Retirees now make up more than a quarter of Southwest Florida’s population, a demographic shift that is reshaping the region’s workforce needs, housing market and long-term economic strategy, according to a new Florida Gulf Coast University study.

FGCU economists analyzed 307,705 nonworking residents age 65 and older in Lee, Collier and Charlotte counties, comparing them with 3.5 million retirees statewide and 41.5 million nationwide. The study accounts for gender, race, education and income and also examines housing characteristics relative to working-age residents.

Published in November, the report is part of a series of issue briefs from FGCU’s Regional Economic Research Institute.

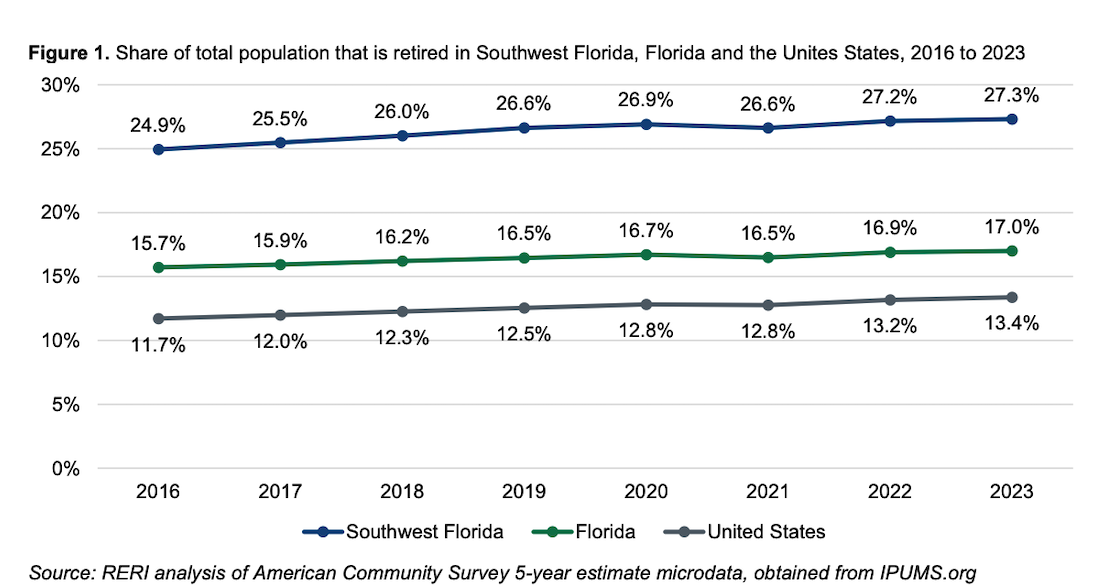

Retirees made up 27.3% of the three-county population in 2023, up from 24.9% in 2016. That compares with 17% statewide and 13.4% nationally.

Their growing share of the population underscores the region’s challenge of attracting and retaining workers in sectors such as health care and tourism.

“One of the things we’re trying our best to do is go back and find nurses or people who have health care experience, who have maybe retired or moved on to other occupations,” Lee County Economic Development Director John Talmage said. “How do we get them back into the health care workforce with training and make sure they’re up to date on their skills?”

Ashley Fearday

The retiree profile was prompted by an earlier report from labor market research firm Lightcast on the impact of Baby Boomer retirements on the national labor market, said Ashley Fearday, an undergraduate research assistant who authored the report with Melanie Schmees, research programs and engagement strategist, and John Shannon, research economist.

The study found Southwest Florida retirees are 88.4% white, more than 10 percentage points higher than state and national averages. Black, Hispanic and other racial groups represent smaller shares of the region’s retiree population.

The group’s average annual income of $52,071 is about 35% higher than that of retirees statewide and nationally. They rely less on Social Security, with 29.9% of income coming from interest, dividends and net rental income, compared with 22% statewide and 17.8% nationally.

“They are slightly more affluent in our region, so they spend more money, which supports local businesses,” Fearday said. “On the flipside, we need those workers to provide services that retirees are looking for.”

Southwest Florida retirees also are more highly educated than their state and national peers. About 19% hold a bachelor’s degree, compared with 16.8% statewide and 15.8% nationally, while 16.5% have a master’s degree or higher, compared with 12.8% in Florida and 12.2% across the U.S.

Nearly half of retirees moving to Southwest Florida came from elsewhere in Florida, with significant numbers also relocating from the Midwest and Northeast, according to FGCU’s Regional Economic Research Institute.

FGCU Regional Economic Research Institute

Nearly half of the region’s retirees moved from elsewhere in Florida. Another 19.6% came from the Midwest and 12% from the Northeast, with the remainder arriving from southern and western states. By state, the largest shares came from Michigan at 4.2%, followed by New York and Illinois at 4.1% each and Ohio at 4%. International retirees accounted for 9% of the group, including 5% from Canada.

More than 87% of Southwest Florida retirees are homeowners, compared with 59% of residents ages 25 to 54. Fearday said those rates may support property tax revenue but also intensify competition for housing.

“Housing availability tightens for younger workers who want to live and work here,” she said.

Shannon described that dynamic as a “crowding out effect.”

“If we’re attracting retired folks down here,” he said, “does that impede our ability to keep a working age population who might be competing in terms of purchasing houses with these retirees who have income accumulated over a lifetime of work?”

Homeownership costs also are higher for Southwest Florida retirees than for their counterparts statewide and nationally. In 2023, retirees paid a median of $937 per month for housing costs including taxes, insurance and utilities, nearly 20% above state and national averages.

Working-age residents paid a median of $1,654 per month to own a home, roughly in line with statewide and national figures. Retirees who rent paid a median of $1,351 per month — nearly 57% above the state and national average — while renters ages 25 to 54 paid about $1,400.

While high homeownership rates can signal financial stability, Talmage cautioned against broad assumptions.

“Those homes may be mobile homes in North Fort Myers, and they may be on a fixed income and barely making ends meet,” he said.