Prosecutors say Paul Mitchell blew donation money on luxury goods, cash withdrawals and personal bills-while evading nearly $3 million in federal taxes

A Brooklyn pastor pleaded guilty Thursday to federal tax evasion charges after prosecutors said he stole millions of dollars from a church and affiliated daycare program and used the money to fund a years-long pattern of personal spending.

Paul Mitchell, 60, the lead pastor of a Brooklyn church, Changing Lives Christian Center, and president of its educational daycare, entered the guilty plea before US Chief Magistrate Judge Vera Scanlon in federal court in Brooklyn. He faces up to five years in prison, along with restitution and financial penalties, upon sentencing. According to the church website, Mitchell is described as a man of integrity. “Pastor Mitchell is a man of integrity and uprightness. He’s a giver of himself.”

Credit: US District Court Eastern District of NY

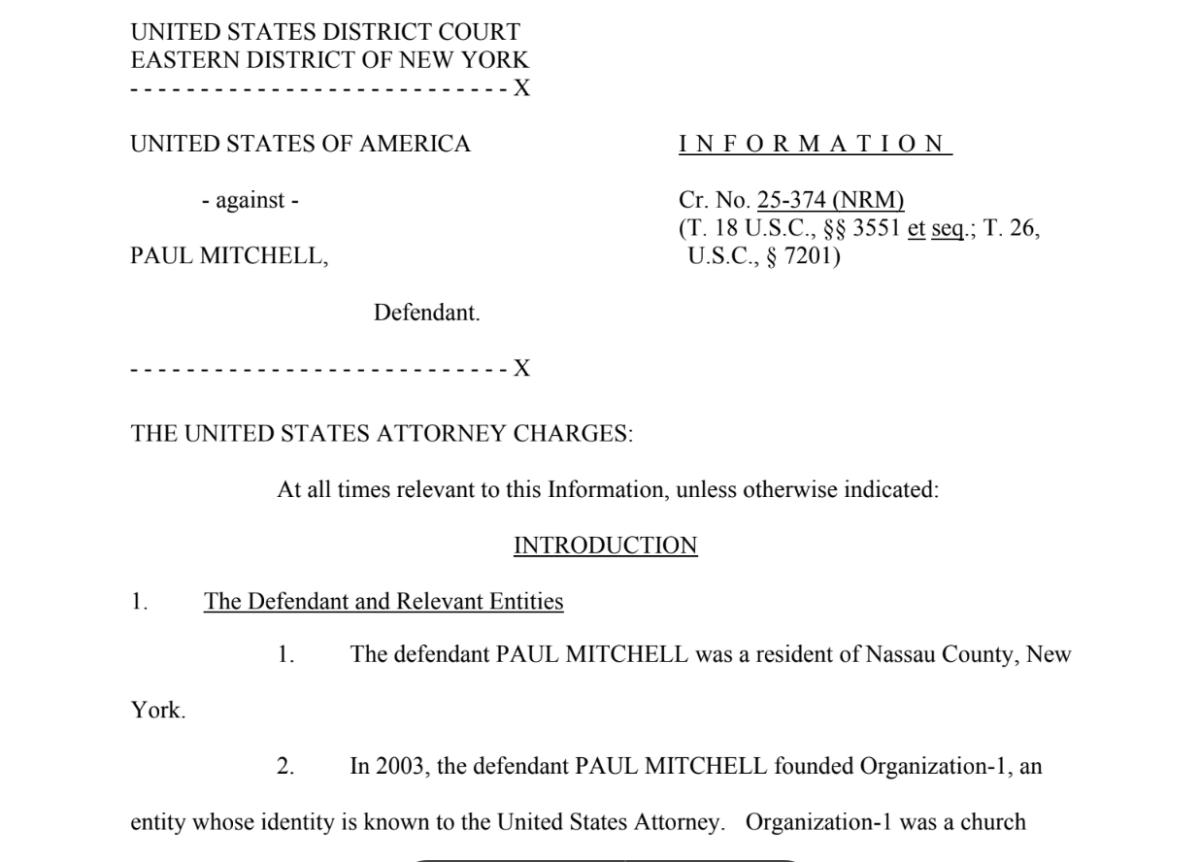

Credit: US District Court Eastern District of NY

According to federal prosecutors, Mitchell used credit cards and bank accounts belonging to the church and daycare between 2015 and 2022 to pay for personal expenses, including men’s clothing, jewelry, luxury accessories and life-insurance premiums. Prosecutors said he also wrote checks from the church’s accounts to cover his credit card bills, withdrew large sums of cash, and transferred organizational funds into his personal accounts.

Mitchell failed to report any of the stolen money as income on his tax returns, resulting in a tax loss of approximately $2.9 million to the IRS and $316,699 to New York State, according to court filings.

“The defendant treated his organization’s accounts as his own personal piggy bank, stealing millions of dollars and betraying the trust of his congregation and those dependent on the services provided to the community,” US Attorney Joseph Nocella, Jr. said in the official press release.

IRS-Criminal Investigation officials said Mitchell’s actions constituted both a breach of trust and a deliberate effort to evade tax obligations. “Paul Mitchell was trusted by his parishioners to use their donations for good, not to fatten his wallet,” said Harry T. Chavis, Jr., Special Agent in Charge of IRS-CI New York.

Scroll to continue reading

The case is being prosecuted by the US Attorney’s Office for the Eastern District of New York’s Public Integrity Section, along with the Justice Department’s Tax Division. A sentencing date has not yet been set.