After 10 years of slowly rising property tax rates, the upward trend appears to be picking up steam with the potential for multiple hikes in close succession.

In Pennsylvania, counties are charged with assessing property. Allegheny County last did that in 2012, with the values taking effect in 2013.

Many properties have kept the assessments assigned then. Others have not. Property owners and taxing bodies can appeal assessments, arguing that they don’t reflect market values. Tens of thousands of appeals have created a jagged tax landscape in which similar, nearby properties can have very different tax bills.

In 2024, the Pittsburgh Public Schools sued the county, seeking to compel reassessment of all property, and the case is now before the Commonwealth Court. A homeowner represented by the district’s solicitor sued last year, and that case is in Common Pleas Court.

The latest legal maneuvering: Allegheny County Council is scheduled to vote Tuesday on a motion authorizing the county solicitor to “pursue a legal remedy against the Commonwealth of Pennsylvania challenging the uniformity of the commonwealth’s assessment system.”

County leaders have long criticized the state’s system, which does not require counties to reassess on a regular basis.

With property taxes still largely pegged to values assigned 13 years ago, taxing bodies facing rising costs have had to jack up millage to boost revenue. A mill is a dollar of taxes owed on $1,000 of assessed value.

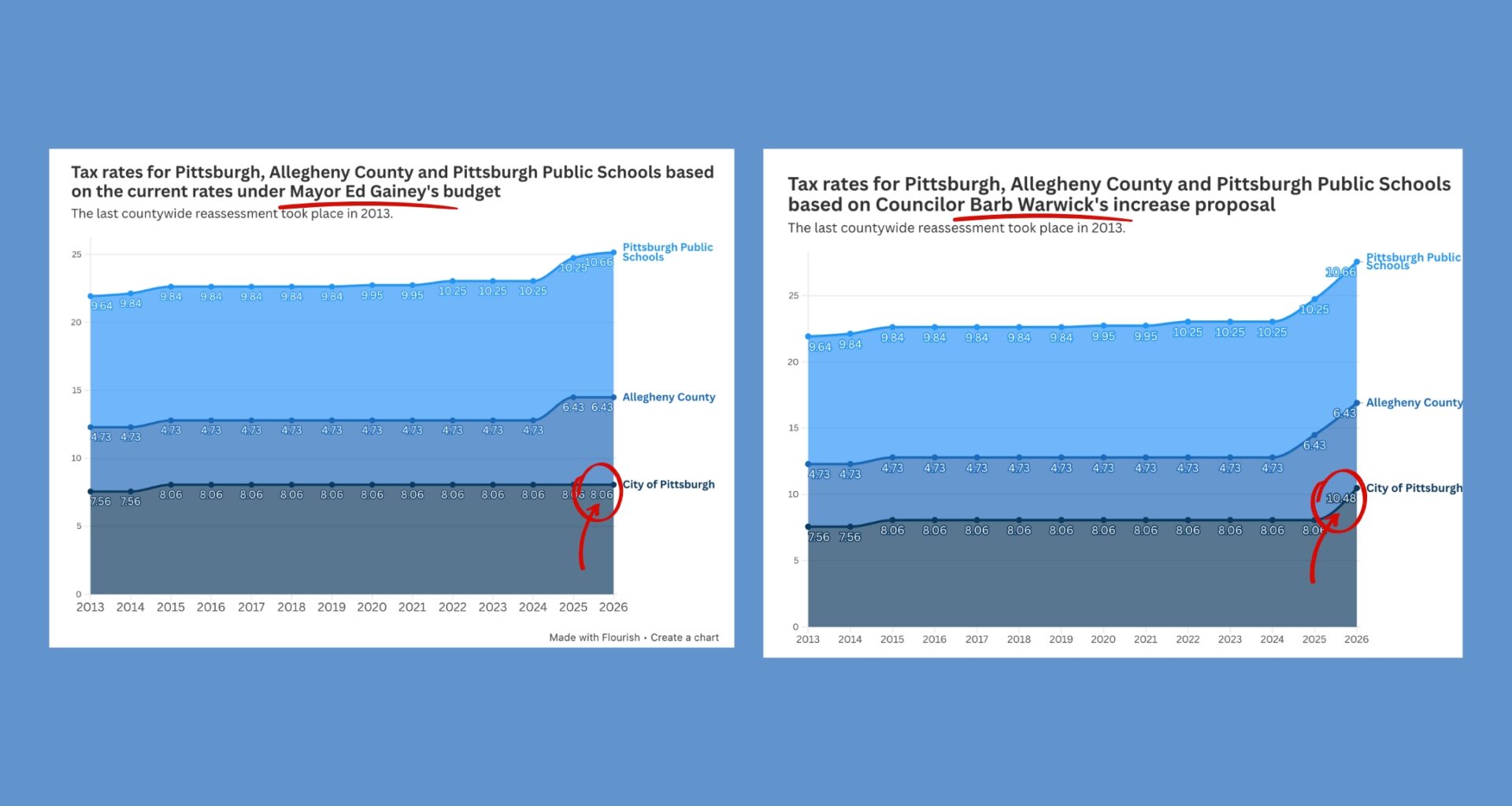

In 2013, owners of properties in the city had to pay a total just shy of $22 per $1,000 in assessed value to the city, county and school district combined — minus modest exemptions if for owner-occupied homes. A series of modest hikes brought that up to $23 by 2024.

The county was the first out of the gate with a big hike, pushing its millage rate up by 36% effective this year. Its 2026 budget does not include a tax hike.

The school district appears poised to follow the county this year with a 4% tax boost, if its board agrees.

PPS is weighing a $729.7 million budget with a $6.3 million operating deficit. If the board approves the tax increase, it would generate an additional $7 million in revenue. If the board does not approve it, the district’s operating deficit would rise to $14 million.

District CFO Ron Joseph has said assessment appeals and tax refunds sought by Downtown commercial property owners have added to the district’s growing financial crisis. Last month, the PPS board rejected the administration’s Future-ready plan that was expected to save the district $102.8 million by closing nine schools. The plan, however, would have only narrowed the district’s operating deficit, which was expected to increase again after 2028.

The school board is scheduled to vote on the budget Dec. 17.

The biggest question is the city, where outgoing Mayor Ed Gainey has presented a budget, widely maligned as unrealistic, without a tax hike.

Councilor Barb Warwick has countered with a proposal for a 30% hike. Warwick said department leaders have told council that additional budget cuts — the only alternative to raising taxes — would diminish resident services. She also noted that the city’s vehicle fleet needs at least $10 million per year more than its current allocation.

It’s not clear how many council members support Warwick’s plan; council has met behind closed doors to hear about their options and will unveil its choices later this month.

City Council has laid out a schedule that includes a Dec. 20 public hearing and Dec. 21 votes.

Lajja Mistry is the K-12 education reporter at Pittsburgh’s Public Source. She can be reached at lajja@publicsource.org.

Charlie Wolfson is the local government reporter for Pittsburgh’s Public Source. He can be reached at charlie@publicsource.org.

Rich Lord is the managing editor of PublicSource, and can be reached at rich@publicsource.org.

This <a target=”_blank” href=”https://www.publicsource.org/pittsburgh-tax-rate-hike-allegheny-county-assessments/”>article</a> first appeared on <a target=”_blank” href=”https://www.publicsource.org”>Pittsburgh’s Public Source</a> and is republished here under a <a target=”_blank” href=”https://creativecommons.org/licenses/by-nd/4.0/”>Creative Commons Attribution-NoDerivatives 4.0 International License</a>.<img src=”https://i0.wp.com/www.publicsource.org/wp-content/uploads/2025/07/cropped-ps_circle_favicon_blue.png?resize=150%2C150&ssl=1″ style=”width:1em;height:1em;margin-left:10px;”>

<img id=”republication-tracker-tool-source” src=”https://www.publicsource.org/?republication-pixel=true&post=1327131&ga4=G-CCLXQK5C14″ style=”width:1px;height:1px;”><script> PARSELY = { autotrack: false, onload: function() { PARSELY.beacon.trackPageView({ url: “https://www.publicsource.org/pittsburgh-tax-rate-hike-allegheny-county-assessments/”, urlref: window.location.href }); } } </script> <script id=”parsely-cfg” src=”//cdn.parsely.com/keys/publicsource.org/p.js”></script>