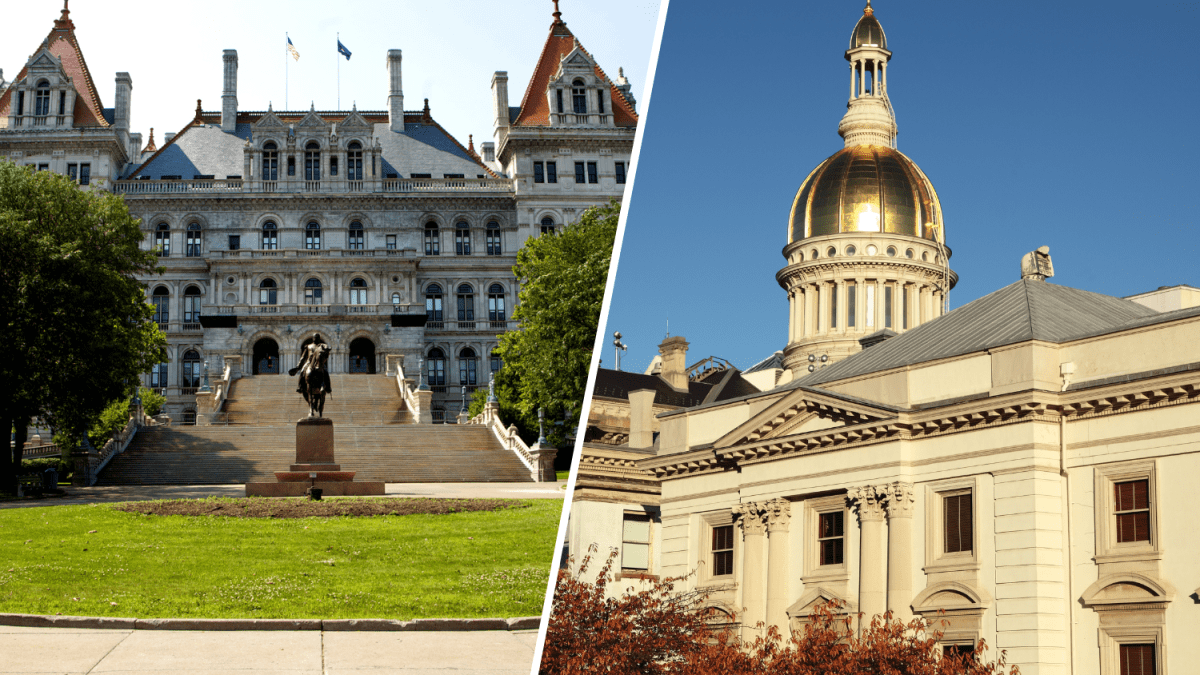

The new year is just around the corner — and with it comes new laws taking effect in New York and New Jersey.

Here’s a review of some of the most impactful pieces of legislation taking effect in 2026, affecting everything from salary to transit to taxes.

NEW YORK

Minimum wage goes up

In New York state, the minimum wage will increase to $17 per hour January 1 for New York City, Long Island, and Westchester County — an increase of $0.50. The minimum wage will be $16 per hour for the rest of the state.

This adjustment of $0.50 per hour is part of a planned series of increases, which will be indexed to inflation starting in 2027.

For more information, go here.

Expanded child tax credit for 1.6 million families

Starting in January, more than 1.6 million families can file for a child tax credit of up to $1,000 per child under age four. Families in 2026 will also continue to receive a child tax credit of up to $330 per child between ages 4 and 16.

Eligible New Yorkers will be able to claim the expanded child tax credit as part of the normal tax return filing process in 2026. Tax season opens at the end of January.

Find more information here.

New BABY Benefit for the most vulnerable families

Gov. Kathy Hochul launched a new BABY Benefit — a one-time $1,800 benefit at birth for New Yorkers who receive public assistance when they have a new baby. This nation-leading initiative will provide vital assistance to families at a critical time, helping support new parents, improve infant health, and reduce childhood poverty.

The BABY Benefit will help thousands of new, under-resourced parents across New York meet vital needs during a crucial period in their lives, the state says. This funding will help families pay for baby essentials — such as diapers, safe-sleep items, and clothing — and ease the financial burden associated with caring for a new baby.

Fare increases in subway and public transportation

New York City Transit

The base fare for subways, local buses, and Access-A-Ride is increasing 10 cents, from $2.90 to $3. The reduced fare is increasing from $1.45 to $1.50, and the express bus base fare is increasing from $7 to $7.25.

Long Island Rail Road and Metro-North Railroad

For the commuter railroads, an average increase of up to 4.5% will apply to monthlies, weeklies, and one-way peak tickets (excluding City Tickets). There will be no increase to Metro-North’s Port Jervis and Pascack Valley lines.

Bridges and Tunnels

One-way passenger-vehicle toll rates will increase between 20 cents to 60 cents at all bridge and tunnel facilities. This includes E-ZPass and Tolls by Mail. The existing toll discount programs for Queens, Bronx, and Staten Island drivers will remain in effect.

MetroCard comes to an end

The last day to buy or refill a MetroCard is Dec. 31, 2025, as the transit system fully transitions to OMNY, a contactless payment system that allows riders to tap their credit card, phone or other smart device to pay fares, much like they do for other everyday purchases.

End of criminal penalties for street vendors

This law removing all misdemeanor criminal penalties for general vendors and mobile food vendors takes effect March 9. Vendors who operate without a license could be subject to a violation and a fine or a civil penalty. Vendors who violate any other street vending laws will be subject to a civil penalty.

Law Effective Date: March 9, 2026

For more information, go here.

Transparency about salary to delivery workers

This law will require delivery services to pay their contracted delivery workers no later than 7 calendar days after the end of a pay period. This law will also require delivery services to provide each contracted delivery worker with an itemized, written statement that outlines their compensation no later than 7 days after the end of the pay period. Also, it will require delivery services to retain such statements for at least three years, and provide copies to contracted delivery workers upon request.

Law Effective Date: January 26, 2026

Gratuities for food delivery workers

This law will require third-party food delivery services and third-party grocery delivery services that offer online ordering to request gratuities for food delivery workers and grocery delivery workers before or at the same time an online order is placed.

Law Effective Date: January 26, 2026

Outreach about fraudulent schemes committed by providers of immigration assistance services

The Department of Consumer and Worker Protection (DCWP) is required to conduct outreach and education about fraudulent schemes committed by providers of immigration assistance services.

This law will require the outreach to include information about common fraudulent schemes and how to avoid them, and to be conducted through specific media, including the internet and subway advertisements. The bill will also require DCWP to report annually on its outreach and education efforts, as well as complaints and inspections related to providers of immigration assistance services.

Law Effective Date: January 26, 2026

New all-electric buildings

Starting in 2026, most new construction of buildings in New York that are 7 stories or shorter must be built to use electric heat and appliances. This will also apply to larger commercial buildings with 100,000 square feet or more of conditioned floor area (bigger businesses).

Safe delivery device access for contracted delivery workers

This law establishes safety requirements for powered bicycles when used by contracted delivery workers who deliver for delivery services. Specifically, the law requires that any powered bicycle operated by a contracted delivery worker on behalf of a delivery service meet local standards established for the sale of such a device, which includes certification by an accredited testing laboratory.

Such device may be provided by the delivery service or the worker, but the delivery service cannot require that the worker obtain a compliant device as a term of employment.

More protection for consumers

From simplifying the process of canceling recurring online subscriptions to cracking down on overdraft fees that target low-income consumers, these measures intend to help people fight unfair corporate practices.

A new law will require businesses to notify consumers of upcoming renewals and price changes, as well as provide clear instructions on how to cancel subscriptions.

The new law will require online retail sellers to post return and refund policies in a way that is easily accessible for consumers.

This legislation introduces safeguards, such as disclosure requirements, dispute resolution standards, limits on all charges and fees, and data privacy protections to ensure consumers are better protected when using these financial products.

Businesses will be required to disclose clearly to consumers when a price was set by an algorithm using their personal data, subject to certain exceptions.

NEW JERSEY

Minimum wage goes up

New Jersey’s statewide minimum wage will increase by $0.43 to $15.92 per hour for most employees, effective January 1.

Under the law, the minimum wage rate for employees of seasonal and small employers will continue to increase gradually until 2028 to mitigate the financial impat to the businesses. The minimum hourly wage for these employees will increase to $15.23 on Jan. 1, up from $14.53.

Agricultural workers are guided by a separate minimum wage timetable under the law, and their minimum wage rate will continue to increase incrementally until 2030. Employees who work on a farm for an hourly or piece-rate wage will see their minimum hourly wage increase to $14.20, up from $13.40.

Additionally, long-term care facility direct care staff will see minimum hourly wage rise by $0.43, to $18.92.

The minimum cash wage rate for tipped workers will rise to $6.05 an hour from $5.62, with the maximum tip credit employers are able to claim remaining at $9.87. If the minimum cash wage plus an employee’s tips do not equal at least the state minimum wage, then the employer must pay the employee the difference.

New cabinet-level Department of Veterans Affairs in New Jersey

This legislation establishes a new cabinet-level Department of Veterans Affairs in New Jersey, reorganizing the existing Department of Military and Veterans Affairs (DMAVA).

Currently, the Department of Military and Veterans Affairs manages both military operations and veterans’ services. Under this bill, the newly established Department of Veterans Affairs will exclusively focus on veteran-related matters, such as delivering housing, healthcare, mental health services, and benefits for veterans and their families.

Military functions will continue at the current department, which will be renamed the Department of Military Affairs.

Gas tax rate will increase by 4.2 cents

New Jersey’s gas tax rate will increase by 4.2 cents per gallon beginning on January 1 to support the State’s Transportation Trust Fund (TTF) program. This increase is the result of the 2024 law (Chapter 7), which gradually raises the State’s Highway Fuel Cap from Fiscal Year 2025 through Fiscal Year 2029. The Fiscal Year 2026 Highway Fuel Cap is set by statute at exactly $2.115 billion, which is 4.1 percent higher than the previous baseline level of $2.032 billion, and will increase each fiscal year, reaching $2.366 billion in FY 2029.

This article will be updated with new laws.