If you are considering what to do with Blackstone stock right now, you are not alone. After all, it is the kind of investment that sparks real debate. On the one hand, its long-term momentum is striking, but short-term volatility has shaken some nerves. Over just the past month, shares of Blackstone have dropped by 14.0% and are down 9.1% so far this year. A more recent slide of 1.7% in just the past week adds to that uneasy feeling. Yet, all this comes after an incredible run: the stock has more than doubled over three years, up 106.0%, and skyrocketed 243.0% in five years. That is the kind of performance that captures imaginations, even when recent moves have disappointed.

Some of the latest headlines hint at the shifting tides behind these numbers. Blackstone made waves by selling a Manhattan office tower for $730M, and it is reportedly considering a big move for the UK’s Big Yellow Group. At the same time, rumors swirl about potential deals for high-profile holdings like ancestry.com. These headlines speak to opportunities, both to secure gains and to redeploy capital into new investments, but the downside risks are clearly front of mind for the market at the moment.

So, how does Blackstone stack up on valuation right now? Using a straightforward 6-point system, the company is undervalued in 0 out of 6 checks, giving it a value score of 0. That might not spark much excitement for pure bargain hunters, but valuation is rarely as simple as a checklist. Let us look at the main approaches to valuing Blackstone, while keeping an eye out for an even smarter way to judge what the shares are worth in today’s market.

Blackstone scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Blackstone Excess Returns Analysis

The Excess Returns model looks at how efficiently a company generates profits above the required return on its equity. For Blackstone, this approach pinpoints both the strength of its business and the hurdles to future value creation. The model examines key figures like return on equity and the surplus generated after covering the company’s cost of capital.

According to analyst forecasts, Blackstone’s Book Value currently stands at $10.67 per share, while its sustainable earnings per share (EPS) is projected at $3.79, based on the weighted average future Return on Equity estimates from five analysts. The company’s average Return on Equity is an impressive 43.47%, suggesting robust efficiency compared to most peers in the capital markets industry. The cost of equity is estimated at $0.72 per share, giving an excess return of $3.07 per share. The stable Book Value estimate, taken from three different analyst projections, is $8.71 per share.

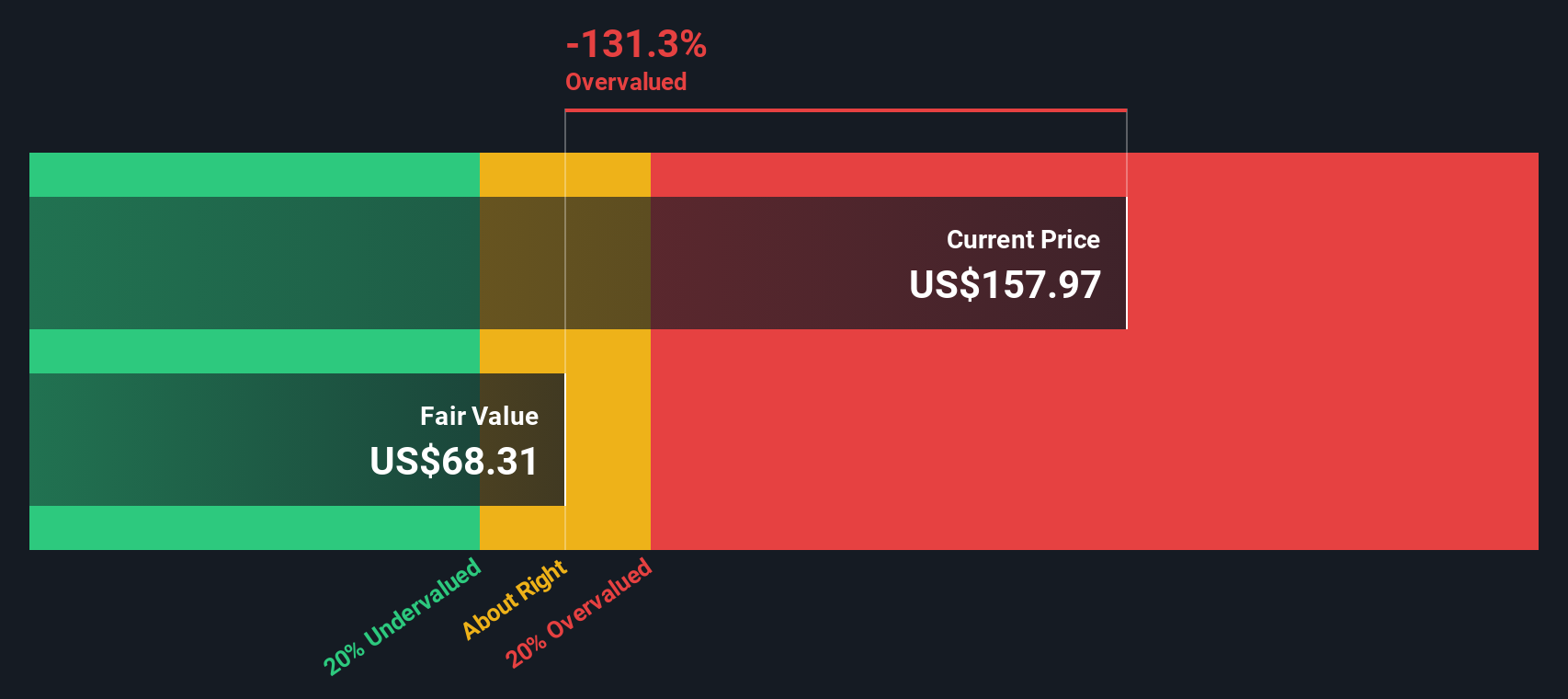

Taking all of this into account, the Excess Returns model estimates Blackstone’s intrinsic value at $68.31 per share. With shares trading significantly above this figure, the analysis shows the stock is 131.3% overvalued compared to the model’s benchmark.

Result: OVERVALUED

BX Discounted Cash Flow as at Oct 2025

BX Discounted Cash Flow as at Oct 2025

Our Excess Returns analysis suggests Blackstone may be overvalued by 131.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Blackstone Price vs Earnings

For companies like Blackstone that produce consistent profits, the Price-to-Earnings (PE) ratio remains one of the most widely used valuation tools. The PE ratio puts the company’s share price into context relative to its earnings, giving investors a snapshot of what the market is willing to pay for each dollar of profit. A higher ratio can often reflect optimism about future growth, while a lower one might signal caution or underappreciation by investors.

The “right” PE ratio for any business is about more than recent earnings alone. It is influenced by expectations around future growth, stability, and the specific risks facing the company or the wider sector. Robust profit margins and strong prospects often justify a higher multiple, whereas slower-growing firms or those in riskier markets generally see lower multiples.

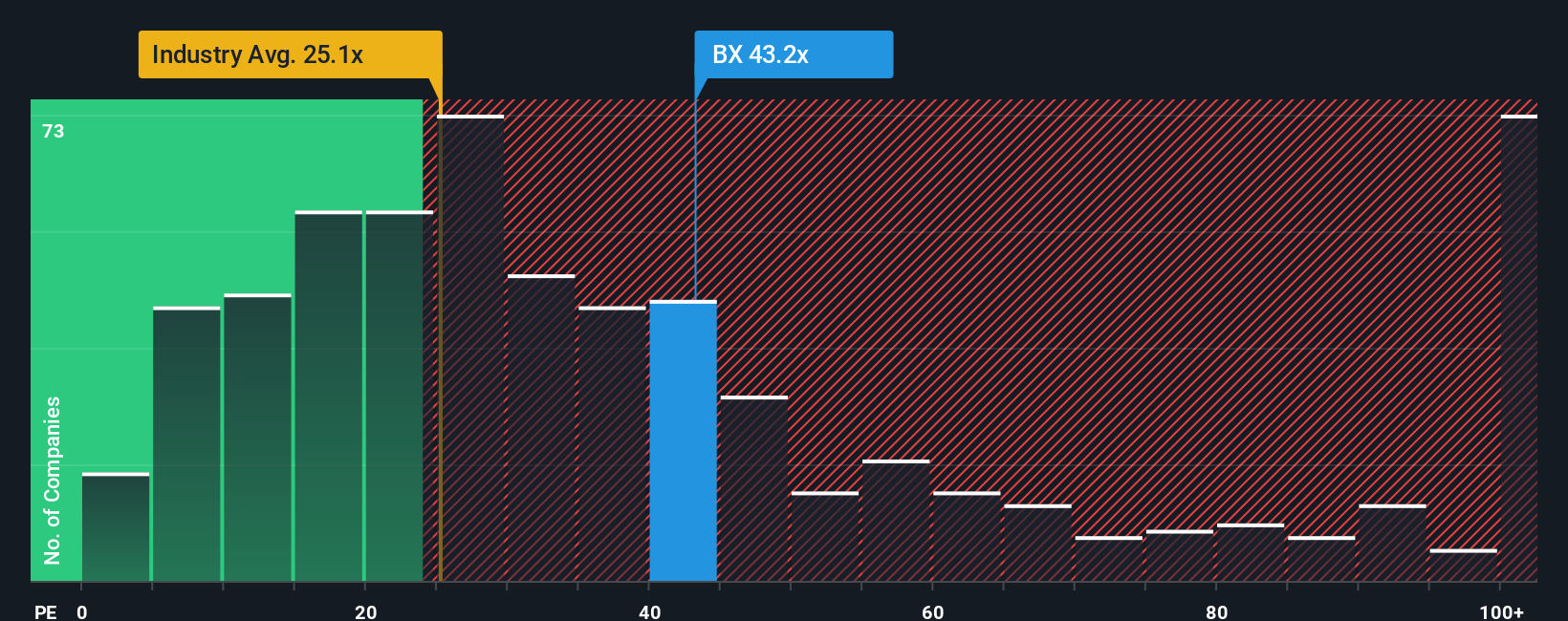

Currently, Blackstone trades on a PE ratio of 43.17x. That is well above the industry average of 25.13x and ahead of its peer average of 41.05x. However, Simply Wall St’s proprietary Fair Ratio, which factors in Blackstone’s size, growth outlook, risk profile, profitability, and its place in the capital markets industry, sits at 26.70x. This Fair Ratio provides a more tailored benchmark than broad industry or peer comparisons since it makes adjustments for financial strength and growth that can sway typical averages up or down.

Comparing Blackstone’s current 43.17x to its Fair Ratio of 26.70x, the stock appears notably overvalued using the PE approach.

Result: OVERVALUED

NYSE:BX PE Ratio as at Oct 2025

NYSE:BX PE Ratio as at Oct 2025

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Blackstone Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your perspective or story about a company’s future, including the strategy, catalysts, and risks you think matter most, tied directly to the numbers that back up your assumptions, such as fair value, future revenue, earnings, and margins.

What makes Narratives powerful is how they connect your view of a company with a financial forecast, and then link that forecast to a clear estimate of fair value. This helps investors translate their research and conviction into practical decisions. Narratives are easy to create and update on Simply Wall St’s platform, right in the Community page, where millions of investors share their outlook and compare updates in real time.

By building and following Narratives, you can judge whether a stock is worth buying or selling by directly comparing your fair value estimate to the current share price. As new information, such as news headlines or earnings releases, comes in, Narratives update automatically, making sure your investment thesis stays relevant and dynamic.

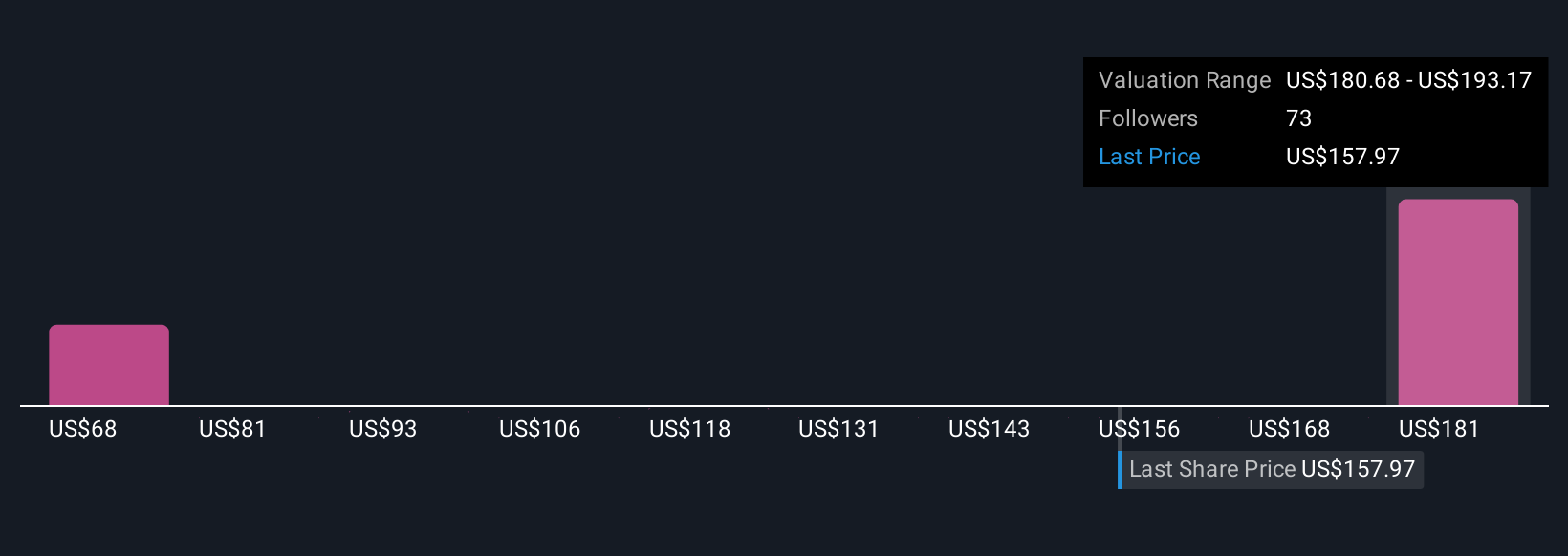

For example, with Blackstone, some investors believe it could be worth as much as $193 if global wealth and private markets continue expanding rapidly, while others see a fair value closer to $124 if operational risks and market saturation take center stage.

For Blackstone, we’ll make it really easy for you with previews of two leading Blackstone Narratives:

Fair Value Estimate: $181.68

Currently 13.0% below fair value

Expected Annual Revenue Growth: 16.7%

Analysts see strong future growth fueled by record capital inflows and a sizable “dry powder” reserve for new, opportunistic investments. Strategic partnerships in private credit and wealth management are expected to expand Blackstone’s market reach and profit margins, particularly as private credit grows by 35% year over year. Consensus price target suggests the stock is close to fairly valued. However, ongoing global economic and geopolitical risks could still impact revenues and real estate values.

Fair Value Estimate: $124.55

Currently 26.9% above fair value

Expected Annual Revenue Growth: 15.9%

Rapid expansion in infrastructure and private wealth could introduce operational inefficiencies, challenging Blackstone’s ability to sustain high profit margins. Heavy reliance on large-scale capital deployments and constantly evolving technology sectors may expose Blackstone to saturation and greater revenue unpredictability. Bullish growth in certain business lines is offset by concerns that market enthusiasm is overestimating future gains, with the current share price seen as significantly overvalued relative to pessimistic analyst assumptions.

Do you think there’s more to the story for Blackstone? Create your own Narrative to let the Community know!

NYSE:BX Community Fair Values as at Oct 2025

NYSE:BX Community Fair Values as at Oct 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com