JetBlue Airways has recently expanded its Fort Lauderdale network with new year-round nonstop routes to Orlando and Dallas, added more daily flights to New York’s LaGuardia, and continued building out its Florida footprint with additional destinations and premium Mint offerings. This push deepens JetBlue’s role as Fort Lauderdale’s largest carrier and tightens connectivity across Florida and beyond, aligning its network more closely with leisure and visiting-friends-and-relatives travel patterns. We’ll now examine how JetBlue’s expanded Fort Lauderdale–Orlando connectivity reshapes the company’s investment narrative and longer-term growth profile.

We’ve found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

JetBlue Airways Investment Narrative Recap

To own JetBlue today, you need to believe its focus on leisure heavy routes, loyalty, and product upgrades can eventually translate into sustainable profitability despite recent losses and ongoing margin pressure. The Fort Lauderdale expansion supports the near term catalyst of rebuilding load factors and revenue, but it does not fundamentally change the biggest risk around volatile demand visibility and close in bookings.

The upcoming fourth quarter and full year 2025 earnings call on January 27, 2026, is the most relevant near term checkpoint, as it will show how this Florida growth is feeding into unit revenues, costs, and capacity plans. Together with prior route additions and Mint expansion, it gives investors a clearer read on whether JetBlue’s network reshaping is easing competitive and margin pressures or simply adding more capacity into an already tight earnings picture.

Yet beneath the appealing new routes and Mint cabins, investors should be aware that JetBlue still faces concentrated exposure to…

Read the full narrative on JetBlue Airways (it’s free!)

In order for analysts’ valuation assumptions to hold, JetBlue Airways’ narrative projects $10.6 billion in revenue and $728.0 million in earnings by 2028.

Uncover how JetBlue Airways’ forecasts yield a $4.65 fair value, a 13% downside to its current price.

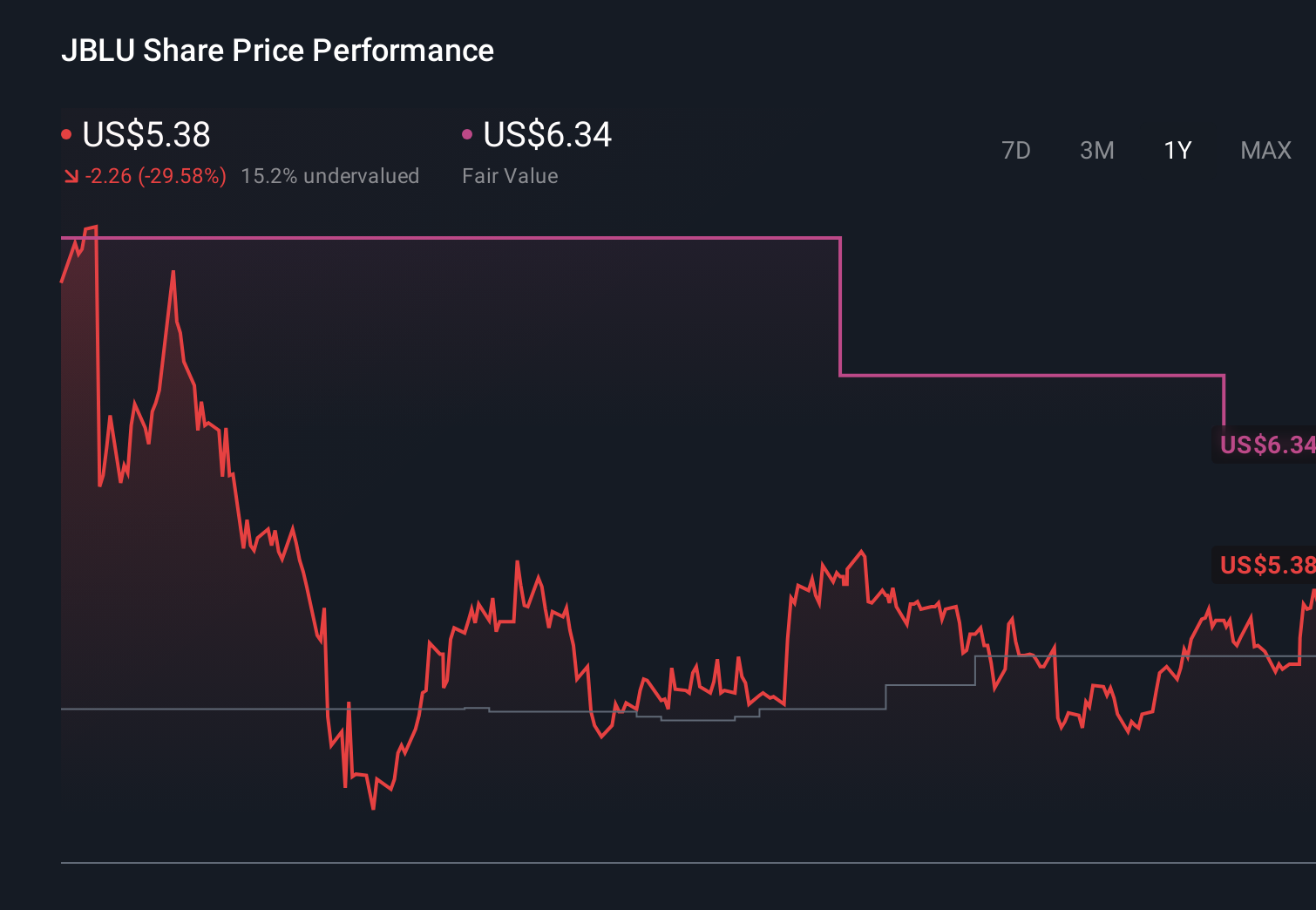

Exploring Other Perspectives JBLU 1-Year Stock Price Chart

JBLU 1-Year Stock Price Chart

Eight fair value estimates from the Simply Wall St Community span from US$3 to an outlier at about US$340, showing how far apart individual views can be. Before you commit to any stance on JetBlue’s Fort Lauderdale growth, it is worth weighing these varied opinions against the ongoing risk of weak demand in travel troughs and intense competition that could limit how much benefit the new routes ultimately deliver.

Explore 8 other fair value estimates on JetBlue Airways – why the stock might be a potential multi-bagger!

Build Your Own JetBlue Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com