SL Green Realty (SLG) just announced its third-quarter 2025 results, showing a swing back to net income with higher revenues compared to last year. The company also unveiled major lease signings and new property acquisitions in Manhattan.

See our latest analysis for SL Green Realty.

Even with upbeat quarterly results and some eye-catching Manhattan acquisitions, SL Green Realty’s share price hasn’t escaped the recent drag in real estate stocks. The company has logged a 1-year total shareholder return of -28.05% and a year-to-date share price drop over 23%. Some of this pressure ties back to broader market volatility and investor caution around office landlords. At the same time, momentum in leasing and property deals hints at recovery potential for the long term.

If you’re curious where else momentum is building outside of traditional sectors, now’s the moment to broaden your investing radar and discover fast growing stocks with high insider ownership

With SL Green Realty delivering a profitable quarter and major New York acquisitions, but shares still trading at a sizable discount to analyst targets, is this the right moment for value hunters or are future gains already reflected?

Most Popular Narrative: 16.9% Undervalued

Compared to the last close price of $52.59, the most widely followed narrative assigns a fair value of $63.28, suggesting notable upside potential. The gap between current price and narrative valuation signals a disconnect based on projected earnings recovery and premium assets in New York City.

Portfolio optimization and disciplined capital recycling, including strategic dispositions and realizing significant gains on debt and preferred equity investments, are strengthening liquidity. This is setting the stage for new accretive investments and reducing interest expense, which may enhance future earnings growth.

Want to know what bold financial levers underlie this optimistic valuation? The narrative rests on turning strategic portfolio maneuvers and expected margin improvement into future profit dynamics. Peek behind the curtain to see what key assumptions are driving the numbers the crowd is watching.

Result: Fair Value of $63.28 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent high interest rates and unpredictable tenant departures could undermine SL Green’s earnings momentum and cast doubt on the recovery narrative.

Find out about the key risks to this SL Green Realty narrative.

Another View: Risk Hiding in the Price Tag?

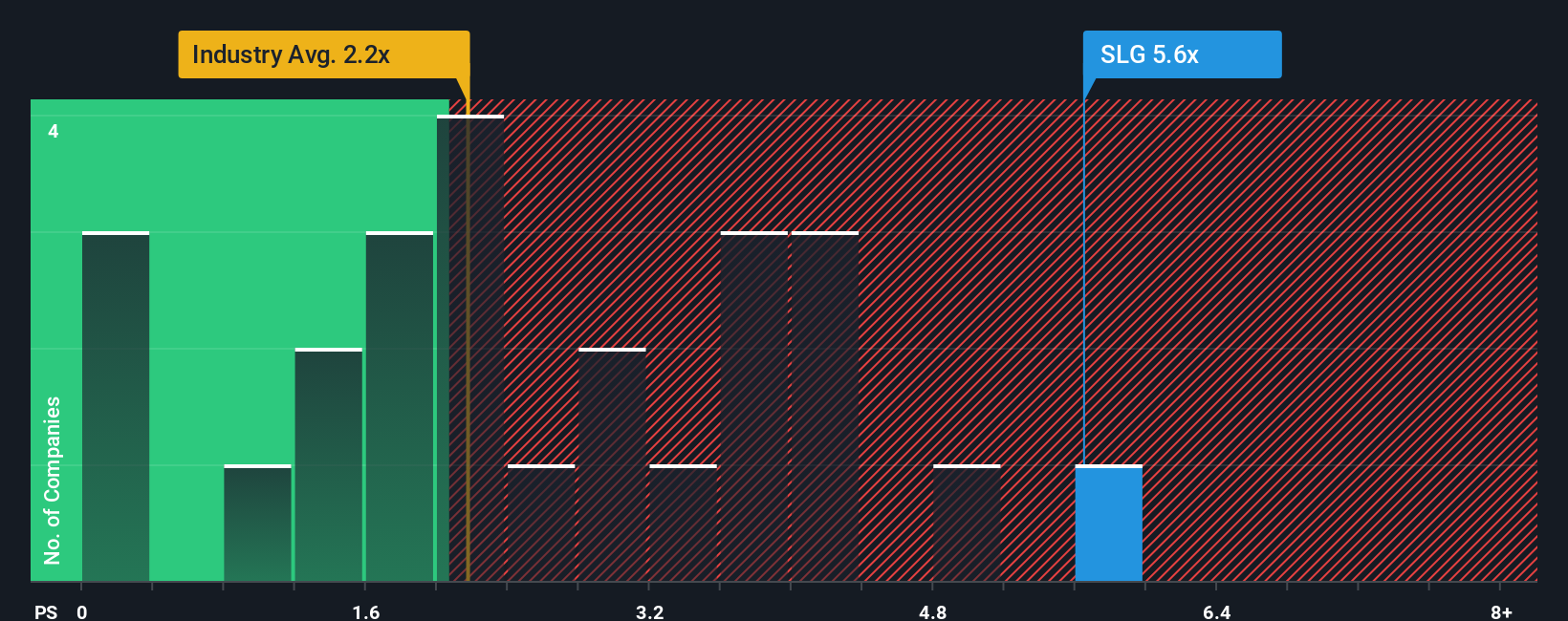

While the consensus target points to upside, our view using the price-to-sales ratio sets a contrasting tone. SL Green trades at 5.6 times sales, well above both peers (4.3x) and the US Office REITs industry average (2.2x). The fair ratio suggests the market could shift closer to 2.2x. Does this premium expose value investors to a hidden risk, or does it reflect unique strengths in Manhattan assets?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:SLG PS Ratio as at Oct 2025 Build Your Own SL Green Realty Narrative

NYSE:SLG PS Ratio as at Oct 2025 Build Your Own SL Green Realty Narrative

If the consensus doesn’t match your take or you’d rather rely on your own due diligence, you can craft a personal narrative in just a few minutes Do it your way

A great starting point for your SL Green Realty research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know when to look beyond the obvious. Tap into new opportunities and see where your portfolio could go next with these handpicked stock lists:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com