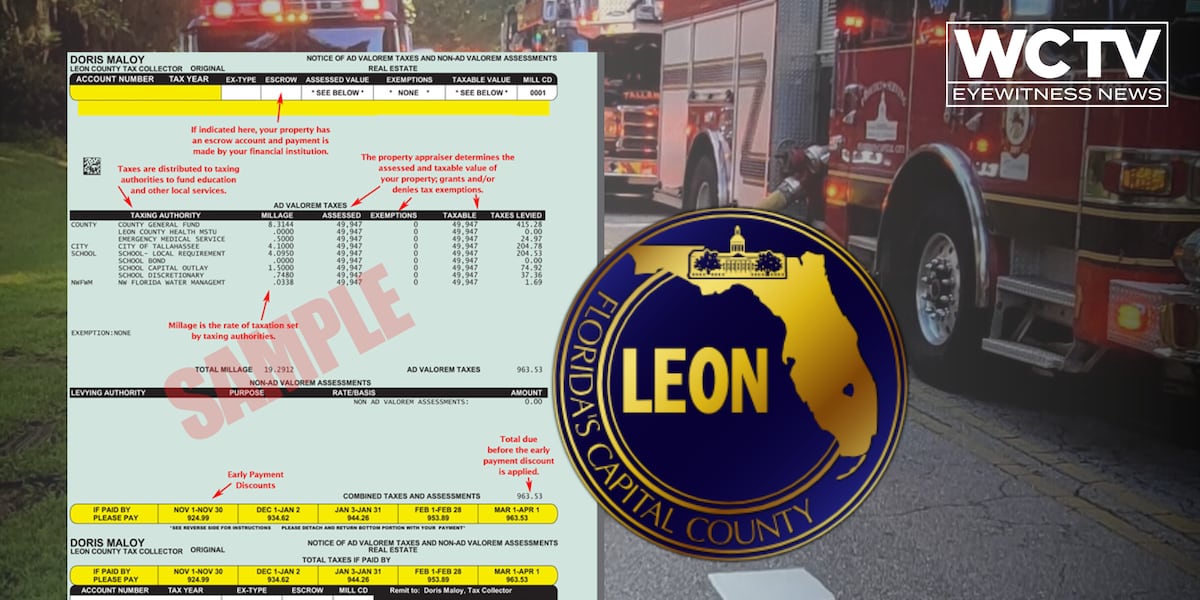

TALLAHASSEE, Fla. (WCTV) – Those in the Tallahassee area outside of city limits are noticing a new fee on their property tax bill: the fire services fee.

The Leon County Tax Collector says they’ve received more calls than usual after tax bills were received in early November. But, they say it’s important to note that taxpayers are not paying more, just paying a different way.

Up until this year, fire fees were often billed on a monthly utility bill, especially for folks who did receive city services but were outside city limits. Those folks are noticing the biggest difference as they’re no longer billed each month, but instead about $230 (or slightly more depending on the “zone”) all at once.

Residents who pay the full property tax bill by the end of the month are eligible for a 4% discount, including on the fire fee, which may actually save some money over years past. Plus, the fire fee is no longer on the utility bill, shifting that monthly cost.

More Tallahassee news:

Still, Tax Collector Doris Maloy told WCTV she knows it can be a burden to pay the fire fee up front. That’s why the office does offer monthly payment plans, quarterly payment plans or other options. Some plans carry a discount, while others don’t. Maloy said it’s best to call the office to see which plan works best for each taxpayer.

Mathieu Cavell, a Leon County spokesperson, said residents are not being double billed. Property owners are paying the fire fee for fiscal year 2026 which runs from October 1, 2025, to September 30, 2026.

“So again, there is no double billing, there is no increase in the property tax assessment,” Cavell said. “But to be abundantly clear, no one is being double billed for fire services assessment when it ends up on their property tax bill. It is the same amount of money.”

Leon County passed an ordinance earlier this year prohibiting collection of the fire fee on utility bills in part over concerns that collecting it that way was illegal and in part because collecting it on the property tax bill gives more protections.

In order to collect the fee on the utility bill, the utility could shutoff power or water. However, the City of Tallahassee has denied that’s happened.

Whereas to collect on the property tax bill, the tax collector would need to go through a more formal process.

The fire fee itself has been controversial this year. The Tallahassee City Commission voted to raise the fee by about 25% in order to fully fund firefighter salaries, continue construction on two stations and lower an insurance metric that could thereby lower insurance premiums.

The Leon County Commission voted to authorize a compromise increase of about 22%, excluding the money for the insurance rating for fear it would not benefit the unincorporated area. Plus, they raised concerns the city had spent fire money without authorization and were mismanaging projects.

Instead, the city commission voted to raise the fee by 10% only on its own residents, stop providing fire services for unincorporated residents in 2028 and pause construction on Fire Station 17. The city and county are headed to a panel of private judges, known as arbitration, over their differences including whether or not the city can increase the fee at all without county approval.

Separately, the City of Tallahassee is facing a lawsuit that alleges the fire fee isn’t legal at all. Plaintiffs in that case, which include a former mayor, argue it’s a “regressive tax” that disproportionally impacts the poor and minorities. Instead, they argue state law requires the city to fund the fire department via property taxes, which are more costly depending on the value of the property instead of a flat fee for everyone.

You can reach the Leon County Tax Collector’s office at 850-606-5100 or by visiting this website.

To keep up with the latest news as it develops, follow WCTV on Facebook, Instagram, YouTube, Nextdoor and X (Twitter).

Have a news tip or see an error? Write to us here. Please include the article’s headline in your message.

Be the first to see all the biggest headlines by downloading the WCTV News app. Click here to get started.

Copyright 2025 WCTV. All rights reserved.