State Sen. Carlos Guillermo Smith, D-Orlando, has revived a hearty push to allow for more flexible use of the revenue that local governments collect through the tourist development tax, a 6 percent tax levied on stays in hotels and short-term rentals.

Florida law currently restricts how much of that tax money can be used to address some of Orlando’s most pressing issues, such as homelessness and transportation, instead requiring most of it to be spent to boost the region’s world-renowned tourist attractions, convention centers, and tourism promotion agencies.

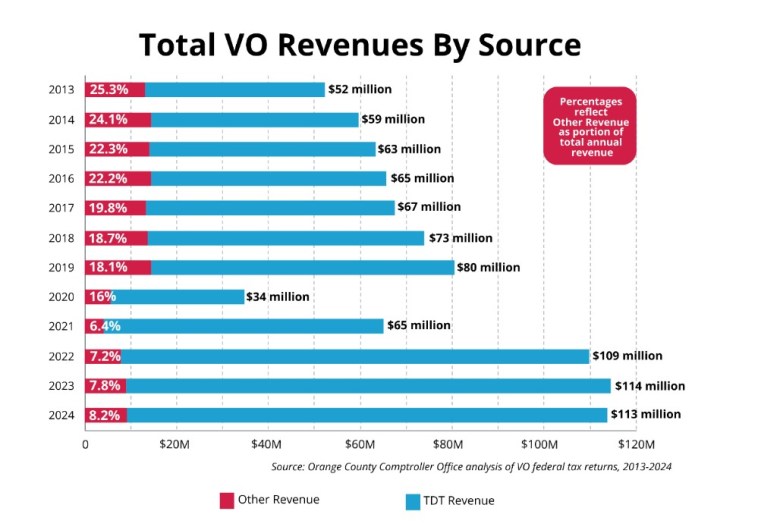

Orange County, for example, collected nearly $360 million in hotel tax revenue during the 2024 fiscal year, the largest pull of any other county in Florida. Nearly one-third of that ($105 million) was distributed to Visit Orlando, a private, nonprofit marketing agency that pays a dozen of its executives six-figure salaries on a budget that is mostly comprised of public money.

It was also recently dinged by the County Comptroller’s office for misclassifying $3.5 million in public money as private, and called out for spending public money on garish outlays like a $12,000 car allowance for its CEO and a lavish $75,000 dinner party promoting local tourism up in New York.

“During a time where more than 62 percent of families here in Orange County are cost-burdened — particularly on things like housing affordability — to me, it’s unconscionable that we spend $105 million a year, not on community needs to support the homeless, for transit, but $105 million a year on corporate advertising at Visit Orlando with public monies,” Sen. Smith argued, speaking on a panel organized by the Orange County chapter of the nonpartisan League of Women Voters early Wednesday afternoon.

Smith, a progressive who formerly served in the Florida House, has introduced a slate of bills for consideration by Florida legislators next year that would reform state law on the tourist development tax, plus require a dollar-to-dollar match on private to public money given to tourism agencies like Visit Orlando.

“I think the industry needs to have skin in the game for their tourism advertising budget,” Smith argued. Roughly 92 percent of Visit Orlando’s budget, for instance, is made up of public TDT revenue. “Why is it that the tourism industry won’t invest in these dollars themselves? Because they want us to pay for it!”

Credit: Orange County Comptroller’s Office

Credit: Orange County Comptroller’s Office

Proposed reforms to the hotel tax, such as allowing that revenue stream to help pay for housing that’s affordable for tourism workers, road improvements and public transportation, have faced strong pushback from the tourism industry, which would — to no one’s surprise — like to hold onto its public money.

Rosen Hotels CEO Frank Santos, for instance, sparred with Smith over the issue Wednesday, telling the League of Women Voters audience that he’d prefer to retain the current restrictions on hotel tax revenue, and create a separate tax or surcharge on tourists to fund transportation needs.

Santos described his pitch as a “tourist transportation tax,” or TTT, that he said would be levied exclusively on tourists, not Florida residents. “I believe that there’s more and more support for a separate tax funding,” he said, referring to unnamed elected officials he’s spoken to and others in the hospitality industry. “I think as long as we stay away from that six sacred cents,” he added, referring to the hotel tax collection, “I think we have a lot of opportunity.”

Smith, to the amusement of his audience, rose to the challenge of meeting Santos’ congenial proposal with his own. While expressing support for “dedicated source of funding for transportation,” Smith described himself as a “yes, and” proponent, questioning the tourism industry’s unwillingness to fund their own marketing themselves.

“Why is it that the tourism industry won’t invest in these dollars themselves? Because they want us to pay for it!”

“If $105 million a year as the budget for Visit Orlando really is the right amount, we need tourism to invest in some of those dollars themselves,” Smith argued.

“The senator,” Santos responded, “doesn’t really understand the cost of doing business as a hotelier and a hospitality company.”

Costs for marketing, Santos explained, are up 20 to 40 percent for Rosen Hotels since the COVID-19 pandemic. “That’s just a part of doing business.”

The revival of a yearslong fight

This isn’t the first time elected officials and tourism industry hawks have fought over what to do with the generous pot of money that the hotel tax brings in.

In addition to supporting the relaxation of Florida’s child labor laws, slashing the minimum wages for servers specifically, and affiliating with a parent organization that has lobbied to weaken food safety regulation, the state’s hospitality industry — via the Florida Restaurant and Lodging Association — has also lobbied to keep TDT revenue earmarked for tourism.

Each year, as local electeds divvy up the revenue between Visit Orlando, the Pentagon-sized Orange County Convention Center and the sports stadiums (and yes, a portion also goes to smaller arts venues and organizations), venue owners simultaneously plead poverty while claiming they offer their hourly workers good wages and benefits, in a bid to get hold of more public money.

“Promoters need to decide to use this facility, either here or they go to Tampa or Jacksonville, or Vegas or Nashville and Atlanta, and we want them to choose Orlando more often than not,” Steve Hogan, CEO of Florida Citrus Sports, told county commissioners in his pitch for improvements to the city-operated Camping World Stadium in 2023. “That’s what brings the visitors, that’s what brings the impact.”

Current law already allows some of the hotel tax revenue to be spent on “public facilities,” including transportation, if at least 40 percent of the revenue is dedicated to tourism promotion, specifically, and an “independent analysis” is conducted to demonstrate “the positive impact of the infrastructure project on tourist-related businesses.”

If that 40 percent isn’t forked over, officials are left with more limited options.

There’s certainly imagination for more. Some local elected officials, for instance, have pitched using a portion of TDT revenue to fund an expansion of Sunrail. Expanding the local rail system’s hours later in the evening and on weekends would cost an estimated $26 million per year — still just a fraction of the revenue that Orange County pulls in through the hotel tax. And that’s assuming other neighboring municipalities don’t pitch in, too.

Related Stories

A proposal from Smith that nearly made it into a bipartisan state budget package earlier this year (before being removed at the last minute) would have made it easier for local governments to spend TDT revenue on public transportation and infrastructure. Smith plans to push for this again in 2026.

Santos, who rose to the position of CEO of Rosen Hotels shortly after the death of hotelier Harris Rosen last December, said he similarly supports expanding Sunrail. He just wants to see that expansion done through something like his proposal — without touching TDT revenue.

Smith is planning to move forward with his reform proposals regardless. The senator told Orlando Weekly after the panel Wednesday that he believes Florida Rep. Anna Eskamani (also a Democrat from Orlando) is prepared to sponsor a couple of his TDT reform bills in the Florida House, and is still working on finding a House sponsor for a couple of others (since House members have limitations on how many bills they can sponsor).

Smith’s proposals include:

SB 446: Would require a “one-to-one match” of private to public contributions to fund “large-scale county destination marketing organizations” like Visit Orlando

SB 454: Would delete the part of Florida statutes that requires a certain percentage of TDT revenue to be spent on promoting tourism

SB 458: Would otherwise revise the percentage to require just 20 percent (instead of 40 percent) of TDT revenue be used for promoting tourism

SB 456: Would allow for revenue from TDT to be used to help fund the development of workforce housing, public safety improvements (because theme park-goers want to feel safe, too) and other affordable housing developments

Legislation filed by state lawmakers must be approved by majorities in both the Florida House and Senate, and then receive final approval from the governor to become law. Florida’s 2026 legislative session is scheduled to begin Jan. 13, 2026, and end March 13, 2026.

Subscribe to Orlando Weekly newsletters.

Follow us: Apple News | Google News | NewsBreak | Reddit | Instagram | Facebook | Bluesky | Or sign up for our RSS Feed

Related Stories

‘We just want to get some of that money back so that our communities can benefit from it.’

The local group calling for ‘No Pulse Museum’ seems to have achieved its goal.

Of nearly $800 million in TDT funds, the bulk is earmarked for an Orange County Convention Center expansion.

Related