The Apopka City Council took the penultimate step Wednesday toward hiking fees developers are charged to help fund police, fire/rescue and recreation services — as much as 42% for residential and 280% for nonresidential construction.

Commissioners voted unanimously during their meeting for proposals increasing impact fees, advancing them to final votes Dec. 17, according to a report in GrowthSpotter. If approved on second reading — with the required supermajority (four of the five members) — the city could begin collecting the higher fees 90 days later. The city last raised these fees in 2017.

Throughout the march toward raising the fees that started months ago, commissioners have repeatedly stressed that the increases are not paid by current residents.

“Just to confirm, this is not a fee to the current residents, this will be a fee to developers that will most likely be passing their fee onto the new residents, correct?” asked Commissioner Nick Nesta.

Shawn Ocasio, senior manager with Raftelis Financial Consultants in Maitland, affirmed that and said during his presentation to the council that without the proposed increases the city would have to pass costs along to current residents.

“Having these fees in place at the appropriate level helps relieve some of the burden on the existing residents,” Ocasio said.

He said if fees are not implemented as proposed, existing residents would have to pick up about $702,000 of growth-related capital costs between 2026 and 2030. Residents would shoulder an additional amount for nonresidential development he said is harder to estimate because of difficulties projecting the makeup of that growth.

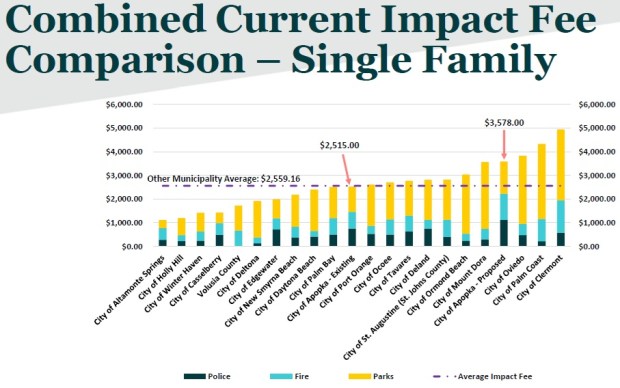

A comparison of the current and proposed impact fees for the City of Apopka to other cities in the Central Florida region. (Courtesy of Raftelis and the City of Apopka)

A comparison of the current and proposed impact fees for the City of Apopka to other cities in the Central Florida region. (Courtesy of Raftelis and the City of Apopka)

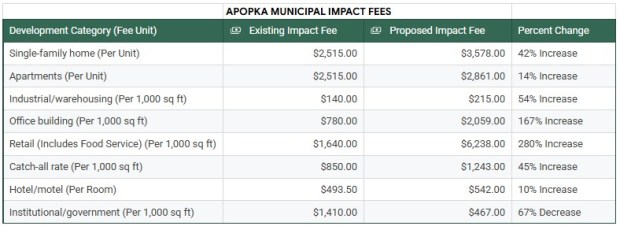

Under the proposals adopted by the council, for a new single-family home total fees would increase to $3,578 from the current $2,515. Total fees on apartments would rise 14% — from $2,515 to $2,861 per unit.

For nonresidential construction, total fees would increase per 1,000 square feet for industrial/warehousing from $140 to $215 (54%); office buildings from $780 to $2,059 (167%); retail (includes food service) from $1,640 to $6,238 (280%); and the catch-all rate (for development not specifically listed) from $850 to $1,243 (45%). The hotel/motel fees (on a per-room basis) would increase from $493.50 to $542 (10%). The sole category that would see a decrease in total fees is institutional/government (per 1,000 square feet) which would drop from $1,410 to $467 (67%).

Ocasio said in an interview with GrowthSpotter before the meeting that many factors are used to calculate impact fees, including how much foot traffic facilities can expect to receive. He said that’s one of the reasons total fees for retail construction would increase the most compared to all other categories.

All categories would see an increase in the municipal impact fees, except for Institutional uses.

All categories would see an increase in the municipal impact fees, except for Institutional uses.

Raftelis conducted the municipal impact fee study for the city that the Florida Impact Fee Act mandates before it can increase fees by more than 50 percent of the current rate due to what’s called extraordinary circumstances.

Details of the city’s multi-year capital improvement plan the fees will help pay for were included in the study.

On the police side that includes about $80 million to help pay for a new public safety complex ($52 million), a police training facility ($25 million) and new vehicles ($3.9 million). On the fire/rescue side that includes about $42 million to help fund the public safety complex ($32 million), a new fire station ($6 million) and firefighting equipment ($3 million). Future recreation costs include about $26 million to help fund land acquisition ($20 million), new tennis and pickleball courts ($2.4 million), and new soccer fields ($2 million).

According to the study, the higher fees proposed would be about the same as those charged by Mount Dora for new single-family homes but above Altamonte Springs — which charges about $1,000 per home — and below Clermont — which charges nearly $5,000 per home.

Brian Bell can be reached at bbell@orlandosentinel.com. Have a tip about Central Florida development? Email Newsroom@GrowthSpotter.com. Follow GrowthSpotter on Facebook and LinkedIn.