A recent study found that most individuals and families across the country’s metro areas find it difficult to balance needs, wants and savings under the 50/30/20 budget rule, with many having difficulty paying for basic necessities.

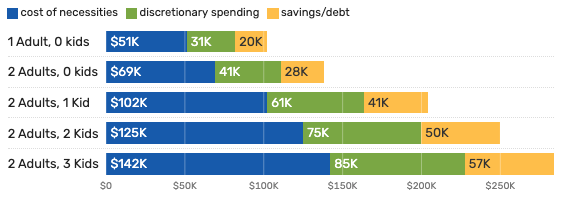

The analysis from Upgraded Points, a travel and financial advice company, calculated comfortable living wages across U.S. metro areas based on data from the Economic Policy Institute and the U.S. Census Bureau. The 50/30/20 rule is a budgeting strategy that recommends allocating 50% of income to needs, 30% to wants and 20% to savings and debt repayment. The framework was introduced by U.S. Sen. Elizabeth Warren, who also is a bankruptcy expert, with her daughter in their 2005 book “All Your Worth.”

But 20 years on, sticking to this budgeting rule has become nearly impossible for many people. Across New York’s metro areas, the ideal income for different household types under the 50/30/20 rule is roughly twice the median income — a pattern that also holds nationwide.

Article continues below this ad

The cost of necessities is calculated using data from the Economic Policy Institute’s family budget calculator, with inflation adjusted to 2025 dollars in the study. The figures show the income a family needs for a modest yet adequate standard of living, breaking out costs for housing, food, health care, taxes and more.

“Many families don’t have the discretionary spending. They want to save for college for their kids and just simply don’t have anything extra,” said Elise Gould, a senior economist from the Economic Policy Institute, pointing out that the budget rule is now unrealistic for many families. “They can have trouble making ends meet, let alone being able to invest in the future.”

Make the Times Union a Preferred Source on Google to see more of our journalism when you search.

Add Preferred Source

Among New York’s 13 metro areas, only four of them — the Capital Region, Buffalo, Syracuse, and Utica-Rome — have median personal incomes high enough to cover the basic cost of living for a single adult.

Article continues below this ad

The Ithaca metro area shows the biggest gap between median personal income and what a single adult needs for an adequate living, a shortfall of about $33,000 to $60,000.

With fewer entry-level jobs due to AI disruption, hiring practices that favor experienced workers, and rising rents, young adults are struggling to achieve financial stability and independence, according to a recent report by the office of state comptroller Thomas P. DiNapoli.

Related: Gen Z and millennial New Yorkers squeezed by costs, debt and fewer jobs

For a typical family of four — two adults and two children — all New York metro areas fall short of the income needed for an adequate standard of living. The average gap is about $20,000, which is smaller than the national gap of about $33,000.

Article continues below this ad

Looking specifically into the Albany-Schenectady-Troy metro area, the income needed to follow the 50/30/20 rule rises sharply with family size. Even a two-adult household with no children would require approximately $140,000 under the 50/30/20 method. The largest increase occurs when the family size grows from one child to two, adding roughly $66,000.

“If you happen to have an employer who’s providing health insurance, or you live in an area that has better child care or has free public transit, the income you need to meet a decent standard of living may be lower because you have those kinds of benefits,” Gould said.

Article continues below this ad