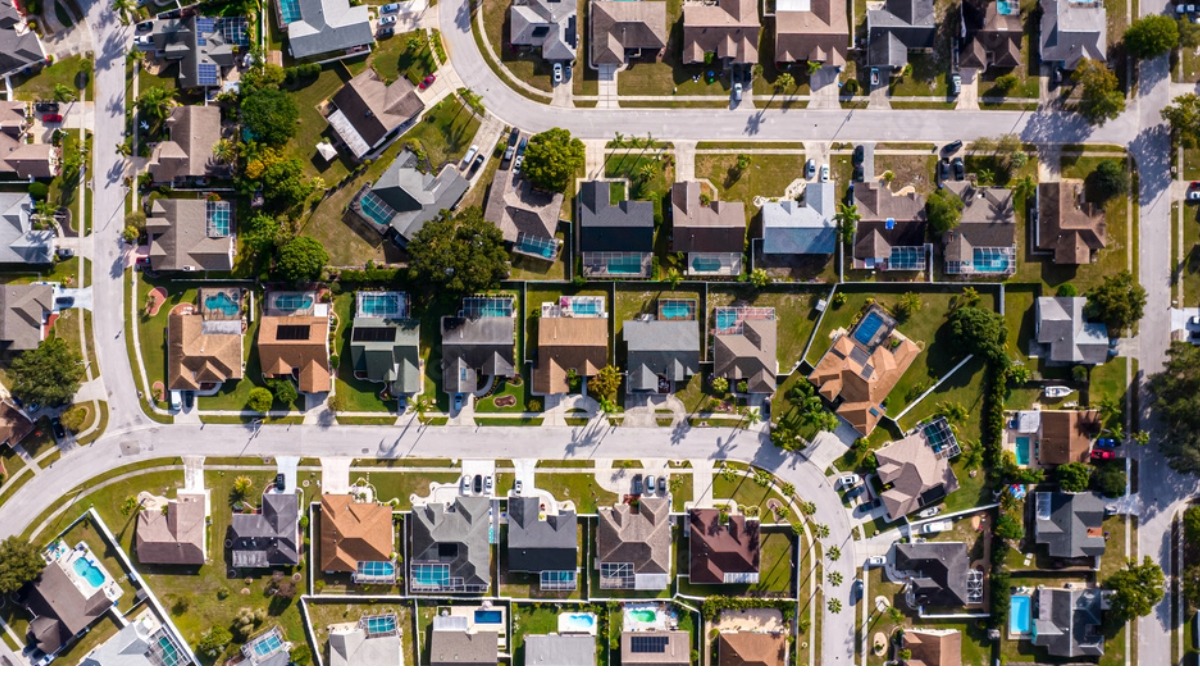

The headline looks negative. The story under it is more complex. In Tampa Bay, the cooling real estate market is creating real breathing room for buyers and better entry points for investors who walked away during the peak.

SIGN UP FOR TBBW’S FREE NEWSLETTER

This article explains what happened, why it matters in Tampa Bay and what you should watch next.

What happened?

Zillow reports that 53% of homes in the country are down from last year. That is up sharply from 14% one year ago.

Key findings include:

The average drop from peak value is 9.7%

Only 4.1% of homes are worth less than when they were last sold

The median owner still has 67% more value than at the time of purchase

The largest share of value losses is in the West and parts of the South.

Tampa has one of the biggest swings. Zillow reports that 85.2% of homes in the Tampa metro are down from peak values, with an average decline of 12%.

Why this matters

The data looks worrying, but there are two clear positives for Tampa Bay.

Buyers have more power again

Tampa buyers have spent years facing low supply, high competition and rising rates. A cooler market means more choice, less pressure and fewer bidding wars. It also supports staff relocation and talent recruitment. Leaders can move people into the region with more predictable housing costs.

Investors have a cleaner path back in

Tampa was one of the most aggressive markets in the country from 2020 to 2022. Prices rose fast and cap rates tightened. As values settle, the math becomes easier. Entry prices improve. Competition falls. Cash flow improves. Long-term prospects in a growing region remain strong.

What you should know

If you are a buyer

Look at listings that sit longer than 30 days

Watch for builder incentives in Hillsborough, Pasco and Manatee

Use an agent who studies sub-markets, not just general averages

If you are a seller

Price your home for the market you are in today

Expect more days on market

Remember that equity is still strong for most owners

If you are an investor

Review rental comps

Re-run cash flow models

Look closely at areas that cooled fastest, such as Riverview, Wesley Chapel and South Pasco

READ: Look inside Saddlebrook’s $92M upgrade in Wesley Chapel

If you are a business leader

Expect continued relocation interest

Use the cooling cycle to support hiring

Track inventory as new regional projects move forward

What’s next?

The next few months will reveal whether this is a brief reset or a more prolonged cooling period. Watch for:

Inventory levels through the first quarter

Rate decisions

Investor activity in the Southeast

Builder starts and cancellations

Migration patterns

Takeaway

The Zillow report shows a national slowdown, but the story in Tampa Bay is more balanced. Prices are cooling but not crashing. Equity remains strong. For buyers and investors, this may be the first real opportunity in years to act without the pressure of a peak era.

Stay Connected