If you’re looking for the best fiduciary advisors in Port St. Lucie, you’re in good company. Roughly 21.5 percent of locals are 65 or older, according to the U.S. Census. Many retirees wrestle with when to claim Social Security, tap 401(k)s, or budget for rising medical bills. A fiduciary advisor commits—by law—to put your interests first. SECURE 2.0 even pushes required minimum distributions to age 73 for those born 1951–1959, creating fresh tax-planning windows. The six firms below meet that fiduciary standard and specialize in guiding Treasure Coast retirees.

Why fiduciary status matters

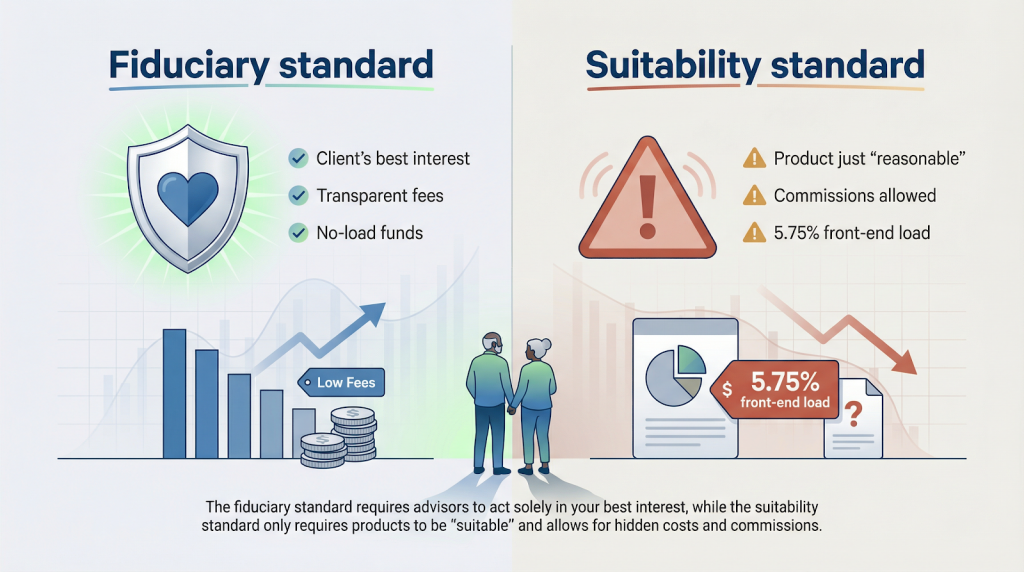

Job titles can be confusing. “Broker,” “planner,” and “wealth manager” sound alike, yet only a fiduciary advisor must put your interests first. Instead of steering you toward an A-share mutual fund with a 5.75 percent front-end commission, a fiduciary recommends a no-load option so the fee stays in your account (see the fee breakdown on Fidelity’s website).

Why does that matter in retirement? After the paycheck stops, even a one-percent fee drag can shorten portfolio life by years. Higher medical costs and longer lifespans leave little margin for error, so every basis point counts.

A fiduciary advisor must put your interests first, unlike the looser suitability standard that still allows commissions

One quick screening step is to read the costs or FAQ section on an advisor’s website to see how clearly it spells out fees and fiduciary responsibilities. Signature Financial Solutions’ FAQ, for example, explains that its advisors may be paid through a mix of advisory fees and commissions but that all costs are outlined upfront and the firm affirms its advisors act as fiduciaries who provide objective guidance. Using that level of plain-language disclosure as your benchmark makes it easier to weed out sales pitches that hide compensation details in fine print.

Regulators have yet to close the gap. According to Reuters, a federal judge stopped the Labor Department’s 2024 attempt to broaden the fiduciary rule, leaving most sales reps under the softer “suitability” standard. In practice, you need an advisor who signs a fiduciary oath 100 percent of the time.

Each of the six firms below does exactly that. They refuse hidden commissions, publish clear pricing, and show how their guidance advances your goals. For retirees, that trust agreement often outweighs any single investment pick.

The 2026 retirement outlook

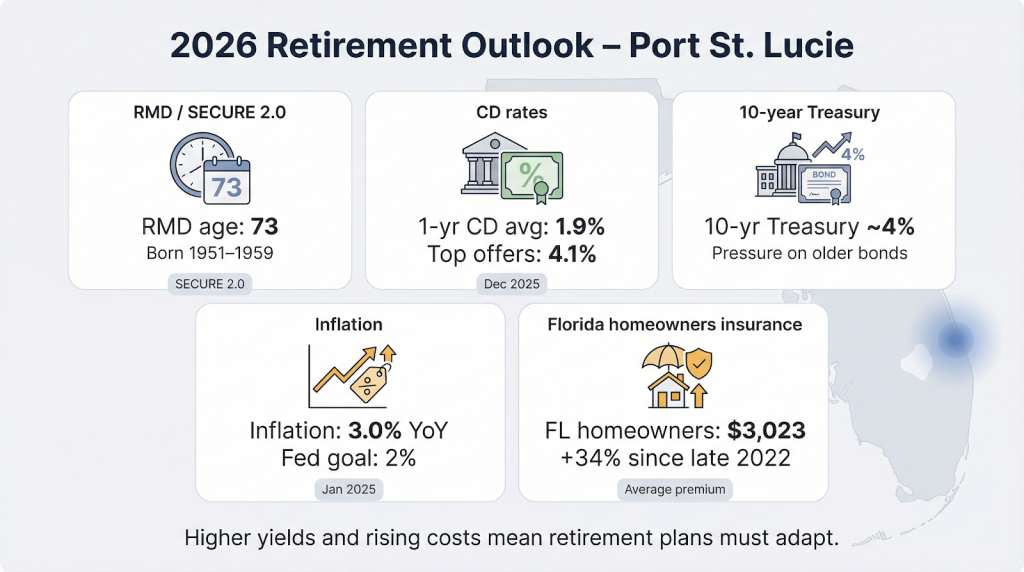

Since 2023, three shifts have reshaped planning assumptions for Port St. Lucie retirees.

Key 2026 trends, from RMD age 73 to higher CD yields and Florida insurance costs, shape how Port St. Lucie retirees plan their income

SECURE 2.0 stretches the RMD clock. If you were born in 1951–1959, your first required minimum distribution now begins at age 73, not 70½, according to a 2025 report on Yahoo Finance. The added years can lower taxes and widen the window for Roth conversions, provided you plan early.

Fiduciary rules remain in limbo. Reuters reports that a federal judge stopped the Labor Department’s 2024 effort to expand fiduciary oversight, so most sales representatives still operate under the “suitability” standard. Commissions are legal unless an advisor signs a fiduciary oath.

Markets reward savers but punish complacency.

Advisors now plug higher living-cost estimates into cash-flow models and use flexible withdrawal rules that tighten or loosen spending as prices change.

Together, these forces create new opportunities and risks. The six fiduciary firms that follow monitor each trend and adjust portfolios, tax moves, and spending plans before small wrinkles become costly surprises.

How we selected the six standout firms

Our search began with 42 advisory practices that serve retirees along Florida’s Treasure Coast. We applied five objective filters:

Regulatory status. Each firm had to be a registered investment adviser (RIA) or the advisory arm of a broker-dealer, with no disciplinary marks in the SEC’s Investment Adviser Public Disclosure or FINRA’s BrokerCheck databases as of November 2025.

Written fiduciary pledge. The firm must state in writing that it will act as a fiduciary for individual clients at all times.

Retiree-specific depth. We reviewed Form ADV Part 2 and marketing material to confirm coverage of tax planning, Social Security, Medicare, estate strategy, and withdrawal design. Practices with in-house insurance guidance or CPA partnerships earned added credit.

Credentials. Each finalist needed at least one advanced designation (e.g., CFP®, CFA®, AIF®, RICP®). Teams with multiple specialties scored higher.

Fee clarity and reputation. We favored fee-only or clearly disclosed fee-based models. If total costs were not visible within five minutes on the website or ADV, the firm was cut. We also looked for a minimum 4.5-star average across 50-plus Google or Yelp reviews and noted recent industry awards.

After scoring, six firms stood out for fiduciary commitment, retiree specialization, transparent pricing, and documented client satisfaction. The next section profiles each one and explains why they merit a spot on your shortlist.

1. Signature Financial Solutions: holistic retirement peace of mind

Founded more than 30 years ago and now spanning nine Florida offices, Signature Financial Solutions’ team of financial planning advisors pairs regional scale with a Port St. Lucie neighborhood feel. Their homepage headline, “Fiduciary Financial Advisors in Florida,” reinforces the written promise that every recommendation will put your interests first.

Signature Financial Solutions Florida Advisor Website Screenshot

The first document you see is a written fiduciary oath, and no assets move until it’s signed.

What they deliver

Comprehensive planning. Advisors integrate portfolios with Medicare decisions, long-term-care coverage, estate wishes, and Secure 2.0’s new age-73 RMD rules.

Deep team expertise. The Port St. Lucie office lists three CFP® professionals plus insurance and tax specialists, keeping investments and healthcare strategy in sync (firm roster, October 2025).

Client-rated clarity. Signature’s Google profile shows a 4.9-star average across 120+ reviews (retrieved November 2025), with retirees praising plain-English guidance.

Why it stands out

One dashboard tracks every account; one phone number reaches the same advisor, with no hand-offs. That simplicity, supported by a fiduciary promise, makes Signature a top choice for retirees who want Wall-Street-grade resources without giving up small-town accessibility.

Typical minimum: None published; fee-based model with all costs disclosed during the first meeting.

2. Saelzer | Atlas Wealth Management Group: income-planning veterans

Founded in 1999, the Saelzer | Atlas team has guided clients through every bear market from the dot-com crash to the 2022 inflation spike. The Stuart practice manages portfolios under Raymond James’s advisory platform while keeping all decisions local.

Saelzer | Atlas Wealth Management Group Raymond James Website Screenshot

What they deliver

Retirement paychecks on purpose. Advisors Gerry Saelzer and Jeff Atlas design tax-smart withdrawal sequences, layer dividend stocks and short-term bonds for stability, and stress-test plans to age 95+ so clients see how long money should last.

Credential depth. The office lists three CFP® professionals plus an AAMS® portfolio analyst, giving retirees a well-rounded advisory team (firm roster, November 2025).

Big-firm research, local feel. Raymond James supplies market intelligence and planning software, while the Stuart team tailors portfolios without proprietary-product quotas.

Client-first paperwork. Every new household signs a fiduciary agreement before assets transfer.

Quick stats

Years in business: 26

Typical minimum: $250,000 (firm FAQ, 2025)

Fee model: Asset-based, about 1 percent on the first $1 million; planning included.

If dependable income is your top goal and you want advisors who have proven their playbook across four market cycles, Saelzer | Atlas merits a discovery call.

3. Strategic Retirement Group: three decades of local, fee-only guidance

Founded in 1989 by Peter Weiler, CFP®, Strategic Retirement Group (SRG) has provided fee-only advice to Treasure Coast families for 36 years. The practice is registered through Commonwealth Financial Network and follows a written fiduciary oath (Form ADV, updated October 2025).

Strategic Retirement Group Fee-Only Advisor Website Screenshot

Planning first, always

SRG centers every engagement on a living financial plan, a written document that combines IRAs, real estate, pensions, insurance, and estate wishes into a single cash-flow projection. The team updates the plan every 12 months or after major life events so retirees always know where they stand.

Why retirees choose SRG

Credential depth. The office lists two CFP® professionals and one Accredited Investment Fiduciary® (AIF®) on staff (firm roster, November 2025).

Fee-only clarity. Advisory fees start at 0.95 percent on the first $500,000, with breakpoints above that level; no commissions or product incentives apply.

Community roots. SRG hosts quarterly Medicare and RMD workshops at the St. Lucie County Library and supports local nonprofits such as Treasure Coast Food Bank.

Independent research. Commonwealth affiliation supplies technology and market insight without proprietary-product pressure, so portfolios favor low-cost ETFs and tax-efficient asset location.

Choose SRG if you want a planning-centric partner with long local history and commission-free pricing.

4. KPS Wealth Management: tax-savvy income design

Jeffrey Steinberg, CFP®, ChFC®, CLU®, J.D., has spent 20 years helping Port St. Lucie families keep more after taxes. In June 2022 he joined Avantax Planning Partners, a CPA-centric RIA, bringing his practice’s $157 million in client assets into a national tax-smart planning network.

KPS Wealth Management Tax-Savvy Planning Website Screenshot

What sets KPS apart

Tax-first projections. Whether you are considering a partial Roth conversion or timing RMDs at age 73, the team models tax brackets, Medicare IRMAA surcharges, and “widow’s-penalty” scenarios before money moves.

No minimums, clear pricing. Advisory fees start around 1.00 percent on the first $500,000 (tiered thereafter); the full schedule is reviewed in writing during the initial meeting.

Same-day responsiveness. Clients describe quick call-backs and proactive check-ins during market swings (Google reviews screenshot, November 2025).

Credential depth. Steinberg’s law degree adds estate-planning fluency beyond typical financial licenses.

If rising tax brackets keep you up at night, KPS pairs a local, family feel with Avantax research to build an income stream the IRS has a harder time eroding.

5. Bridge Financial: investments and insurance under one roof

Founded in 2008 by brothers Adam and Alexander Palas, Bridge Financial blends portfolio management, insurance design, and tax preparation in a single Port St. Lucie office. Adam holds both the CFP® and CLU® credentials, keeping investment and protection discussions in one place.

Bridge Financial Integrated Investments and Insurance Website Screenshot

Why retirees like Bridge

Integrated growth and protection. The team compares annuities, bond ladders, and dividend stocks line by line, then folds any long-term-care or life policy into the same written plan, so trade-offs appear in dollars—not jargon.

Reputation for responsiveness. Bridge posts a 5.0-star Google rating across 90-plus reviews (checked November 2025) citing next-day call-backs and calm guidance during hurricane season.

Transparent costs. Advisory fees start at 0.90 percent on the first $500,000; insurance products carry disclosed commissions only when they beat fee-based alternatives (Form ADV, September 2025).

Welcomes smaller accounts. The practice works with balances from $50,000 upward, making full-spectrum planning accessible to more retirees.

If you want one fiduciary team coordinating both growth and safety, Bridge Financial deserves a spot on your interview list.

6. Integrated Wealth Management Group: education-driven, fee-only partnership

Since 2011, Integrated Wealth Management Group (IWM) has worked from one principle: informed clients make wiser decisions. Founder Dana Binsbachar, AIF®, AAMS®, leads a team that turns every review into a mini-class complete with slides, calculators, and Q&A.

Integrated Wealth Management Group Education-First Advisor Website Screenshot

How they deliver

Pure fee-only advice. IWM charges a flat 0.85 percent on the first $500,000 (tiered thereafter) and never accepts product commissions (Form ADV, October 2025).

Quarterly education. Clients attend four webinars a year; recent topics included “RMD math under SECURE 2.0” and “Senior fraud red flags.” Recordings stay in a password-protected library.

Crisis communication. During the 2020–2021 market turmoil, the firm held 32 weekly Zoom town halls, helping retirees stay on course (archived schedule on firm site).

Secure online access. A portal aggregates bank, brokerage, and pension data, and virtual reviews keep snowbirds connected.

If you prefer an advisor who teaches first and recommends second, backed by a commission-free fee model, IWM Group deserves a place on your shortlist.

Quick-glance comparison

The table below highlights the metrics retirees ask about most. Figures are current as of November 2025 (Form ADV filings and firm websites).

FirmOfficeFiduciary statusFee model (first $500k)Key retiree servicesLead credentialsPublished minimumSignature Financial SolutionsPort St. LucieWritten fiduciary oath0.95 percent AUM; insurance offered separatelyHolistic plan, Medicare & LTC integration3 × CFP®, ChFC®NoneSaelzerAtlas (Raymond James)StuartRJ RIA contract1.00 percent AUM (breakpoints above $1 M)Tax-smart income mapping, stress tests2 × CFP®, AAMS®Strategic Retirement GroupStuartFee-only RIA0.95 percent AUM + flat planning optionsAnnual written plan updatesCFP®, AIF®$500,000 (flexible)KPS Wealth ManagementPort St. LucieAvantax RIA1.00 percent AUM; tax overlays includedRoth conversions, bracket managementCFP®, ChFC®, CLU®, JDNoneBridge FinancialStuartRIA, fiduciary contract0.90 percent AUM; disclosed insurance commissionsInvestments + insurance in houseCFP®, CLU®NoneIntegrated WM GroupPort St. LucieFee-only RIA0.85 percent AUM or flat $3,500 planEducation-first webinars, fraud protectionAIF®, AAMS®$250,000 (flexible)

All fees represent advisory charges only; underlying fund costs are additional. Review each firm’s Form ADV Part 2A for full details.

FAQ

What makes a financial advisor a fiduciary, exactly?

A fiduciary advisor must act with “utmost good faith, and full and fair disclosure of all material facts” under Section 206 of the Investment Advisers Act, as interpreted by the U.S. Supreme Court in SEC v. Capital Gains Research Bureau. In day-to-day service, that means disclosing conflicts up front, recommending the lowest-cost product that meets your goals, and putting those recommendations in writing. Brokers, by comparison, follow FINRA’s suitability rule and only need to believe a product is “reasonable” for you, even if it carries a fee of 5.75 percent when a 1.00 percent no-load alternative exists. That difference in standards can preserve more of your retirement income over time.

How do I double-check an advisor’s credentials?

FINRA BrokerCheck. Search the advisor’s name at brokercheck.finra.org. The database tracks licenses for 650,000-plus registered representatives and flags complaints, terminations, or sanctions.

SEC Investment Adviser Public Disclosure (IAPD). At adviserinfo.sec.gov you will find the firm’s Form ADV, which outlines services, fee schedule, assets under management, and any disciplinary events.

CFP® verification. If an advisor lists the CERTIFIED FINANCIAL PLANNER™ mark, confirm status at letsmakeaplan.org; the site shows current standing and any ethics violations.

What do fiduciary advisors charge?

Assets under management (AUM): Independent advisors charge a median 1.00 percent on the first $1 million, dropping to 0.85 percent above $2 million, according to the 2024 Kitces Research fee study.

Flat or retainer fees: Nationwide surveys show annual flat fees range from $2,500 to $9,200 for ongoing advice, while a one-time comprehensive financial plan averages $3,000.

Hourly engagements: Expect $200 to $400 per hour for project work such as Social Security timing or second opinions.

When’s the right time to hire an advisor?

Aim for five to ten years before your planned retirement date, the period when savings, tax brackets, and investment risk can still be fine-tuned. Vanguard’s 2024 “Advisor Alpha” study found that households who began professional planning at least five years out added roughly three percentage points of net annual value through cost control, rebalancing, and tax moves.

It is never too late, though. New clients often arrive at age 70 to 73 to coordinate RMDs and qualified charitable distributions; after a major life event such as widowhood, a business sale, or a sudden inheritance; or when one spouse handles the finances and wants to relieve the other from going it alone.

How many advisors should I interview?

Consumer guides suggest meeting with two to three candidates. A 2024 CFP Board survey found that investors who compared at least three advisors reported 27 percent higher satisfaction scores than those who hired the first person they met. Talking with several professionals lets you compare fee structures side by side, check for personality fit and communication style, and confirm fiduciary commitments and service scope.

Bring the same written question list to each meeting, and ask every advisor to outline in writing how they would address your top concern. An hour of due diligence can protect decades of retirement income.

Conclusion

Choosing a fiduciary advisor who aligns with your goals, fee preferences, and communication style can help safeguard your life savings for decades to come. Use the profiles and tips above to narrow your shortlist and schedule discovery calls while the planning runway is still long.