SANFORD, Fla. – United States Secret Service members were in Central Florida to investigate the illegal act of capturing and recording card data – known as “skimming.”

The U.S. Secret Service – along with the Orlando Field Office and local law enforcement – conducted an operation on Dec. 2 to remove skimming devices. Agencies aimed to reach 800 to 1,000 stores in Central Florida, searching for skimmers.

By Tuesday afternoon, officials had found seven skimmers.

What is card skimming?

What is card skimming?

What we know:

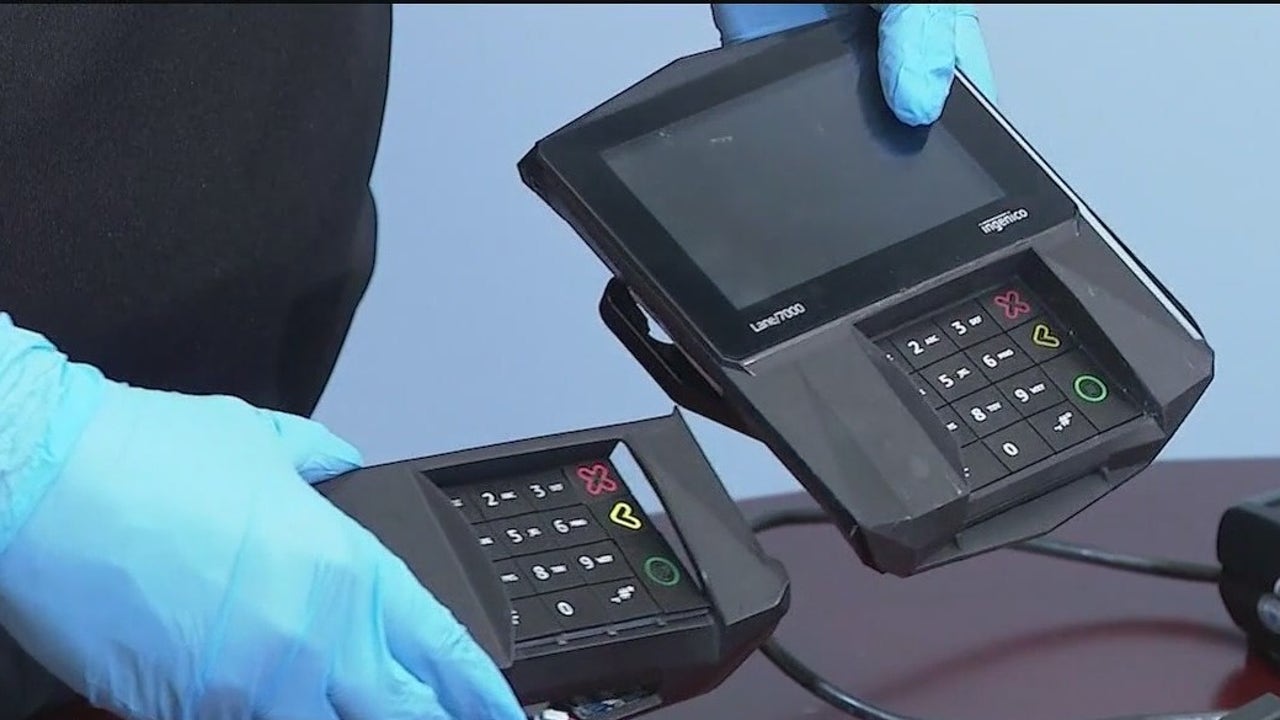

Card skimming is the act of illegally collecting card data to steal money from ATMs or credit and debit cards. It’s done by placing equipment onto the card slot on point of sale devices to steal card information – and in some cases, a person’s pin. The false card captures and copies the card information, the FBI said.

Skimmers can also use Bluetooth technology to get information onto their phones or computers, officials told FOX 35.

Robert Engel, the Special Agent in Charge of the U.S. Secret Service in the Tampa Field Office, said, “The criminals that participate in this type of activity are very slick and very good at what they do, and placing these devices onto point of sale terminals and stores and gas pumps within 30 seconds or less.”

Officials said skimmers are active at gas station pumps, grocery stores and even local mom-and-pop shops.

Secret Service, law enforcement crack down on skimmers

U.S. Secret Service footage from a Central Florida grocery store shows a person slip something out of their hoodie and onto a store credit card reader. Detectives said it was a card skimmer.

The people who do this are quick, Michael Peck, a U.S. Secret Service agent, said. Another Secret Service Agent, Caroline O’Brien-Buster, said they want the “bad guys” to know they’re onto them.

By the numbers:

These devices steal millions of dollars from Floridians each year, FOX 35’s Chris Lindsay reported.

How to avoid skimming

How to avoid skimming

Officials said skimming devices are getting harder to detect. To avoid being “skimmed,” the Secret Service gave a few tips on how to limit the risk:

– Change your pin regularly.

– Lock your card when you aren’t using it.

– Check if you can see the light behind the card machine buttons.

– Officials said using “Tap to Pay” options, such as Apple Pay, is a safer option.

– Check your bank account constantly for fraudulent transactions.

– If something feels off, walk away.

The Source: Information in this story was gathered from a Dec. 2 press conference with law enforcement and U.S. Secret Service officials.