]]>

New York’s most recent round of state water and sewer funding is translating into a broad pipeline of municipal construction work entering procurement in early 2026, as projects across the state advance from planning and design into bid-ready and early execution phases.

More than $453 million awarded late last year through programs administered by the New York State Environmental Facilities Corp. is supporting wastewater treatment upgrades, drinking water reliability projects and sewer system expansions across multiple regions. While the awards were announced months ago, their construction impact is only now becoming clear as owners move projects into procurement and field execution.

]]>

In announcing the funding, Gov. Kathy Hochul (D) said the state aims to support communities in completing long-overdue infrastructure projects without burdening ratepayers with additional costs.

“New Yorkers should not be burdened by rising water bills and outdated systems,” Hochul said, adding that the awards are intended to allow local governments to move forward with essential projects without passing “unsustainable costs to residents and businesses.”

In the Hudson Valley and Lower Upstate corridor, several large wastewater treatment and conveyance projects are advancing through environmental review or late design, positioning them for bid release this year. In many cases, state grants closed financing gaps that had delayed projects or constrained scope as construction costs escalated. With funding secured, municipalities are now pressing toward procurement to stabilize pricing and secure labor.

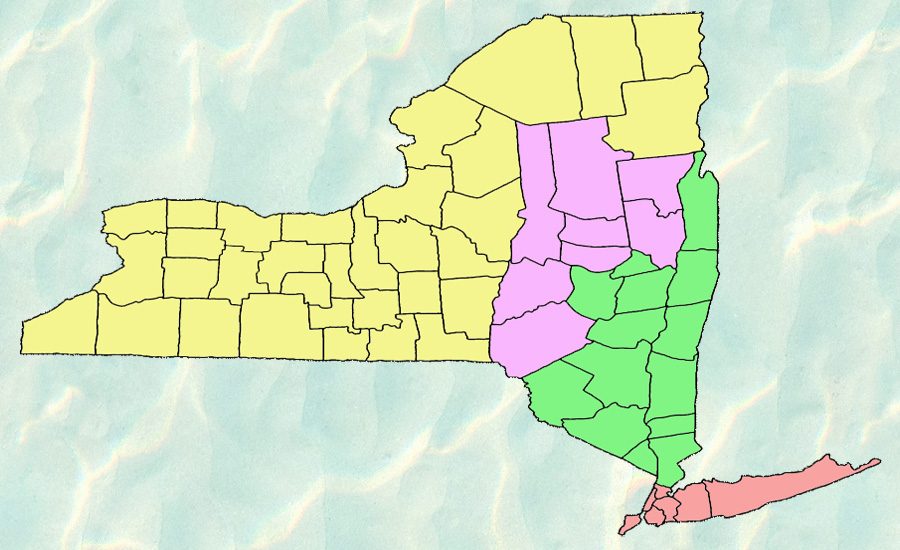

ENR grouped New York’s water and sewer awards into four regions to analyze how state-funded projects are moving from funding into procurement and early construction in 2026. Click each map for details

Across regions, owners are breaking work into phased or discipline-specific bid packages to manage procurement risk, particularly for projects at active treatment facilities. Several municipalities are expected to release bid packages in clusters through mid-2026 rather than evenly across the year, increasing competition during peak procurement windows.

]]>

On Long Island, the current award list is dominated by drinking water treatment projects targeting emerging contaminants such as 1,4-dioxane and PFAS. Those projects typically generate equipment-driven scopes that can move efficiently from bid to construction once designs are finalized. Although New York City is not listed among the recipients in this funding round, its ongoing capital programs continue to define the state’s largest and most complex water and wastewater construction market.

Western and Northern New York account for the largest geographic share of funded work, spanning treatment plant improvements, regional sewer expansions and system rehabilitation projects.

Several of the biggest awards in this region are tied to multi-phase projects expected to generate successive bid packages over multiple construction seasons, providing sustained work rather than one-off contracts.

In the Capital Region and Mohawk Valley, funding is supporting treatment plant modernization and corridor-scale transmission work along the Mohawk River, with several awards tied to multi-phase capital programs rather than standalone repairs.

Albany County Executive Daniel P. McCoy said the county’s sewer infrastructure has been operating “beyond its original design capacity” and that state funding will allow long-planned upgrades to move forward, making the system “safer, more resilient, and prepared to meet current and future environmental standards.”

RELATED

Drinking Water Leaders Convene to Tackle Funding Challenges, Forever Chemicals

State environmental officials have framed the awards as a mechanism to accelerate execution rather than extend planning timelines. New York Dept. of Environmental Conservation Commissioner Amanda Lefton said the funding will support “dozens of critically important infrastructure projects” statewide, enhancing water quality while delivering long-term environmental and economic benefits.

Across all regions, most construction contracts remain unawarded. Design services are typically secured before state funding approvals, and many projects are only now aligning final designs, permits and procurement documents. Owners are increasingly focused on bid timing and packaging as they balance delivery pressure against remaining cost uncertainty.

Taken together, the awards point to a steady, statewide cadence of water and wastewater construction entering the market in 2026 rather than a single surge. ENR’s regional pop-outs above are not intended as a comprehensive project list but as an execution-focused snapshot of where state funding is translating into near-term construction activity.

For contractors, the relevance lies less in the headline funding total than in how projects are distributed by region, size and execution readiness—factors that will shape bidding strategies and backlog planning throughout the year.