Despite this year’s tough venture capital market, some Philly startups are still securing funding.

How do they do it? One company that recently closed a round says the key is widening the pool of potential investors.

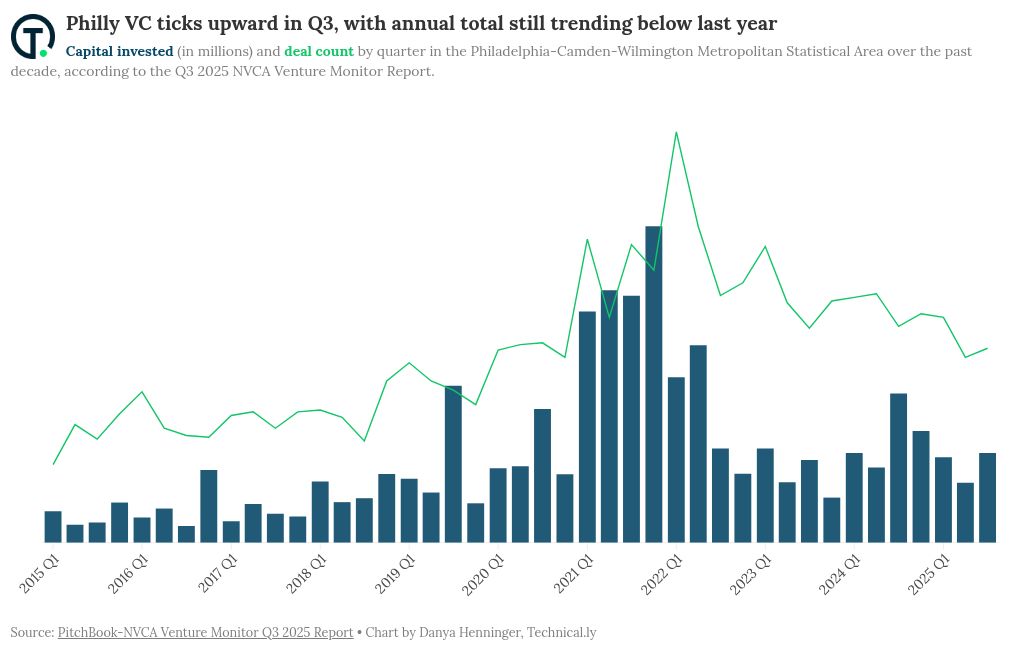

Venture capital activity in Philly bounced back a bit in Q3 2025, raising $877.2 million over 107 deals, according to the latest Venture Monitor report, released quarterly by PitchBook and the National Venture Capital Association.

“My best advice right now is to be aggressive, targeted and efficient.”

Samuel Reeves, founder and CEO at FORT Robotics

The improvement stemmed from big raises like automation company FORT Robotics’ $43.9 million Series B. The company added $18.9 million to the round last quarter, making it the fourth largest raise across the Philly region, according to the report. Founder and CEO Samuel Reeves says that it’s important to center the company’s core mission, no matter the circumstances of the venture capital market.

“Entrepreneurs who naturally like to challenge conventional wisdom and disrupt the status quo will still find pockets of interested investors,” Reeves told Technical.ly, “but you have to be more expeditionary in seeking them out.”

Despite investors’ optimism at the end of 2025, venture activity overall has been down this year due to economic and policy uncertainty, like tariffs, PACT president Dean Miller previously told Technical.ly. Unpredictability at the macroeconomic level causes investors to be extra cautious when making investments.

Philly’s most recent numbers are an improvement from Q2, when the region had its lowest quarter for VC in the last five years, only bringing in $550.5 million and 102 deals. Q3 also came out slightly better than Q1 of this year, which brought in $783 million over 124 deals.

Founder advice: Pitch to a variety of investors

FORT’s latest round saw support from existing institutional investors, but also new interest from family offices, companies that manage money and make investments for wealthy families, he said.

“It shows that interest in robotics and physical AI is broadening far beyond traditional venture capital and reaching a universal investor audience,” Reeves said.

Regardless of the sector, Reeves also advises startups to incorporate the impact of AI into their pitch, which aligns with current trends. AI continues to drive VC activity in the United States, making up almost 40% of the country’s deal count last quarter, according to Kyle Stanford, director of US venture research at PitchBook.

For companies that are currently fundraising, Reeves warns that the process is a numbers game and that founders should be prepared to pitch dozens of times before securing a deal.

“My best advice right now,” Reeves said, “is to be aggressive, targeted and efficient.”