There’s no freeze on soaring costs.

City homeowners and landlords are bracing for a hike in their property taxes, as Mayor Zohran Mamdani’s “rent-freeze” promise can send prices soaring for residents who don’t live in rent-controlled apartments.

Building owners whose stock includes government-regulated apartments said that if the socialist mayor gets his wish of a “rent freeze” for the rent-controlled units could make it harder to maintain their properties — and could force them to hike rents for market-rate properties to make up the difference.

City homeowners and landlords are bracing for a hike in their property taxes, as Mayor Zohran Mamdani’s “rent-freeze” promise can send prices soaring for residents who don’t live in rent-controlled apartments.

“You can’t have your cake and eat it, too. You can’t say you want to freeze the rent and then raise my property taxes,” said Humberto Lopes, CEO of HL Dynasty and the Gotham Housing Alliance, who owns 100 properties.

Lopes said a 20-story, rent-regulated apartment building he owns on 446 Senator St. in the Bay Ridge neighborhood would jump from $78,000 to $91,000 under updated assessment rolls that saw valuation on co-ops, condos, and apartment buildings by 6.2%.

Meanwhile, single-family houses or buildings with up to three units saw assessments go up 4.7%, which could also send property tax bills soaring.

“You want to freeze the rent? Freeze the property taxes or lower them. Right now, you’re increasing the expenses to my building.”

Building owners whose stock includes government-regulated apartments said that if the socialist mayor gets his wish of a “rent freeze” for the rent-controlled units could make it harder to maintain their properties, according to reports. Helayne Seidman

The city Department of Finance let the cat out of the bag about a pending property tax hike when it released preliminary assessment rolls for properties last week, covering the fiscal year July 1, 2026, through June 30, 2027. The rolls partially dictate forthcoming hikes.

Property taxes will rise to account for the surging market value of the city’s housing stock, not a hike in the tax rate.

DOF reported that:

For Class 1 properties covering one-to-three family homes, assessed values rose an average of 4.7%.

Staten Island homes had the greatest percentage increase in assessed value, up 5.1%.

Assessments jumped an average of 6.2% on Class 2 properties covering co-ops, condos and rental apartment buildings.

In Mamdani-loving Brooklyn, co-op and apartment buildings saw an 11.1% increase, the highest in the city.

For commercial properties, assessment increased by 5.8%.

Commercial properties in the Bronx saw the largest increase in assessed value, at 11%.

Assessed value for office buildings increased by 4.2%, and retail buildings saw a 5.9% increase.

Brooklyn had the largest increase in assessed value for retail buildings at 7.6%

“These higher assessments mean one thing: higher property tax bills,” said a spokesperson for Homeowners for an Affordable New York.

Meanwhile, single-family houses or buildings with up to three units saw assessments go up 4.7%, which could also send property tax bills soaring, reports say. Christopher Sadowski

“Mayor Mamdani promised to make the city more affordable; yet under his watch, the city is quietly hiking taxes that property owners will inevitably pass on to tenants,” the spokesperson said. “Rising assessments are an invisible rent hike for every tenant in New York, and ordinary homeowners are being squeezed, too.”

Meanwhile, small property owners filed a lawsuit last fall claiming New York State’s Rent Stabilization Law of 2019 makes it economically unfeasible to lease vacant apartments because of caps imposed on rents on units that are unoccupied.

There are about 1 million rent-stabilized units in the city whose rent is set by members of the Rent Guidelines Board appointed by the mayor.

Brothers Pashko and Tony Lulgjuraj said in the suit that the rent in one of the vacant units in their building is capped at $700, and they claimed they would lose money for years if they rented it out.

The case is just a microcosm. In 2024, the Census Bureau released data showing there are more than 26,000 “zombie units” in the regulated stock– rent-controlled apartments that are vacant and off the market.

Lopes, the landlord, said owners of one-to three-family homes will also get squeezed.

He owns three three-family homes on Coffey Street in Red Hook, Brooklyn, and estimates the property taxes on these buildings could increase from the current $35,151 to about $38,000.

“In Red Hook. Is that crazy?” Lopes said.

The Mamdani administration pushed back on a possible property hike.

“No, the City has not increased property taxes [rates] since January 1st — the last mayor to do so was [Mike] Bloomberg,” spokesperson Dore Pekec said Sunday.

The Mamdani administration pushed back on a possible property hike. Paul Martinka

“This annual preliminary report is simply an assessment of property values,” Pekec said. “The mayor has made it clear he plans to advocate for reform to our broken property tax system.”

City Hall also noted the assessed value reflects new construction as well as economic growth and housing market changes, and is only one component used to calculate a property tax bill. There are annual assessment caps in place under the law that limit large increases.

Start your day with all you need to know

Morning Report delivers the latest news, videos, photos and more.

Thanks for signing up!

Mamdani caused a stir during his successful mayoral campaign when he said he wanted to shift the tax burden from “overtaxed” homeowners in the outer boroughs to “more expensive homes in richer and whiter neighborhoods.”

He also said he would seek a change in state law to stop treating co-ops and condos as if they were rental properties to smooth out the tax burden.

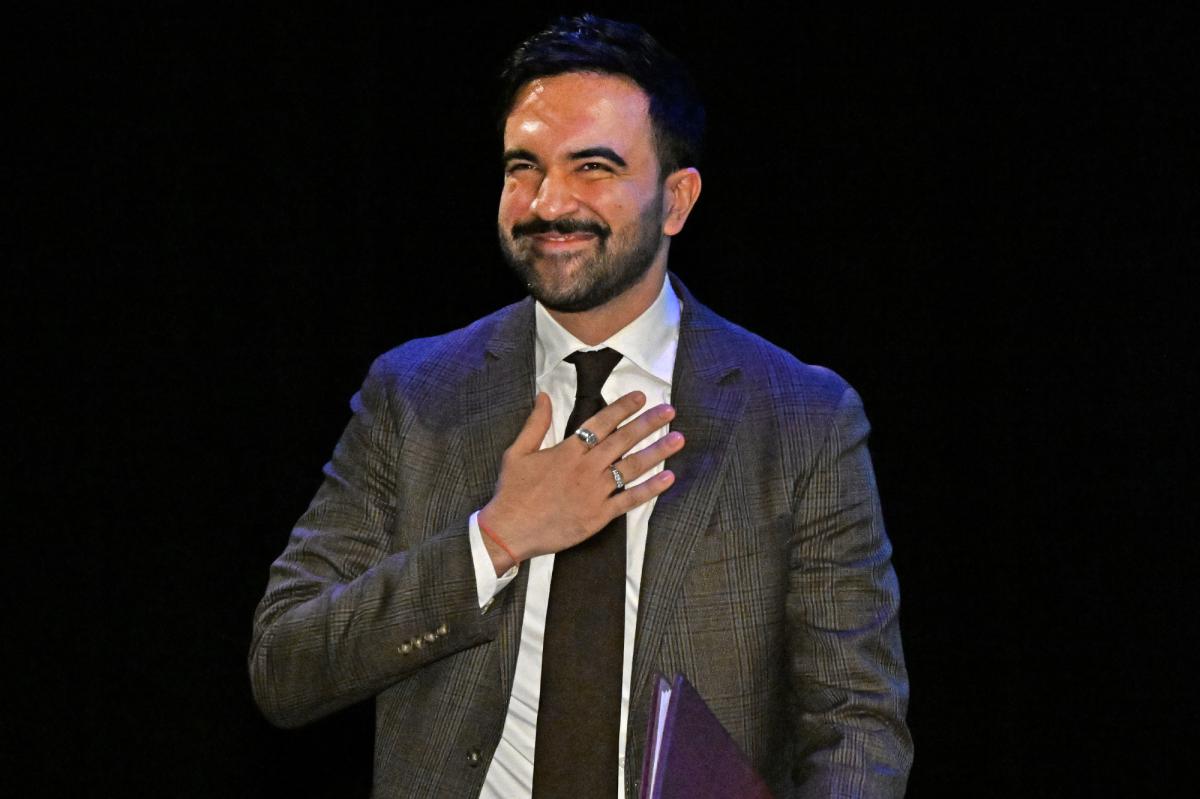

Lex Rountree (pictured), a resident of Flatbush, speaks in favor of a rent freeze at an event held by Zohran Mamdani in August 2025. Gregory P. Mango

DOF sends a Notice of Property Value to owners, including information about market and assessed value, and other property information.

The NOPV gives property owners the opportunity to review their tentative assessments and file a challenge with the city Tax Commission, an independent city agency, before the assessment roll is finalized in May.

The deadline to challenge property values for Class 2, 3, and 4 properties is March 2; the deadline for Class 1 property owners is March 16. Forms are available on the Tax Commission’s website.

A general view of apartment buildings at night on E96th Street in New York, NY as seen on November 14, 2025. Christopher Sadowski

In June, DOF will use the final roll to generate property tax bills for FY 27, which begins on July 1.

DOF also administers several abatement and exemption programs for qualifying homeowners to help lower their property tax bill, including covering senior citizens, veterans, people with disabilities, and clergy, etc.

The agency also noted that it offers payment plans that allow owners to pay their property taxes over time, instead of paying the full amount all at once.