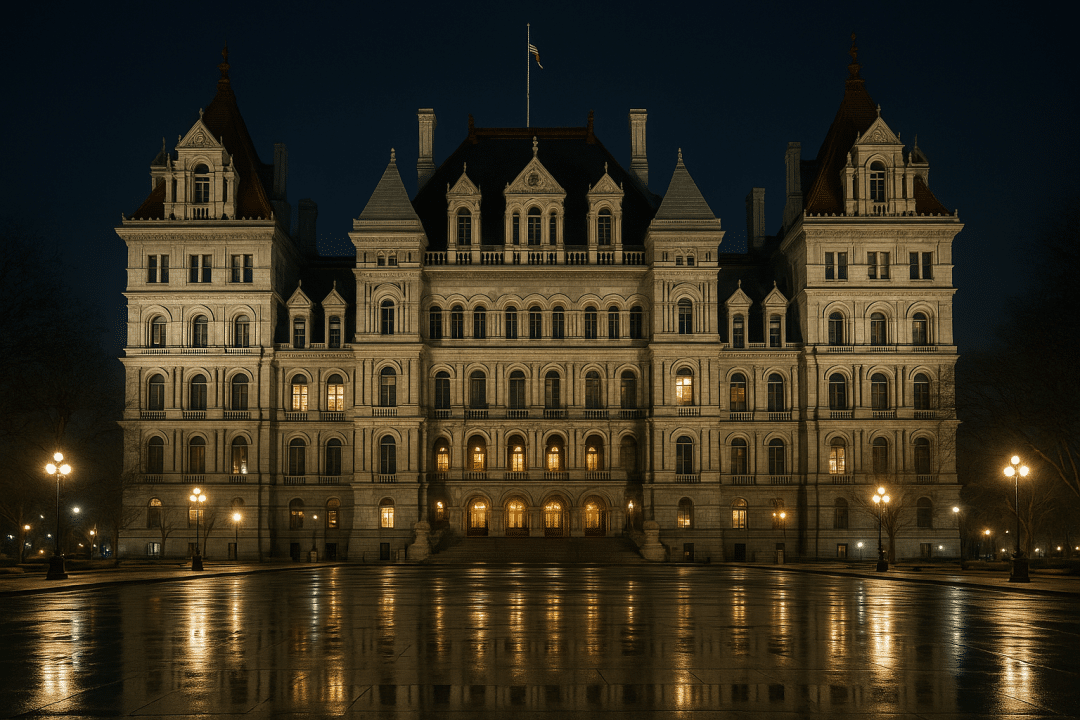

New 2023 tax data show New York’s highest earners did not leave the state in unusual numbers after the 2021 income-tax increases, while their payments made up a larger share of total personal income tax revenue. The findings come from a Fiscal Policy Institute analysis of state filings and budget figures and undercut claims of a post-hike “tax flight.”

Did higher rates push millionaires to move?

No. Migration by top earners in 2023 looked like pre-pandemic patterns. Part-year resident filings, a standard proxy for moves in or out during the year, returned to levels seen from 2015 to 2019. Filers with more than $5 million in income normalized fastest after the pandemic spike in 2020 and 2021. That points to pandemic disruption, not tax policy, as the main driver of the earlier shift.

How was migration measured?

The analysis tracks part-year returns by income group and compares 2023 with both the pre-COVID baseline and the 2020–2022 period. Gross migration rose across the board during the pandemic, then settled last year. High-income filers remained the least likely to move relative to other groups, consistent with historic patterns.

What changed in 2021 and who pays more now?

Lawmakers added three brackets in 2021 above roughly $1 million, $5 million, and $25 million, lifting top marginal rates to 9.65%, 10.3%, and 10.8%. The Division of the Budget pegs the ongoing yield from those changes at about $3.6 billion a year.

Millionaires now account for roughly half of personal income tax receipts, up from around 40% before the hike, while their share of total statewide income stayed near 25% to 30%. That gap signals that the rate change, not a surge in high-end income, drove the revenue gain.

Did overall out-migration change the tax base?

New York continued to see net out-migration in recent years, but the report finds top earners were not the main contributors. By 2023, high-income filers’ movement rates were at or below pre-pandemic norms. The state’s PIT base at the top remained stable despite population churn elsewhere in the distribution.

Are the higher rates temporary?

The 2021 brackets were first set to sunset and have since been extended through 2032. The report argues that the 2023 data support keeping the structure in place and, if needed, adjusting top rates to meet budget goals without risking a large loss of high-income taxpayers.

What does this mean for the budget debate?

The data strengthen the case that progressive rate design can fund programs while maintaining the high-end tax base. With receipts from top brackets steady and migration normalized, the report identifies fiscal room to prioritize Medicaid, child care, housing production, and transit without triggering a millionaire exodus.

What are the limits of the analysis?

Part-year filings are an imperfect proxy for migration and lag real-time moves. The analysis covers 2023 data, so any shifts in 2024 or 2025 are not yet visible. Results focus on income-tax filers and do not capture households with complex residency or entity-level strategies.

Bottom line

New York’s richest residents did not flee after the 2021 tax hikes. They are still here, and they are paying a larger share of the bill.

Get the latest headlines delivered to your inbox each morning. Sign up for our Morning Edition to start your day. FL1 on the Go! Download the free FingerLakes1.com App for iOS (iPhone, iPad).

FingerLakes1.com is the region’s leading all-digital news publication. The company was founded in 1998 and has been keeping residents informed for more than two decades. Have a lead? Send it to [email protected].