ORLANDO, Fla. – Florida led the nation in foreclosures in October, according to ATTOM’s October 2025 U.S. Foreclosure Market Report, and the top three major cities with the worst foreclosure rates were all in the Sunshine state.

According to ATTOM’s report, which compiled foreclosure filings, consisting of default notices, scheduled auctions or bank repossessions, there were 36,733 U.S. properties with foreclosure actions taken on them in October – a 3% increase from September and nearly 20% year over year.

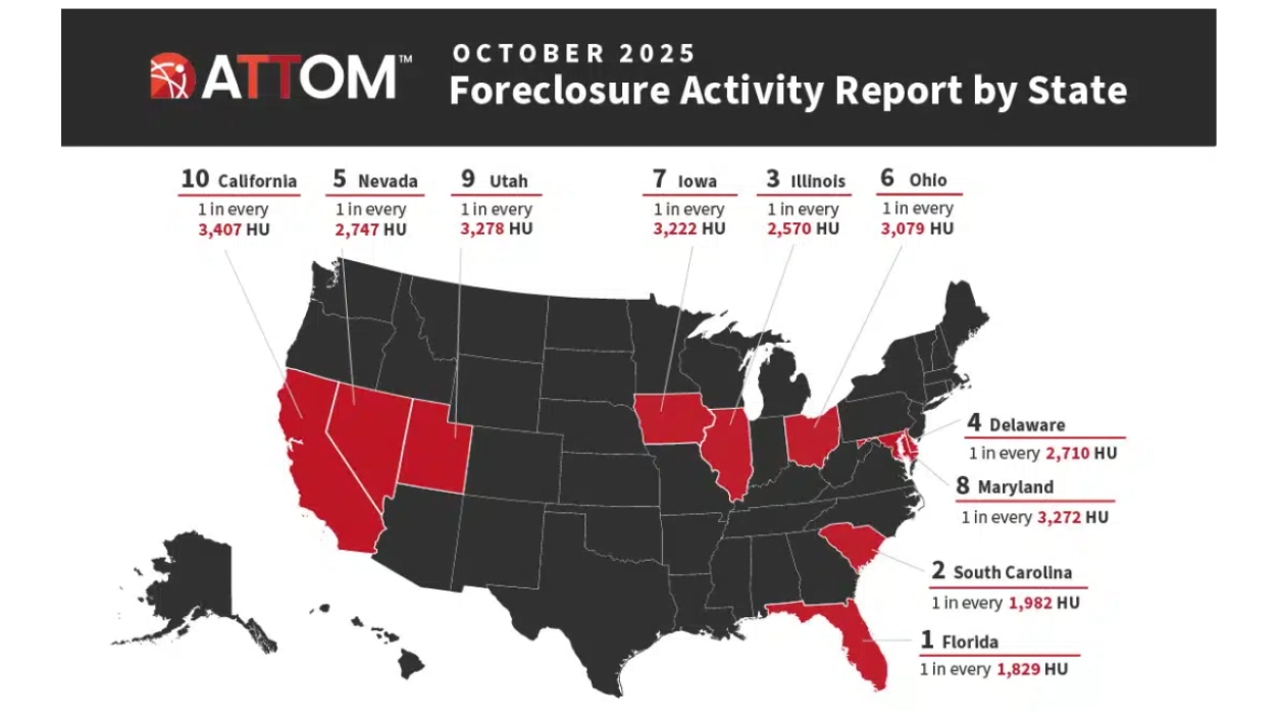

Top 3 states with the worst foreclosure rates

1. Florida (one in every 1,829 units)

2. South Carolina (one in every 1,982 units)

3. Illinois (one in every

Illinois, Delaware, and Nevada were also among the states with the highest foreclosure rates.

Top Florida cities with the worst foreclosure rates

1. Tampa

2. Jacksonville

3. Orlando

“Among metro areas with populations of 1 million or more, Tampa, FL posted the highest foreclosure rate in October 2025, at one in every 1,373 housing units. The increase reflects a temporary spike caused by the resumption of data collection in Hillsborough County, which added backlogged records and is expected to normalize in November,” the report stated.

States with the highest foreclosure starts

1. Florida (4,136 starts)

2. Texas (3,080 starts)

3. California (2,685 starts)

4. Illinois (1,252 starts)

5. New York (1,165 starts)

What are realtors and economists saying?

FOX 13 Tampa talked with Mia Annibale, a realtor in St. Petersburg. She said some homeowners are learning their homes, if sold, would likely sell for the same price they paid.

“They would have to sell at essentially the same price they bought for because there has been a declining market,” Annibale said, adding that many would need to bring “roughly $10,000 to the closing table in order to avoid a short sale.”

To figure that out, the numbers have to be calculated and sometimes homeowners find out they’re upside down – unable to sell and cannot afford the property, FOX 13 reports.

USF economist Michael Snipes told FOX 13 that housing costs have increased across the board – mortgage insurance, property taxes, HOA fees, and insurance.

“It’s really all prices and all costs associated with housing, whether it’s HOA, whether it is interest on mortgage payments, whether it is insurance payments. All of those costs are going up,” he said.

He said those on fixed incomes have been hit especially hard.

What does it mean?

In a prepared statement, Rob Barber, CEO of ATTOM, said while starts and foreclosure completions are trending higher, they’re below historic highs.

“Even with these increases, activity remains well below historic highs. The current trend appears to reflect a gradual normalization in foreclosure volumes as market conditions adjust and some homeowners continue to navigate higher housing and borrowing costs,” he said.

According to the Orlando Regional Realtor Association’s October State of the Market report, there were more homes for sale, more new homes listed, more new contracts, and more pending home sales when compared to October 2024.

The average home price was $380,000, a slight increase from September, the report said.

“October’s data shows a promising shift, with interest rates continuing to trend down and sales trending up. We’re also seeing reports of property insurance prices beginning to stabilize,” said Lawrence Bellido, president of the Orlando Regional Realtor Association in a written statement.

“While inventory remains steady, the rise in new listings suggests that more homeowners are ready to make their move. The Orlando market has found its footing, which is good news for anyone looking to make this region their home”.

The Source: This story pulls information from ATTOM’s October 2025 U.S. Foreclosure Market Report, the Orlando Regional Realtor Association’s October report, and reporting from FOX 13 Tampa Bay, the sister station of FOX 35 Orlando.