Reversing their earlier stance, a consensus of the Polk County Commission on Nov. 14 now say they will vote for a school district referendum asking voters for a 1 mil increase in ad valorem property taxes because Florida statute requires the board to vote for it.

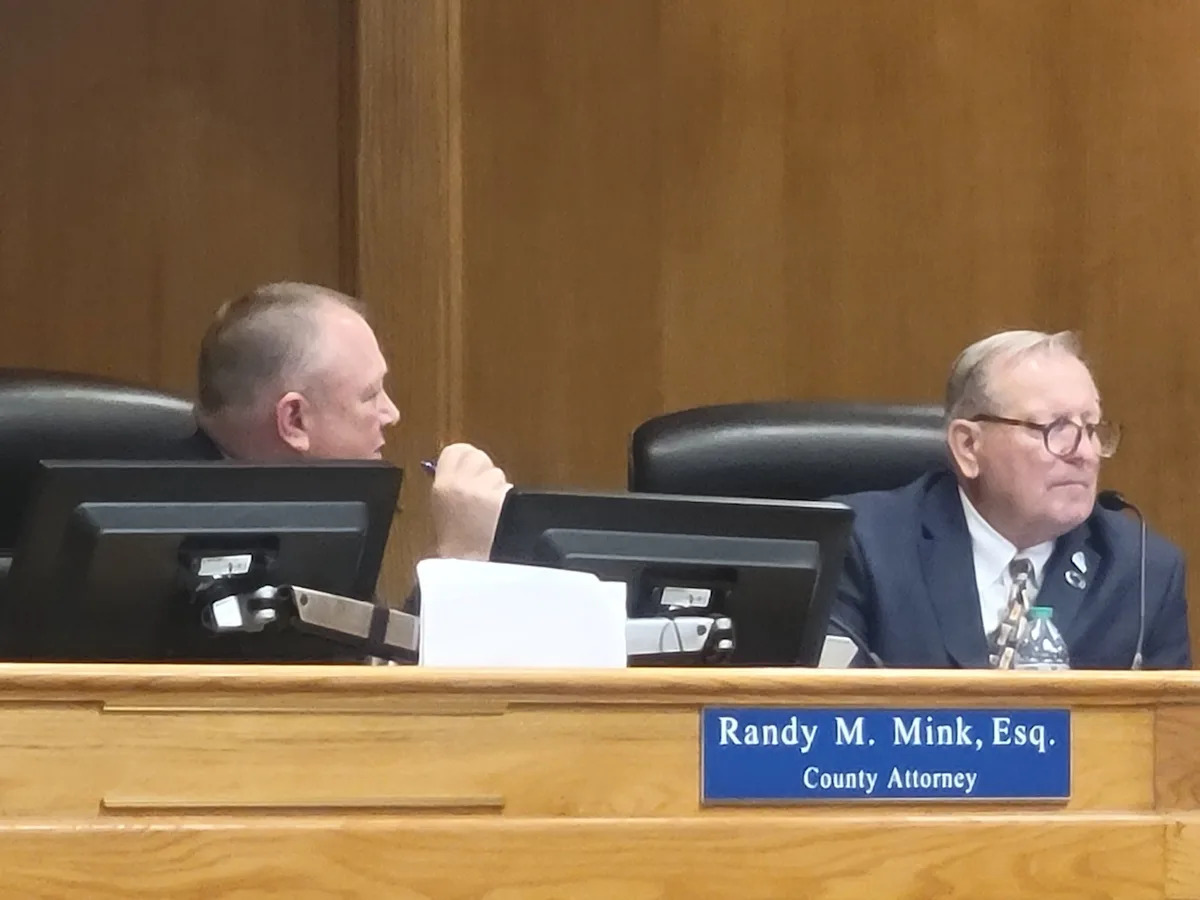

Polk County Attorney Randy Mink advises Commission on school tax referendum.

The vote would come Nov. 18 after the commissioners and the public have time to speak on the matter during public comments – and not during the first week of January, as the board voted to do at its last meeting.

Like it or not, current state law requires the commission to approve a referendum on a tax increase for schools once the district initiates a request for one.

The School Board voted unanimously in April to draft a referendum, asking voters to approve a levy of one mill, or $1 for every $1,000 of assessed property value, the Ledger has previously reported. The district estimates that the tax would generate about $80 million over four years.

County Attorney Randy Mink advised the commission that it had “no discretion” and the vote was “ministerial in nature,” at the Nov. 14 agenda review in Bartow.

Troutman champions a change in statue

That is something first-term Commissioner Becky Troutman has asked state Rep. Jennifer Canady (R-Lakeland) to change, because she does not want the residents to blame the commission for a tax increase.

Polk County Commissioner Becky Troutman during a commission meeting Tuesday August 5, 2025 in Bartow Fl. Ernst Peters/The Ledger

“We are working through state statute to get this changed. I think we are going to be successful in that,” Troutman said at the agenda review. She said in the future, she wanted the School Board to vote on a mileage increase, and a referendum would then go directly to the supervisor of election to place on the ballot.

Canady did not respond Nov. 14 to an email and a phone message for comment.

Mink told the commission on Nov. 14 that he’ll place a letter on the commission’s agenda for Nov. 18 and asking the legislature to change the current statute requiring the commission vote to approve tax referendums.

The district has said the tax increase for the county’s public schools is necessary to help pay teachers and other costs.

Millage rate increase for more than teacher’s pay

The Polk County School District has the lowest teacher pay in Florida. And the state of Florida has paid the lowest salaries to its educators of all 50 states in the last two years, according to the National Education Association reports.

Polk County Public Schools Superintendent Frederick Heid answers media questions during a press conference at the Polk County Schools office in Bartow Fl. Thursday August 4, 2022. ERNST PETERS/ THE LEDGER

Polk Schools Superintendent Frederick Heid and two school board members attended the commission agenda review on Friday for any questions the commissioners might have. Heid also tried to clarify what a millage rate increase would fund and provide further context for the request.

“We are ranked 63 out of 67 (Florida) districts in school funding. We receive on average $300 less per pupil than all of the surrounding larger districts,” Heid said.

“Last year in order to achieve a 7% increase on average for staff we cut programs,” Heid said. “We’re one of the most efficient school districts in the state of Florida.”

He added that “We are the lowest paid employee group of all the school districts because 27 of 28 districts have passed referendums.”

Heid also countered claims the referendum would all be for teacher’s salaries, since “it does not say that in the ballot language,” he told the commissioners.

The referendum language specifies how the revenue would be used. About 18% would be directed to charter schools, Heid said in his statement the Ledger has previously reported.

Of the remainder, 80% (or $53.1 million) would go to “school-based staff retention and recruitment bonuses,” Heid said. The final 20% would go to “special program supports for fine/performing arts, school safety and security, workforce development/career and technical education, early childhood development.”

Could the 1 mil ask be lowered?

Commissioner Michael Scott suggested in light of the $13 million in school taxes to be generated by the recently announced data center project in Fort Meade, the district may want to consider lowering its millage rate request in the referendum.

“That comes out to 18% of the milage rate increase being asked,” he said. “18% of it would be taken care of essentially by the addition of that project.

“So for the school board to be asking for the 1 mil, basically, what’s the justification for that? I know that’s not on the board. It’s not on our part to provide the justification, but the public was asking instead of 1 mil why couldn’t it be 0.8 mil,” he said.

Commissioner Martha Santiago noted that instead of the County Commission being viewed by the public as agreeing to raise the milage rate, she wanted it made clear that the vote was driven by the statute not by the Commission.

“I think we all said it in the last meeting, that again nobody was opposed to the concept,” Santiago said. “What we wanted to make sure, and I think that I publicly said, I just got my first text saying why we the commissioners are raising the millage rate when we have not.”

“And since I have been here, we have never raised the millage rate, she said. “In fact, we have decreased the millage rate three years.”

This article originally appeared on The Ledger: State law forces Polk Commission vote on a tax referendum for schools