Sue-Ann Shaw is shopping for a home and hoping to buy within the next year.

“I want a nice kitchen, two car garage,” she said, but many of the things on her wish list are out of her budget.

“The cost of living down here is crazy. It’s astronomical,” Sue-Ann said.

BUYING A HOME

Homebuyers like Sue-Ann are facing high prices, high interest rates and high property insurance rates. This trifecta is making the dream of owning a home out of reach for many, even as the real estate market cools.

Lender data handed over to the federal government shows the number of people applying for mortgages has sharply dropped since 2021 when interest rates were at an all-time low.

Now, in 2025, many people feel like they have been priced out of the market.

‘EVERYTHING IS HIGHER’

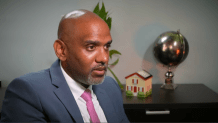

“We have inflation across the board. Everything is higher,” said mortgage broker Kalil Jones.”(Buyers) they’re coming in and they’re looking at their salaries, and it’s like everything is up except my salary barely moved.”

Jones says getting homebuyers approved for lending is harder now than a few years ago.

“So, before you would see an application in 2019, one person, one income, one buyer,” Jones said. “In some situations, you need to get grandma in the mix with social security or a child who’s working. So, the way people are getting it done is either you have one extremely high-income earner or multiple mid-to-low level income earners.”

NBC6 crunched data from Zillow and found it would take a median income household in Miami around 12 years to save for a 20% down payment on a home.

If you are trying to keep your housing expenses below the suggested 30% of your monthly income, you would need to make at least $130K a year, according to the Zillow data NBC6 analyzed.

But in Miami, data shows incomes aren’t rising.

The Opportunity Atlas, a data tool from the U.S. Census Bureau, shows people in Miami at age 27 were making 3.5% more in 2005 than they were 14 years later in 2019. Today, the average median income in Miami-Dade County hovers around $70K.

REAL ESTATE MARKET SHIFT

But the real estate market is shifting as homes sit on the market longer. A stagnant market offers some options to make homebuying more feasible.

“So once upon a time, sellers weren’t willing to give any money towards closing costs. Now, if you ask a seller to give you something because they need it to go, they’re willing to go as high as $10K, $15K, $20K to give you can sell a concession. And that’s good for the buyers,” said real estate agent Arlene Shaw.

Also, buying new construction could help you get a lower mortgage rate. According to the National Association of Home Builders, around 65% of new home builders offered sales incentives to buyers last month. Lenders have also rolled out new mortgage programs offering increased loan limits, lower down payment requirements, and to help for first-time homebuyers.

“Because remember, you can always buy your dream home another time, but what is it that is most important to you right now?” Arlene Shaw says she often asks her clients. It’s a question she has also posed to her daughter, Sue-Ann, as she continues her homebuying journey.

It’s stagnant. It’s hard to sell and hard to buy all at the same time

Sue-Ann Shaw

“So, it’s just, it’s stagnant. It’s hard to sell and hard to buy all at the same time,” Sue-Ann said.

There are grants available to help South Florida homebuyers offset the cost of buying. The Florida Hometown Heroes Housing Program and Florida Assist Program offer grants. There are also lender programs offering down payment assistance depending on the zip code you are buying in.

Many programs are for first time homebuyers so be sure to read the fine print to make sure you qualify.