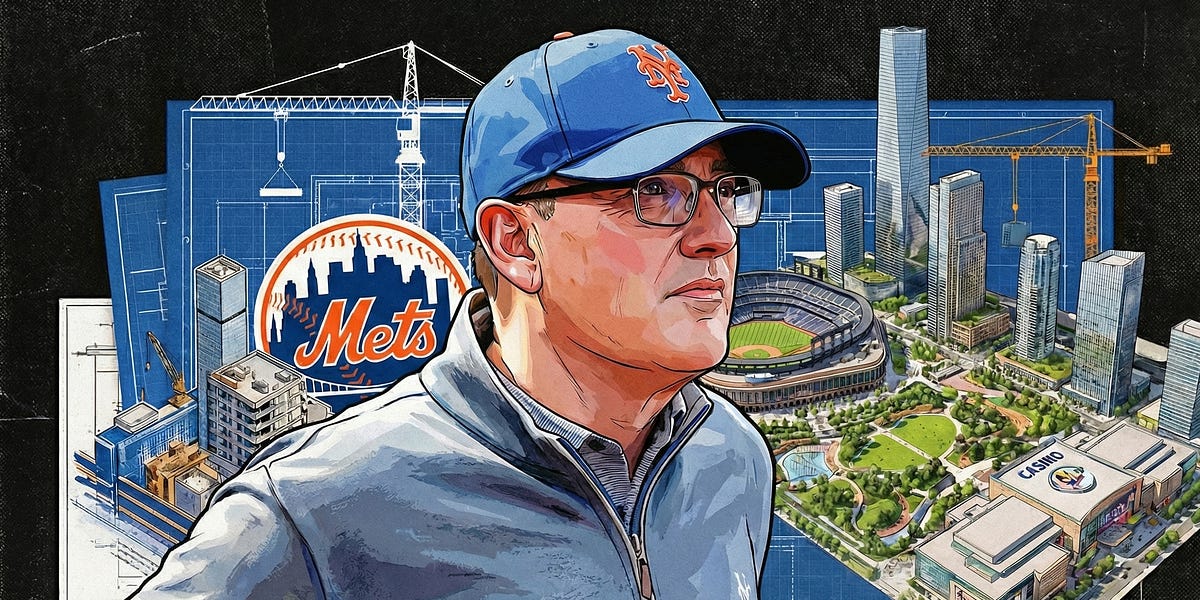

Five years after buying his childhood team for an MLB record $2.4 billion, hedge fund billionaire and New York Mets owner Steve Cohen is ready to take his next big swing.

On Monday, the New York State Gaming Commission unanimously awarded Cohen one of the state’s three downstate casino licenses. In exchange for a 30-year casino operating license, Cohen will pay a $500 million upfront fee (and an estimated $850 million in annual tax revenue back to the state) just for the right to spend another $8.1 billion on an entertainment complex located in the parking lot surrounding Citi Field.

The thesis is simple: MLB teams are seasonal businesses. The Mets generate revenue from media rights, tickets, concessions, merchandise, and sponsorships, but all of that money is earned during the season. So by converting an area that generates minimal recurring revenue today — the parking lot — into a year-round casino and hospitality complex, the Mets can reduce seasonality, increase foot traffic, and generate exponentially higher returns by diversifying the use of an asset they already own.

Several sports teams are already doing this, including the Atlanta Braves, Milwaukee Bucks, New England Patriots, and Texas Rangers. But if Cohen pulls off what he is attempting, the Mets’ real estate project will make the others look like child’s play.

Yes, you read that right. New York voters actually approved an amendment allowing up to seven full-scale casinos on non-tribal land back in 2013. The first four casino licenses were awarded upstate, with those properties given a 10-year head start so they could get up and running before downstate casinos cannibalized their business.

Once that 10-year period expired, the New York State Gaming Commission turned its attention to New York City. With three casino licenses up for grabs across NYC, Long Island, and Westchester, about a dozen operators expressed interest. After a few rounds of vetting, that list turned into a party of eight — three bids from Manhattan, one in Yonkers, one in the Bronx, two in Queens, and one on Coney Island.

I’m not going to go through every step of the approval process because half of you will fall asleep, but what you need to know is that each of these potential casino projects had to gain regulatory approval from a local Community Advisory Committee (CAC).

The CAC is essentially a mix of local elected officials, civic leaders, and area residents who vote to determine whether your project is in the best interests of residents and businesses. Casino operators present their plan and argue for their vision at two separate hearings, with a majority vote of approval required for the project to proceed.

As you can imagine, this process gets super political. In fact, only 50% of the groups interested in acquiring a downstate casino license gained CAC approval. Manhattan’s CACs voted against every single casino proposal inside the city due to concerns over traffic and the potential adverse effects on Broadway’s theaters, while Coney Island’s CAC shut down a $3.4 billion proposal by Thor Equities via a 4-2 vote in September.

Steve Cohen’s Metropolitan Park proposal also faced plenty of roadblocks along the way. Senator Jessica Ramos (representing the district) initially opposed the bill and even refused to introduce it. The USTA also filed a lawsuit and successfully obtained a temporary restraining order, arguing that the project would breach its contract with the state by disrupting parking services during the 23-day US Open. And if that wasn’t bad enough, Cohen and his partners also had to convince the state to convert the parking lot surrounding Citi Field from parkland into a commercial development.

We are all adults here, so I’m not going to pretend like this entire process is done by the book. While it’s true that Cohen and his partners hired expensive lobbying firms and spent thousands of hours and millions of dollars meeting with residents to quell their concerns, it’s also true that Cohen and his partners donated to local politicians, hired lawyers from the Mayor’s office to work on the deal, and even agreed to fund a complete renovation of the Mets-Willets Point 7 subway station. I’ll let you decide what factors ultimately got the deal done, but it’s probably a combination of both.

In the end, four bids passed through the CAC process for three licenses. MGM Empire City in Yonkers then withdrew its application at the last minute due to concerns about market cannibalization from three casinos being built within 40 miles of each other. That left three bidders — Bally’s in the Bronx, Resorts World in Queens, and Metropolitan Park outside of Citi Field — all of which were approved this week.

The New York State Gaming Commission will approve and license all three casinos at once, but Steve Cohen’s Metropolitan Park project is really in a league of its own.

Rather than building a smaller, regional-style casino with 500 hotel rooms, Metropolitan Park will be more similar to what you would find in Las Vegas. In addition to 1,000 luxury hotel rooms, the property will have 5,000 slot machines, 375 live dealer tables, 30 poker tables, and a total of 286,208 square feet of gaming space.

Outside of gaming, the complex will also have retail shops, a 5,650-seat theatre, 19 food and beverage venues, and 25 acres of public parks, including athletic fields and playgrounds. However, what really makes Metropolitan Park unique is its location.

The 50 acres of asphalt parking lots that will be used for this project sit adjacent to Citi Field, which also just so happens to be next door to the USTA Billie Jean King National Tennis Center (where the US Open is played every year) and a new 25,000-seat stadium that is currently being built for New York City FC of Major League Soccer. Not to mention, the 7 train stops right there, making it easy for people traveling in from Manhattan, and LaGuardia Airport is only about two miles away.

Citi Field’s parking lot was perfect for this because 1) Steve Cohen already owns the land, but 2) very few businesses and residents have to be displaced by the project, and 3) visitors will actually end up with more parking options. By building multi-story garages, Citi Field will increase its parking capacity from 7,750 today to 13,750.

Yes and no. For Cohen, absolutely. For taxpayers, not really. Metropolitan Park is structured as a joint venture between Steve Cohen and Hard Rock International.

Cohen didn’t necessarily need a partner, but it makes everything easier. Hard Rock will leverage the gaming expertise and operational chops it has built up by operating a portfolio of 300+ properties across 75+ countries to run the hotel and casino business.

The budget you’ll find online is $8.1 billion, but that number needs context. Even if we ignore the standard 20% bump for cost and material overruns, Metropolitan Park’s $8.1 billion budget doesn’t include the $500 million upfront casino licensing fee or the other $500 million Cohen has promised for infrastructure improvements (trains, etc.).

Then, we need to consider taxes. With New York’s gaming taxes ranging from 10% for table games to 25% on slot machines, the state’s gaming commission is projecting that Metropolitan Park could generate $850 million in annual tax revenue by its third year.

Gaming Taxes (25% on slots + 10% on tables): $550 million

NY State Income Taxes (on employee wages): $80 million

Local Property Taxes: $50 million

Sales and Occupancy Taxes (hotel, retail, dining): $120 million

Other Taxes and Fees: $50 million

Total Annual Tax Estimate (Year 3): ~$850 million

Even if we set aside tax payments, Cohen and Hard Rock will probably need to spend between $9 billion and $10 billion to build Metropolitan Park. This money will likely be financed primarily through debt, with the property expected to generate sufficient cash to cover what could be $300 million (or more) in annual debt service costs.

As for the state of New York, it will receive a $500 million upfront payment in exchange for a 30-year casino license. Combine that with $500 million in capital improvements that the state would otherwise have to cover with hundreds of millions of dollars in new tax revenue from full-time workers and casino games, and it’s no surprise that the New York State Gaming Commission approved Metropolitan Park.

To avoid burying the lede with licensing fees and tax payments, let’s make something clear. Steve Cohen and Hard Rock wouldn’t have spent years working on this proposal if they didn’t expect it to generate significant long-term value for everyone involved.

According to the New York State Gaming Commission’s own internal estimates, Metropolitan Park’s hotel and casino business is projected to generate $3.9 billion in annual revenue by year three. Shovels won’t be put into the ground until next month, and the property won’t open for another 4-5 years, but if those numbers hold true, that would position Metropolitan Park among the top 10 casinos in the U.S. by revenue.

Roughly 2/3 of this revenue would come from the casino floor. The sportsbook could contribute a few hundred million dollars in revenue, but that’s a low-margin business.

Instead, based on industry trends, the casino will likely generate at least 80% of its revenue from slots and table games. Cheap rooms will then be used to make up the difference by increasing occupancy rates, enabling the Hard Rock to potentially generate another $1 billion off the casino floor, including nightly room rentals, food and beverage, concerts, retail operations, parking, spa services, and event buyouts.

Total Projected Revenue: ~$3.9 billion annually

Gaming Revenue: ~$2.4 billion

Non-Gaming Revenue (hotel, entertainment, etc.): ~$1.5 billion

Everything from payroll, utilities, marketing, food costs, and corporate overhead must then be deducted from this total. But suppose we assume that Metropolitan Park’s hotel and casino will operate at margins close to those of other premium casinos in Las Vegas. In that case, the property could generate $1.5 billion in annual EBITDA.

That would be more than enough cash flow to service debt comfortably, but it could also quickly become the single most lucrative asset attached to the Mets organization — one that continues to print cash no matter how the team performs on the field.

(The 50 acres of parking lots surrounding Citi Field via Wikimedia)

(The 50 acres of parking lots surrounding Citi Field via Wikimedia)

Even if you don’t care about gambling, Metropolitan Park is still a win for Mets fans because it finally gives Citi Field something it has never had: a neighborhood.

Right now, Citi Field lives in a sea of asphalt. You hop off the 7, watch the game, and then 40,000 people pour back into the same bottleneck of trains and parking lots like it’s a fire drill. Tailgating is fun, but it’s also a workaround for the fact that there’s basically nowhere else to go unless you jump in a car or want to visit a local chop shop.

Metropolitan Park flips that dynamic. Restaurants, bars, parks, a theater, and a hotel can turn a three-hour experience into a full-day event, especially on the weekend. The casual fan gets entertainment outside the stadium, while diehards experience a real pregame and postgame vibe worth the ticket price. And even if the Mets lose, you don’t have to jump right on the train. You can stay and linger, making the trip worth it.

But let’s not kid ourselves — Steve Cohen isn’t investing billions of dollars just to improve the fan experience. This is about the team’s balance sheet. With Steve Cohen spending so much money on players that other MLB owners literally had to create a new luxury tax threshold, the Mets have been losing a lot of money. Despite a record $444 million in revenue last year, the Mets recorded -$268 million in operating income.

While Cohen might be willing to do this forever, a year-round casino, hotel, and entertainment district can also help change the math. Metropolitan Park can become a recurring revenue engine that doesn’t care if the Mets win 95 games or 75, an increasingly important asset given the value of financial stability when payroll spikes, national media rights change hands, and ticket demand swings with the standings.

Think about it this way: Steve Cohen is essentially building a hedge against sports performance risk through diversified hospitality revenue. While Cohen is unlikely to sell the team anytime soon, an integrated sports and entertainment operating company (rather than just a baseball franchise) would command a premium price.

But franchise valuation aside, the development of Metropolitan Park is great for fans and for the team. By pairing a world-class casino district with a perennial big-market franchise, Cohen is creating something far more durable than a single season. He’s building a business that not only provides its customers with a great gameday experience, but one that can thrive regardless of what happens between the foul poles.

If you enjoyed today’s newsletter, please share it with your friends.