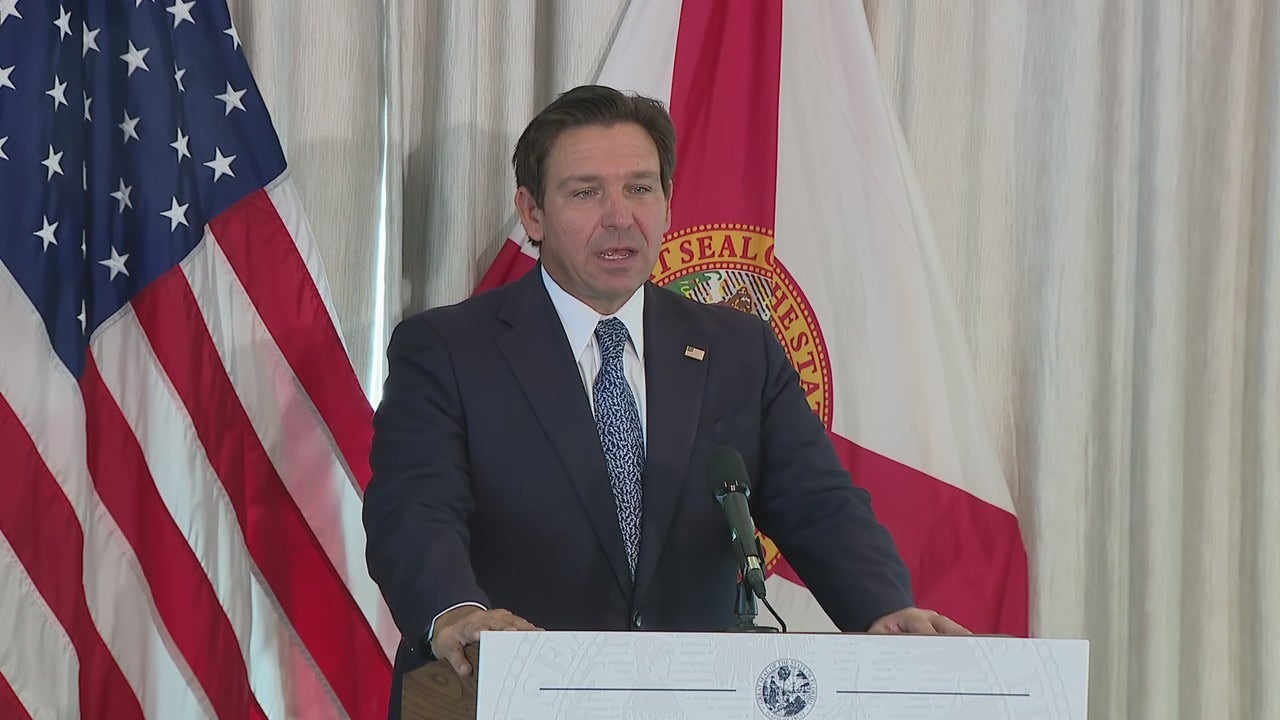

SARASOTA, Fla. – Florida Governor Ron DeSantis said Progressive auto insurance policyholders in Florida should be getting a rebate or a credit due to litigation reform in the state and those who are insured by other companies should see savings in the near future.

The governor made that announcement during a press conference on Wednesday morning in Sarasota.

By the numbers:

In 2024, DeSantis said auto insurance was the No. 1 nationwide consumer staple in terms of inflation with a 20% increase.

READ: Florida’s home insurance crisis: The search for solutions

He said in 2025, the top five auto-writer insurance groups in Florida have averaged a 6.5% reduction in rates.

DeSantis said those rates are likely to decrease further in the future.

He said part of the reason for the lower costs is a decline in litigation expenses. He said those expenses went down almost immediately after the 2022-2023 reforms were put in.

DeSantis said consumers should get refunds.

READ: My Safe Florida Home: Some insurance bills may go up after state-funded upgrades

On Wednesday, DeSantis said almost $1B in credits have been secured for Progressive Auto Insurance policyholders.

“The savings that we’ve seen because of the litigation reforms now means they are going to be giving to you,” the governor said. “It may depend on how long you’ve been with Progressive, and you might get a bigger rebate. It may be a check. It may be a credit on your bill, but the average across Florida policyholders is going to be a $300 rebate for Progressive.”

DeSantis added that Florida Office of Insurance Regulation Commissioner Michael Yaworsky is in discussions to do the same with other insurance companies by Jan. 1, 2026.

READ: Florida’s home insurance crisis: Investigating the risk, cost of underinsured homes

“This rebate of almost $1B is on top of, they just filed again for even more reduction,” DeSantis explained. “So, they’re 10, 15, maybe 20% down as this whole year goes on for their policy holders and then you’re going to be getting almost $1B back with this.”

In an SEC filing, DeSantis said Progressive Insurance wrote, “That since Florida’s insurance reform was enacted, we’ve seen lower lost costs on certain types of claims and favorable reserve deployment, and we’ve experienced strong in Florida personalized auto business.”

DeSantis said in the past, insurance companies didn’t want to be in Florida due to demographics, bad driving and legal challenges.

Florida homeowner’s insurance reform

DeSantis said when it came to homeowner’s insurance, the state represented 8% of claims nationwide, but 78% of litigation costs.

Since January 2024, DeSantis said 33 homeowners insurance companies have filed for a rate decrease and 46 companies have requested no change or zero percent.

DeSantis said Peninsula is one of the largest insurers in the state and it requested the largest decrease for the company in modern history of 8.4% for homeowner’s premiums and 12% for condo owners.

In 2024, he said Florida had the lowest increase in the nation for homeowners at 1%.

What they’re saying:

“We now have, since these reforms were passed, 17 new companies are now operating in Florida, so they’re bringing capital in, and they are offering new policies,” the governor stated.

“You’re getting $1B back from an auto insurance company because of those reforms,” DeSantis added. “That’s the only reason that is happening.”

The Source: Information for this article came from Governor Ron DeSantis’ press conference