Manhattan Associates (MANH) reported net profit margins of 20.2%, a decline from last year’s 21.4%. Its earnings are forecast to grow at 11.7% per year, trailing the US market’s anticipated 15.5%. The company’s revenue is projected to increase at 7.2% annually, which is also slower than the 10.1% US market forecast. Its most recent year showed negative earnings growth, despite a strong 21.1% per year average over the past five years. Trading at $194.52, the stock sits below its estimated fair value of $219.69. Profitability remains strong but shows some margin pressure heading into the next period.

See our full analysis for Manhattan Associates.

Next, we’ll see how these numbers compare to the narratives widely followed by investors and analysts, highlighting where the results reinforce expectations or call them into question.

See what the community is saying about Manhattan Associates

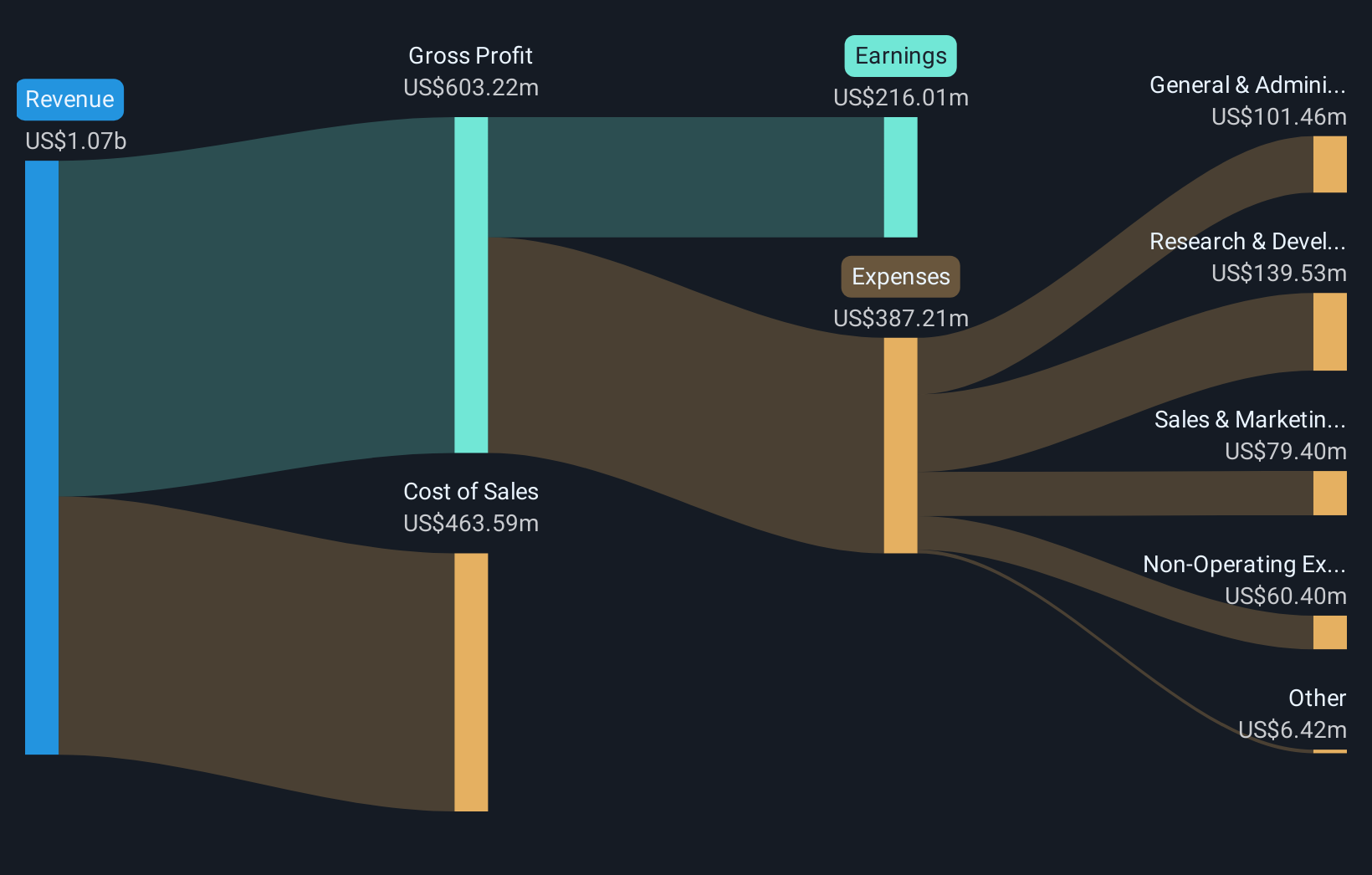

NasdaqGS:MANH Revenue & Expenses Breakdown as at Oct 2025 Cloud Momentum Drives Margin Expectations Analysts forecast net profit margins to rise from 20.9% today to 22.8% by 2027, reflecting strong expectations for operating leverage as Manhattan expands its mix of recurring cloud revenue. According to analysts’ consensus view, higher-margin cloud and AI solutions could anchor Manhattan’s long-term earnings power,

NasdaqGS:MANH Revenue & Expenses Breakdown as at Oct 2025 Cloud Momentum Drives Margin Expectations Analysts forecast net profit margins to rise from 20.9% today to 22.8% by 2027, reflecting strong expectations for operating leverage as Manhattan expands its mix of recurring cloud revenue. According to analysts’ consensus view, higher-margin cloud and AI solutions could anchor Manhattan’s long-term earnings power,

Sustained 20%+ cloud revenue growth and increased cross-selling are central drivers of recurring high-margin business, backing forecasts for margin expansion. However, slower-than-expected cloud migrations—with only 20% of on-prem customers having switched—could undermine these positive margin projections if pipeline conversion lags. Consensus view on the bullish thesis is shaped by the durability of cloud demand and the pace of customer migration, which both strongly affect margin upside. For a deeper dive on how this positions Manhattan for the future, check the full consensus narrative. 📊 Read the full Manhattan Associates Consensus Narrative. Contract Renewals Signal Revenue Durability The upcoming multi-year SaaS contract renewal cycle (2026 to 2027) offers a catalyst for revenue acceleration, as renewals are expected to occur at higher rates and include more modules, supporting stable recurring revenues. Analysts’ consensus view contends Manhattan’s unified product platform and larger renewal pipeline should drive revenue resilience,

Increased adoption of new modules and price escalations embedded in renewals mean remaining performance obligations can convert to higher cloud revenue. However, macro uncertainty and the extended ramp time for contract deployments could slow revenue recognition, keeping near-term topline growth below prior years’ trends. Valuation Premium Weighs Against Peers With Manhattan trading at $194.52 per share, which is below its DCF fair value of $219.69 but implies a 2028 forward price-to-earnings multiple of 56.5x, well above the US software industry average of 36.2x, investors must weigh strong quality signals against a premium valuation. Analysts’ consensus view acknowledges Manhattan’s premium stems from recurring SaaS and high-margin business,

Steady forecasted growth and margin gains justify some valuation gap versus peers, but the modest negative growth in the latest year and slower outlook relative to the market could limit further rerating. Relatively tight analyst price targets—$225.27 versus today’s $194.52—underscore that expectations for further outperformance are much lower now than in recent high-growth years. Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Manhattan Associates on Simply Wall St. Add the company to your watchlist or portfolio so you’ll be alerted when the story evolves.

Have a different take after reviewing the results? Share your perspective and build your own narrative in just a few minutes by clicking Do it your way

A great starting point for your Manhattan Associates research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Manhattan Associates enjoys strong profitability, its slower expected growth, premium valuation, and recent earnings dip signal challenges in sustaining outperforming momentum.

If you want to focus on stocks that pair attractive valuations with stronger forward prospects, consider opportunities surfaced by these 874 undervalued stocks based on cash flows that could offer better value for your investment now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com