With its over 400 miles of canals and hundreds of waterfront properties, the sun-soaked, tranquil city of Cape Coral, Florida, was created to be an ideal retirement destination.

Many, through the years, have bought into this dream. But some have paid a much higher price than others for it, ending up spending all their life savings and postponing retirement to see their forever homes in this “waterfront wonderland” complete.

All because of one man: Paul Beattie, a local developer who took millions from dozens of homeowners to build their dream retirement homes—but failed, in many cases, to deliver a finished product.

Among the homeowners left on the hook by Beattie’s company, Beattie Development, are John and Mary Ann Fitzgerald.

The married couple, who are ranchers from Northern California, hired Beattie Development to build a home in March 2022 because the company “was very well recommended in the community,” Mary Ann Fitzgerald told Newsweek.

“Paul Beattie had been building homes in Lee County for around 15 years, winning builder of the year for three years, and was, at one time, head of the Lee County Builders Association. Many subcontractors were familiar with him for years and seemed to have the same trust,” she said.

Kristen and Matt Kramer had similar reasons to hire Beattie. The couple met in Key West, Florida, “a long, long time ago,” they said. They fell in love, married, moved across the country, had children, and raised them in Colorado—but always had the deep-seated desire to return to the Sunshine State.

They were ready to make the big step in 2021, after their kids went to college. They decided to build their dream home in Cape Coral. “We saved all our money and we said, this is our plan A and there is no plan B,” Matt Kramer told Newsweek.

They looked for a reputable builder, and found Beattie’s company. “Everything that we read online was good. Everything that we heard, word of mouth, was good. He had all these awards. He was president of this association and that association. And he had the house we wanted. So we ended up signing a contract in October-November 2021,” Kristen Kramer said.

The Kramers sold their home in Colorado and moved into a rental with their two dogs, telling themselves they could wait around for those nine to 12 months they were told were needed to build their forever home. “We’ll be patient and we’ll make it work,” Matt Kramer said.

Another couple, Paul and Vivien Haynes, had also sold their home while waiting for Beattie Development to build their new, bigger property in Cape Coral. The Hayneses, who are British, have for years split their time between the U.K. and the Sunshine State.

They had owned a home in Cape Coral since 2007, but, after the pandemic, they decided to build a bigger one—and hired Beattie to do it.

They were told they would be able to move in within 10 to 11 months, but that was not the case. Not for the Hayneses, not for the Fitzgeralds, and not for the Kramers.

“After a year, they still hadn’t broken ground,” Matt Kramer said.

Hundreds of miles apart, another couple was experiencing the same problem. Roberto and Manuela Vissepo, who are originally from Puerto Rico and Germany, respectively, were living in Colorado when they hired Beattie to build their dream retirement home in Florida.

Their idea was to retire in the sun and be closer to Roberto’s mom, who was living in Puerto Rico at the time. They contracted Beattie to build their home in September 2021, and he told them it would be ready in 10 to 12 months.

“Needless to say, it took so long [to finish their Cape Coral home] that we didn’t get to enjoy any time with her because she passed away last year, when we moved here. So we lost two years of spending time with her,” Manuela Vissepo said.

During the time that their house should have been built, the Vissepos were supposed to receive updates from Beattie on how the construction was proceeding. But the company didn’t break ground until January 2023.

How A Dream Turned Into ‘A Four-Year Nightmare’

How A Dream Turned Into ‘A Four-Year Nightmare’

As the months went by without progress, the Vissepos—like the Hayneses and other homeowners involved—kept asking Beattie what was going on, but they were told that any delays had been caused by Hurricane Ian, which struck Florida in September 2022.

“We were going to fly down here to check to see what was going on, and we were told not to come because they need the space for their own people after Ian. That’s what he called it. And we should just stay away,” Manuela Vissepo said.

By the time the couple made it to Florida, in 2024, Beattie had gone into liquidation.

The Hayneses were relatively luckier. As they were “nomads,” having sold their home, they were offered to stay with some neighbors in Cape Coral.

“Our neighbors were really good. We stayed over the road, which was a saving grace, because Beattie lived just down the road,” Vivien Haynes said.

This proximity, she said, pushed Beattie to make more progress on their home than on others. Still, the couple ended up using extra funds to finish their unfinished dream home.

“We’ve ended up having to put an inheritance we didn’t know we were going to get from a cousin of Vivien’s and my mother’s inheritance,” Paul Haynes said. “They’ve all gone just finishing this house,” he added.

“Money we had already paid. And we ended up paying again,” Vivien Haynes said.

They were initially told they would spend $360,000 on their home. Then they were told $460,000, as home values had gone up during the pandemic. “It did end up being just over $600,000, by the time we ended up adding extras we thought we had money for,” the couple said.

After the pandemic home price growth in Florida, building their dream home in Cape Coral still made financial sense for the Hayneses. But as prices have fallen in recent months, that is no longer the case.

“Now I think it’s probably not worth what we’ve paid, because the price of properties dropped, it’s actually not quite worth what it cost, but we’re not looking to sell it in the next 5 minutes,” Paul Haynes said. “So it doesn’t really matter. It’s just a beautiful home.”

Dozens of Beattie Development customers lost money in building their dream homes.

When it became clear that Beattie Development was having huge money problems, in June 2024, the Fitzgeralds’ home was 46 percent completed, even though they had paid all but the last 6 percent of the amount due.

The Fitzgeralds, who are in their 60s, had “worked hard” their entire lives to get to the point where they could afford to retire in Florida, “getting up at 4:30 a.m. weekdays to feed our cattle, then both going to their full-time jobs in town,” May Ann Fitzgerald said.

“The contractor went out of business, leaving us on the hook for just shy of $400,000 to finish,” John Fitzgerald told Newsweek.

“As for the nearly 100 homes that we estimate were in contract to build at the time our was being built, the amount of money we spent was enormous,” Mary Ann Fitzgerald said.

Even after realizing something deeply wrong was happening, many homeowners were stuck.

“It took us a while to figure it out,” Kristen Kramer said. “When you put everything together, it’s like, Oh my gosh, we are so foolish,” she added.

The experience has had a heavy emotional toll on the couple, but they are fighting to break the stigma around it.

“People will say to us, Well, you should have done your homework. You wouldn’t have gotten into this if you had done your homework,” Kristen Kramer said. “But we did do our homework, we’re smart people, you know, you’re investing this kind of money. But there was no way to know.”

Getting out of the contract with Beattie was not a straightforward move. The Kramers’ attorney suggested they waited a full year until the contract was null to avoid more troubles and more expenses instead of ending straight away. “It was very stressful,” Kristen Kramer said. “We had all our staff in storage for three years. We had no house, no money left.”

The Kramers had to come up with another $330,000 in cash to finish the house that Beattie had left 60 percent completed. On top of that, they had to pay attorney fees.

“Our liquid savings are gone, it probably put us another two or three years behind in terms of retiring,” Kristen Kramer said. “Or we could retire for like 10 minutes when we are 93.”

The Hayneses also had to continue making payments for things they knew they would not be delivered to avoid being put into a legally vulnerable position.

The Vissepos found another builder to finish their home, which was 65 percent completed when Beattie went into liquidation.

“We don’t know where the money went. Our initial price for the home was $474,000, and we paid $700,000,” Roberto Vissepo said. “And that was without the lot because we already owned the lot.”

While the Fitzgeralds, the Hayneses, the Kramers and the Vissepos all live in their now-finished homes in Cape Coral, others are still out of their properties.

Courtney Dellinger-Porter told Newsweek that, to this day, her family does not have a Certificate of Occupancy that allows them to live in the home they paid $300,000 out of their retirement savings to finish after Beattie Development left it “incomplete and uninhabitable.”

She described the whole experience as “a four-year nightmare filled with empty promises, repeated delays, and ultimately, financial loss.”

The Beattie Development case was also particularly devastating for the Owens, a couple from Kansas. A few years ago, Wes Stuart Owen was diagnosed with a genetic error and neurological condition that causes his muscles to atrophy and which means that he will lose much of his mobility over time.

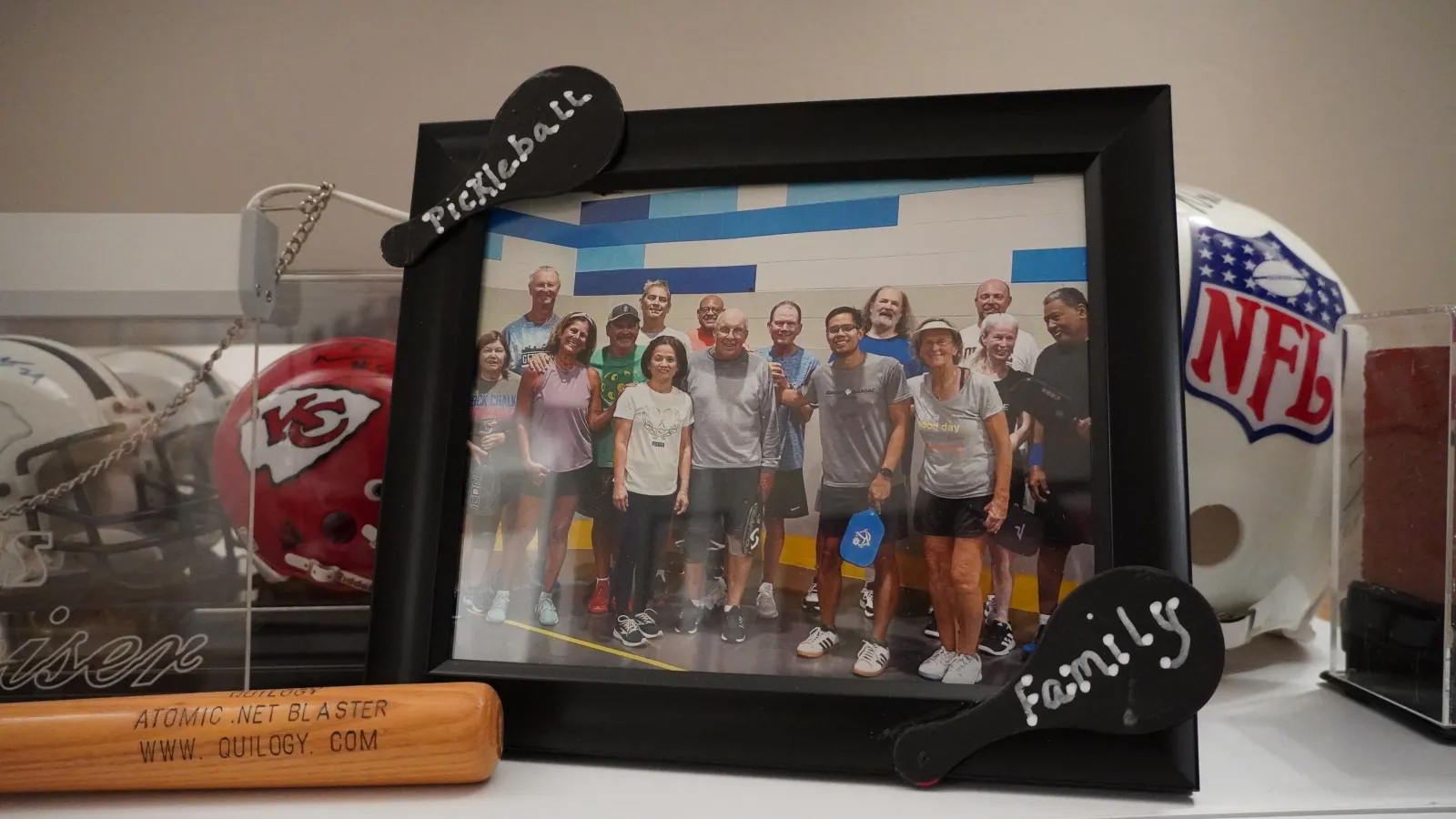

For this reason, he and his wife Kim decided to retire in mid-2020 and move to Florida, with the idea of enjoying his last years of mobility in a house with a pool and in a city where he could continue playing his beloved pickleball. In October 2021, they hired Beattie Development to build it.

As in all other cases described here, Beattie told them it would take 10 to 12 months to finish the home. “They didn’t even break ground until February or January 2023,” Wes Stuart Owen told Newsweek.

They were only able to move into their home after paying to finish it with another developer last year. When Beattie Development went into liquidation, the showers weren’t completely tiled, there was paint on the floor, the doors had no handles on them, “things like that,” Wes Stuart Owen said.

The Owens said they were, however, luckier than other families, as they saved at least $95,000 when Kim said they should not give any more money to Beattie. “That’s what allowed us to finish the house,” Wes Stuart Owen said. “The bank, though—I had to fight them for weeks, months, to get the money out of the loan to finish the house. They said they could only give the money to Beattie.”

While the Owens love their home now, the experience has taken something away from them.

“I feel like Paul Beattie and all these people just stole two years of my mobile life, because right now I’m pretty much having to give up pickleball already,” he added.

“I’m playing [Italian] bocce ball, though, and I really enjoy playing down here,” he said, undefeated by the mess his life was dragged into.

‘Where Is The Money?’

‘Where Is The Money?’

Multiple lawsuits were filed over the past year against Beattie Development, accusing the company of taking hundreds of thousands of dollars from homebuyers without ever actually completing the work they were hired for, or paying subcontractors.

In the summer of 2024, the offices of the Cape Coral-based homebuilder were raided by law enforcement, as reported first by local TV channel WINK News, which had been following the issue since the very first claims were made.

A few months later, Beattie Development liquidated all of its assets to pay what it owed to 288 among homeowners, companies, subcontractors and others. While the company didn’t officially file for bankruptcy, the process of liquidation works very similarly, with the main difference of running through state courts.

According to court filings mentioned by WINK News, Beattie Development was $11.5 million in debt—though documents didn’t even include all homeowners who said they had hired the company to build their dream homes.

Beattie did not go to jail, though he was stripped of his license—which means he can no longer build homes in the state of Florida.

In May, attorneys for Beattie Development filed to close the liquidation case, revealing that homeowners affected would receive a $240.36 payout. The sum was later doubled, but homeowners told Newsweek that it was still ridiculous, if not outright offensive.

Many feel there should be harsher legal consequences for Paul Beattie, the company’s owner. At the liquidation court hearing in October, Beattie blamed the company’s chief finance officer for what happened. Cape Coral police are investigating what happened at his company.

In June, when Newsweek first contacted them, the Cape Coral Police Department said that the investigation into Beattie Development was still very active. “Due to the nature of the case, we cannot provide further information at this time, but I can promise you our detectives are diligently working this case,” a spokesperson said.

Meanwhile, the homeowners whose lives have been turned upside down by Beattie have a theory about what happened.

“He mismanaged the company completely. He wasn’t paying any attention. He was just living the good life,” Roberto Vissepo said. “He lost control completely. He told us that twice in a conversation.”

“He said he lost control, and somebody else supposedly took the money; we don’t know what happened. All we know is that we wired the money every single time he said a payment was due,” Manuela Vissepo said. “To me, it’s like, why can they find the money?”

Homeowners were told that their case had reached the Florida Attorney General, “but nobody’s ever contacted us in the 15 months since we filed this police report to tell us or ask us any questions,” Roberto Vissepo said.

“It’s proven that he owes $22.6 million. That’s a lot of money,” Manuela Vissepo said. “The money is gone. They can’t find it. And we feel like nothing is happening, that nobody is looking for that amount of money.”

Many feel they were taken advantage of because they were out of state.

“I believe 80 percent of us were out of state or out of the country and we couldn’t be here back and forth, checking every weekend on the progress of our homes,” Roberto Vissepo said. “I say, about 80 percent of us are senior citizens—that’s a federal crime in this country. I’m a minority for being Hispanic—that’s a federal crime in this country. And the attorney general is doing nothing,” he added.

“This builder is still not in jail, and has paid zero to any of us, as of now,” Mary Ann Fitzgerald said.

“Not only did the builder abandon us, taking all of our life savings, but the lack of action by our elected officials and law enforcement forced us to take out a loan to finish the home on our own.”

Some are angry at their lenders as well. “Like many families, we trusted that a reputable builder and our lender, Lake Michigan Credit Union (LMCU), would work in tandem to ensure the project was completed responsibly. Instead, we’ve been left with a house that’s unlivable—and a construction loan with $56,000 still outstanding,” Dillinger-Porter said.

“This has not only been a financial disaster—it’s been years of emotional strain and uncertainty,” she added. “We trusted this company to build our home and protect our investment. Instead, we’ve been left picking up the pieces while Beattie Development appears to move on with impunity.”

Newsweek contacted LMCU and the Florida Attorney General for comment by email on Wednesday, December 3.

Simon A. Gaugush, who represented Beattie in the liquidation case, told Newsweek in a statement in June: “The insolvency of Beattie Development Corporation (BDC) is an unfortunate reality of the business world.

“BDC enjoyed success for many years. Since 2009, BDC and Paul Beattie built or remodeled over 2,800 homes in Southwest Florida,” Gaugush added.

“But with COVID-19’s detrimental impact on the economy, soaring labor costs, labor shortages, supply scarcities, increased supply costs, and Hurricane Ian’s devastation to southwest Florida, BDC suffered financially. Its collapse was an unfortunate side effect of these uncontrollable market conditions,” he said.

“We understand that customers have been deeply affected by BDC’s insolvency. Every day that weighs heavily on Paul Beattie, who took pride in delivering quality housing for thousands of customers for years and enjoyed an impeccable reputation in the housing industry and the community. This matter is now in civil court where it belongs. We need to allow that process to take its course.”

This statement, when read to homeowners affected by the developer’s liquidation, was infuriating. “He never apologized, he didn’t think he was wrong at all. He blamed everyone else for his misfortune, that’s what he called it,” Manuela Vissepo said.

“And I just don’t want this to happen to other people because we all work hard for our money and we save and so we can finally, you know, retire. We know a lot of people who said they couldn’t retire, they have to keep working now because of him.”

Gaugush did not respond to a further request for comment in November.

A Happy Ending Of Their Own Making

The Fitzgeralds, the Hayneses, the Kramers, and the Vissepos are all now part of a group of about 80 former Beattie Development customers who get together to help each other finish their homes and encourage optimism.

“The friends that we’ve made through this entire ordeal are amazing, just like the best friends in the world. And it’s people who just get it,” Kristen Kramer said.

“People don’t say it, but I feel embarrassed that he took advantage of us,” Roberto Vissepo said. “We’re professionals, all of us. Presidents of companies, CEOs, lawyers from Europe. We know what’s happening. And he took advantage of all of us.”

This embarrassment and shame are shared by many former Beattie Development customers—but together, they are determined to move on and enjoy the life they were dreaming of in the first place.

“What’s great now is when we all get together, we don’t talk about it anymore. We’re just living life and I’m enjoying this wonderful place,” Kristen Kramer said.

“So if the cabinet doors don’t shut, right, or the garage door doesn’t close. We’ll deal with those kinds of things, we’ll just rise above and just enjoy it,” Matt Kramer said.

“That experience was awful. Some judge will say whether or not that money was truly stolen from us, but he will not steal my joy. We love this home. We love the friends that we’ve made. We love that view that’s right there,” Kristen Kramer said.

“I absolutely love this home. I love Florida now,” Wes Stuart Owen told Newsweek. “And I think that literally spending hours here, weeks at a time, scrubbing the floors, putting the doorknobs on, finding the vendors, overseeing them, doing all that—I took a great sense of ownership in the home,” he added.

Kim Owen has a different story to tell. She started a full-time job the moment she arrived in Florida, and did not have the time to put into finishing their home, so she does not feel that same attachment.

“I will never build another house in Florida ever,” she said, drawing her conclusions from her experience with Beattie Development. “That’s the thing, consumer protection down here, it’s just not there,” she added.

“I have a background in real estate. I sold in the Midwest for almost five years. I’ve had relatives that have sold real estate in Georgia and I have family members that also were mortgage brokers,” she said. “So in all of that experience in history, this is like—you know, they can’t believe that I had to go through this. So it’s just, you know, we did and we survived it, but it should have never happened like that.”