Manhattan Associates (MANH) caught attention this week after delivering third-quarter results that topped both revenue and earnings expectations. Management responded by raising its full-year guidance and highlighting gains in its cloud business.

See our latest analysis for Manhattan Associates.

It has been a volatile year for Manhattan Associates, with the stock recently sliding after Q3 results despite topping expectations and seeing fresh executive leadership. However, broader momentum is still evident from its 63.8% total shareholder return over three years and 122.9% return over five years. Over the short term, the 1-year total shareholder loss of nearly 29% contrasts sharply with those longer-term gains, reflecting shifting risk perceptions and some near-term growth headwinds. Management’s new guidance and buyback activity highlight ongoing confidence in future prospects.

If you’re interested in uncovering other technology leaders riding similar waves of transformation, explore the full list with our tech and AI stocks screener: See the full list for free.

With shares off their highs and guidance moving upward, the question now is whether Manhattan Associates is trading at an attractive valuation or if the recent optimism means investors have already priced in the company’s growth potential.

Most Popular Narrative: 13.6% Undervalued

With Manhattan Associates closing at $194.68 and the most-followed narrative indicating a fair value substantially higher, there is a notable pricing gap that stands out amid recent volatility. The narrative itself sets ambitious expectations for growth drivers, especially from new technology initiatives and recurring revenue streams.

Enhanced investments in AI, automation, and unified product development (such as Agentic AI and the Manhattan Active Agent Foundry) position Manhattan to capture increasing customer demand for real-time analytics and next-generation supply chain automation. These efforts could potentially drive new bookings, average contract value, and expansion into underpenetrated markets, all supportive of sustainable double-digit top-line growth.

Want to know what powers this bullish target? This narrative leans on a handful of bold assumptions, such as faster profit growth and a premium future valuation multiple. The real revelation is that the numbers behind the story defy the market’s current view. If you think the future looks different from the past, you’ll want to see how this valuation is built.

Result: Fair Value of $225.27 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, if cloud migrations slow down or services revenue remains volatile for an extended period, this could quickly challenge the bullish outlook and weaken the pace of Manhattan Associates’ long-term growth story.

Find out about the key risks to this Manhattan Associates narrative.

Another View: High Market Price vs. Industry Benchmarks

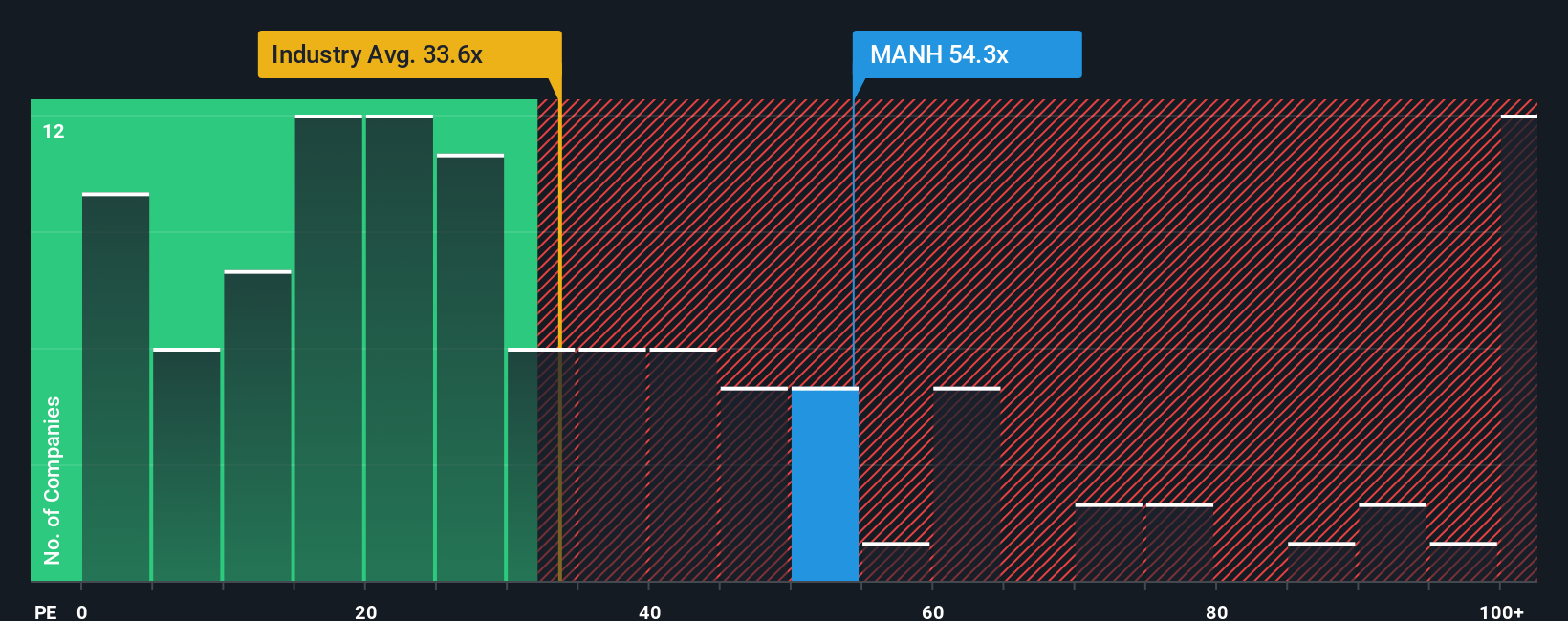

Looking at valuation multiples, Manhattan Associates is trading at 54.3 times earnings. This is significantly higher than both the US software industry average of 34.3 times and the peer group average of 36 times, as well as our calculated fair ratio of 32.3 times. Such a premium indicates the market anticipates exceptional growth, but it also increases the risk if future results do not meet expectations. Does this high valuation leave much room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

NasdaqGS:MANH PE Ratio as at Oct 2025 Build Your Own Manhattan Associates Narrative

NasdaqGS:MANH PE Ratio as at Oct 2025 Build Your Own Manhattan Associates Narrative

If you see things differently or like to dive into your own research, you can craft your own assessment in just a few minutes. Do it your way.

A great starting point for your Manhattan Associates research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more standout investment opportunities?

Don’t let tomorrow’s winners slip through your grasp. Take action now and discover stocks with massive potential by checking out these handpicked opportunities:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com