For Middle Island resident Joanne Smith, her inflation refund check from the state arrived in the mail at precisely the right moment.

Smith’s heating system stopped working a few weeks back, costing roughly $7,600 to replace the 27-year-old unit. The unexpected $200 check that landed in her mailbox a few days ago will go toward paying the invoice on a new unit, said Smith, president of a Suffolk County chapter of the National Active and Retired Federal Employees Association.

“I think it’s wonderful,” Smith said of the check in a phone interview with Newsday.

“Every little bit helps,” the Defense Department retiree added.

Across New York, nearly 1.6 million inflation refund checks have been cashed as of Friday, amounting to more than $388 million, state officials told Newsday. Gov. Kathy Hochul implemented the $2 billion initiative to award taxpayers checks of up to $400 to reimburse them for a jump in state sales tax revenue due to elevated inflation, tax officials said.

And since September, the state has mailed out about 3 million of the 8.2 million checks it estimates will be sent to New York residents, officials have said. On Long Island, 1.25 million people are eligible for a check.

Outside of filing taxes, residents who qualify must be within the income limits, plus they should not be listed as a taxpayer’s dependent, officials said.

For instance, a couple who submits their taxes together and has a maximum income of $150,000 can get a $400 check, officials said. Couples earning up to $300,000 will receive a $300 payout.

Individual filers will be granted a $200 check if they make no more than $75,000, or a $150 payment, as long as their income doesn’t exceed $150,000, officials said.

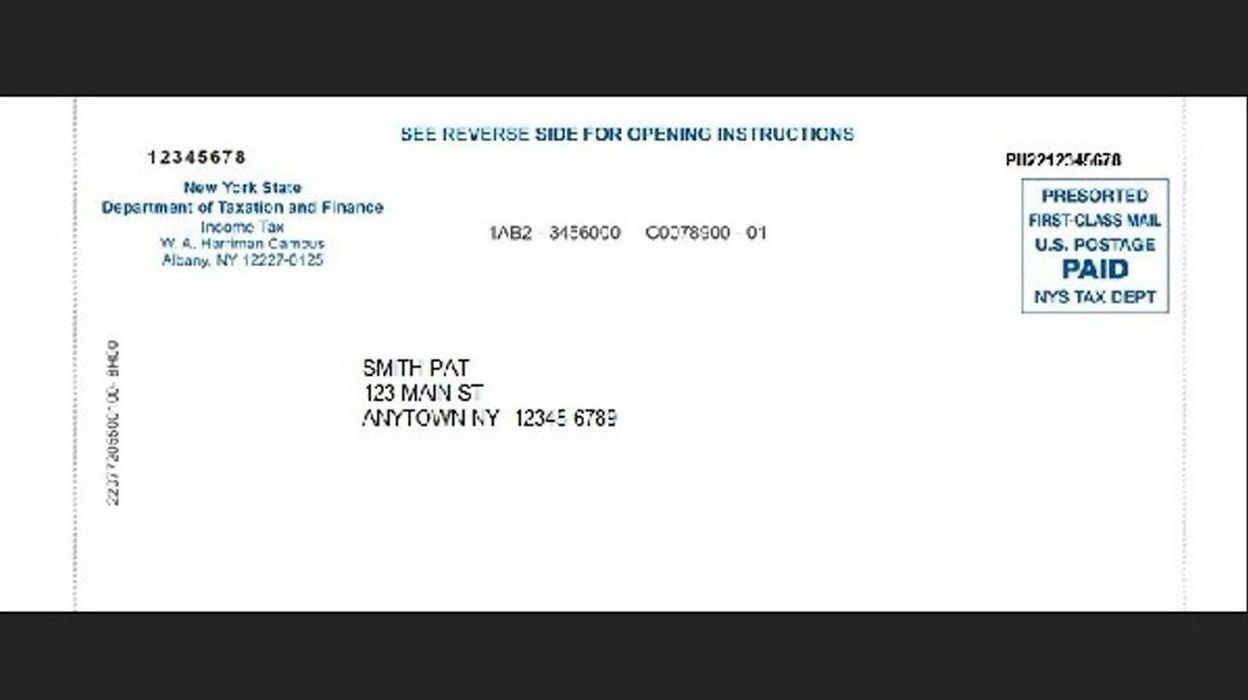

As the state sends out roughly 200,000 checks each weekday, officials have warned residents about rackets in which scammers tell residents they need their financial data so the check’s amount can be transferred electronically.

The state has noted that checks are being delivered through the mail and that qualifying residents who filed their 2023 state taxes earlier are expected to receive their refund check faster.

“People who filed early — that is well before the filing deadline of April 15th — will receive their check early,” said the Department of Taxation and Finance in an email. “People who filed closer to the deadline or on extension, will receive their check later.”

The checks don’t expire, officials said, but they could become unclaimed property after a considerable time if not deposited.

Despite the governor touting the program as an aid to residents, the inflation refund check program has come up for criticism, including that people receiving the checks are required to pay federal taxes on the funds and that higher sales tax revenue might continue beyond the one-time payout, Newsday previously reported.

Jared Walczak, vice president of state projects for the Tax Foundation, a nonpartisan nonprofit based in Washington, D.C., said earlier this month that inflation is not growing at the same rate, but that doesn’t mean prices are going down. And because of that, he said, the state will likely have additional sales tax money in the future.

“If the state doesn’t want that additional revenue due to price inflation, the state could cut the sales tax rate,” he said in a phone interview. “But presumably the state doesn’t want to lose that revenue in future years.”

Yet, for some residents, the checks are a support.

Michael Mendonis and his wife received their $400 inflation refund check in the mail, but they have not yet decided how they will spend the money.

The money could go toward their vacation fund, or toward a down payment on a used Nissan Rogue that Mendonis, 53, said he has been eyeing. When asked about the check amount, he said it was “good.”

“I can’t complain,” Mendonis, of Mastic Beach, said outside an Aldi grocery store in Shirley on Monday evening. “More would have been better, but I guess this is fair.”