Most of the states’ inflation reduction checks have been sent to mailboxes, but the payout of up to $400 won’t be going to every state resident.

The checks — aimed at compensating New Yorkers for overpaying sales tax during heightened inflation — might not go to certain Social Security recipients who opted not to file state taxes because doing so wasn’t required, state officials confirmed on Wednesday.

The inflation refund check program has several requirements, including that residents file their 2023 state tax returns, officials said. There is also an income threshold and the person can’t be named as a dependent on someone else’s tax returns.

Because of that stipulation, inflation refund checks might not go out to some recipients of both Social Security and Supplemental Security Income (SSI), benefits that help people who are low-income, disabled, and 65 and older, according to officials.

WHAT NEWSDAY FOUNDNot every state resident will be getting a New York State inflation reduction check.The checks were aimed at compensating New Yorkers for overpaying sales tax during heightened inflation.The program has several requirements, including that residents must have filed their 2023 state tax returns, officials said.

Those beneficiaries who receive all their income from either program generally do not have to file state or federal taxes, experts say. Therefore, the nonfilers don’t meet the tax-filing requirement for the state inflation refund check, experts say.

David Silversmith, a certified public accountant in the Melville office of EisnerAmper, said there are several reasons a Social Security beneficiary might not file taxes, including when the spouse who handles finances dies or the beneficiary lacks the mental capacity to file.

But without a tax return, he said, the state has “no way for them to know either the person’s income or if they’re in the [inflation reduction program’s income] threshold.”

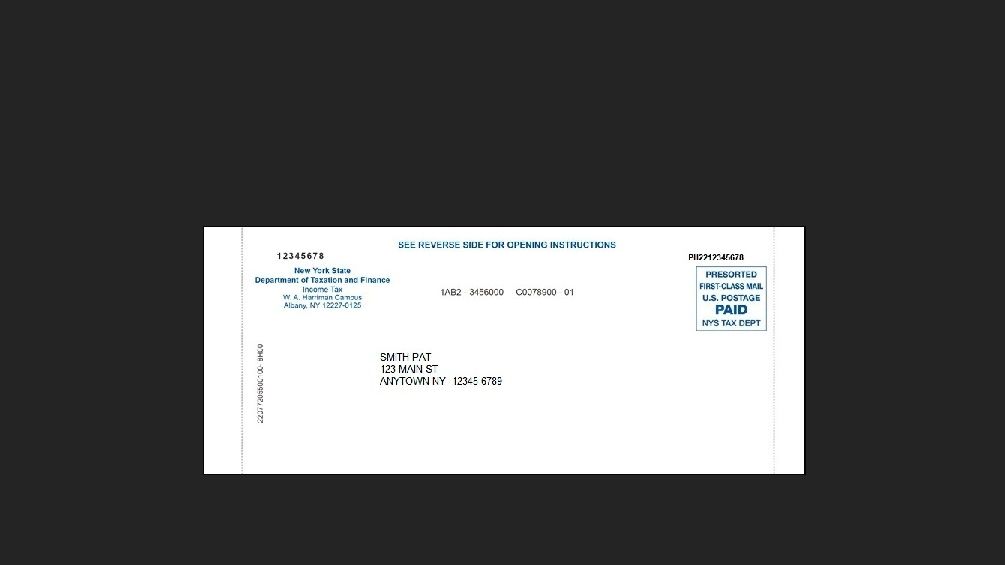

Gov. Kathy Hochul’s administration instituted the $2 billion check program to repay taxpayers after the state saw a surge in sales tax revenue amid heightened inflation, tax officials said. In New York, 6.5 million of the roughly 8 million inflation reduction checks have been sent out as of Wednesday, state officials said. The state’s population is almost 20 million.

The payout on the checks can be as high as $400 for a couple who files together or a qualifying surviving spouse who earns a maximum of $150,000, officials said. It can be as low as $150 for a person who files by themselves or as the head of a household and makes “more than $75,000, but not more than $150,000.”

However, some Social Security beneficiaries might not receive the payout due to tax rules, experts say.

Supplemental Security Income benefits are not taxable income, tax experts say. And New York does not tax Social Security benefits, experts say.

When determining whether Social Security benefits are federally taxable, provisional income is compared to a base amount.

For people receiving Social Security who don’t have other income, the provisional income is their total benefits, experts say. That amount is multiplied by 50%, and if it is equal to or lower than the base amount, then the person is not likely to be taxable and does not have to file. The base amount is over $25,000 for a single head of household and $32,000 for a married couple.

In New York, if a person files a federal return, they typically have to file a state return, experts said. Additionally, the state also requires that if a person doesn’t file a federal return but has other non-Social Security income over $4,000, they might have to file in the state.

“So if all they got was Social Security benefits, then they likely wouldn’t have to file a New York return, barring some other special circumstance,” said Carl Breedlove, principal tax research analyst with the Tax Institute at H&R Block.

However, Social Security beneficiaries might still have to file federally in other situations, such as if they have Affordable Care Act tax credits or have a self-employment income of more than $400, Breedlove said.

Lisa Rispoli, a partner-in-charge of private client services and trusted estates with accounting and advisory firm Grassi, said that for people who don’t have to file taxes, the decision to do so is a cost-benefit analysis.

“If they have to pay an accountant to do it, it’s not going to be worth it,” said Rispoli, also a CPA.

Rispoli added that a person might be able to get free tax help from the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly.

The Department of Taxation and Finance encouraged people who didn’t file taxes to do so.

“Even if you are of low or fixed income and are not legally required to file a tax return, there is nothing that prohibits an individual from filing a tax return to claim various credits and benefits,” the department said in an email to Newsday.

“State tax law,” the department said, “allows individuals and joint filers up to 3 years after the tax return is due to file an amended tax return.”

Tiffany Cusaac-Smith is a general assignment reporter for Newsday. She previously worked at USA TODAY and is an alum of Howard University.