The News10NBC Team details breaking News, Traffic and Weather.

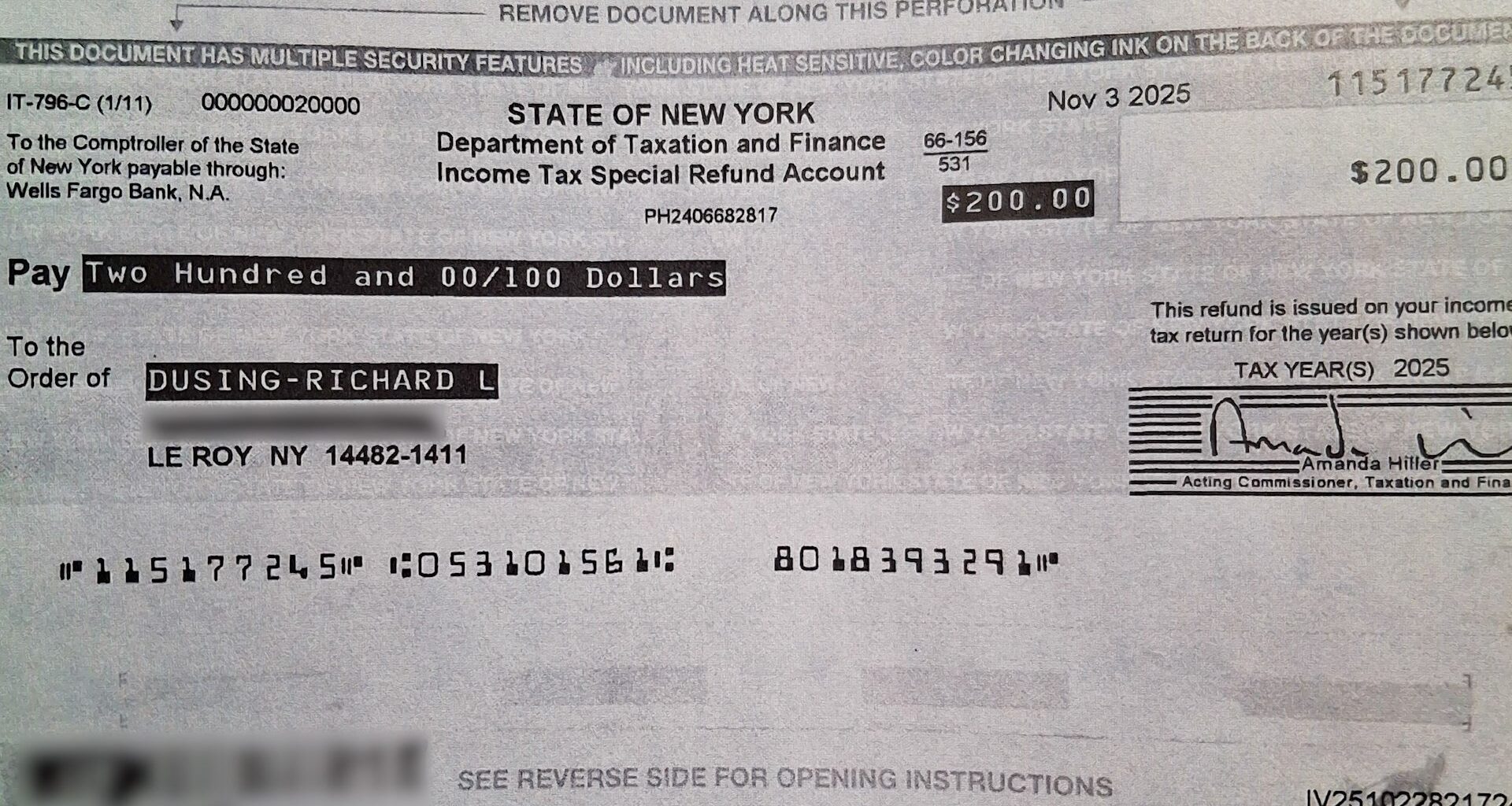

ROCHESTER, N.Y. — Valerie Liles lost her father, Richard Dusing, in May after a long-term illness. So she was surprised when a $200 check from New York state arrived in the mail earlier this month.

“I just never expected they would send a check to someone who’s been deceased for, what was it, 6-7 months?” Liles said.

It’s an inflation refund check, part of a state-sponsored effort to help New Yorkers with rising prices. Over the past two months, checks of up to $400 have been mailed to people who meet eligibility criteria. And that includes the dead in many cases.

“That’s why I was even more confused because if it’s an inflation check, he’s not here to spend any money to help the economy,” Liles said.

But because Richard filed a 2023 state tax return, he got a check, leaving Liles to wonder what to do with it.

News10NBC reached out to the State Department of Taxation and Finance. A spokesperson said anyone who gets a check made out to their deceased loved one needs to contact them and establish that they are the estate administrator or a beneficiary. If not, they’re not entitled to the check.

The spokesperson didn’t say how they plan to monitor that. So how many dead people received checks? The state says it won’t know until the rollout is complete.

As for Liles, she says after repeated phone calls to state agencies, she did manage to speak with someone who told her she could deposit her father’s check in the estate account. But she wonders if there’s a better way to help struggling New Yorkers.

“I mean, it’s like they’re willy-nilly picking a year, sending checks out. They don’t even know if these people are dead or alive. It’s just bizarre,” Liles said.

For more information about the inflation refund checks, you can visit the State Office of Taxation and Finance website or call 518-457-5181.

For Related Stories: inflation refund checks Nw York Department of Taxation and Finance