Berks Family Business Alliance, a special program of the Greater Reading Chamber Alliance, recently hosted experts in human resources and estate planning for a presentation on preparing for the future.

The Dec. 11 presentation was held at GRCA’s Center for Business Excellence in Wyomissing.

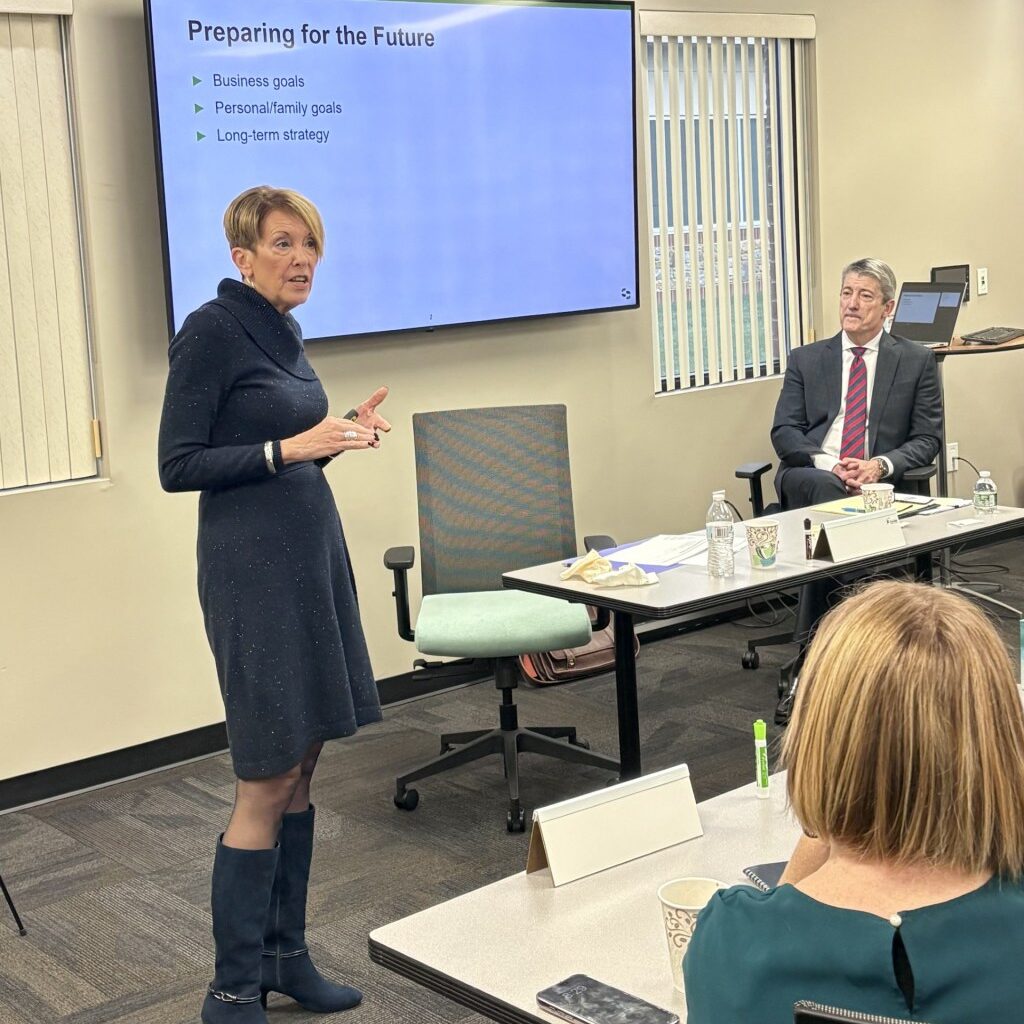

It featured Laurel Cline, managing director at Cherry Bekaert, and Brian Boland, head of Kozloff Stoudt’s Estate Planning and Administration Department, and was attended by 25 family business owners.

25 family business owners attended an event by the Berks Family Business Alliance on preparing for the future. (Courtesy of the Greater Reading Chamber Alliance)

25 family business owners attended an event by the Berks Family Business Alliance on preparing for the future. (Courtesy of the Greater Reading Chamber Alliance)

Cline offered advice on building a people strategy for retirement, selling or scaling the business, while Boland focused on the legal facets of business and estate planning, the GRCA said in a release.

Building a people strategy

Cline said that when looking to retire, sell or scale, it is essential to identify critical roles and competencies, and whether employees with the skills to fill them are already available.

She said long-term incentive plans can help retain workers who have the needed skills or the aptitude to acquire them, but who may not be a part of the family or ownership.

“You have to think about what’s going to motivate that talent,” Cline said in the release. “What are they looking for, and, depending on your strategy, how do you best attract, retain and incentivize that person to do what you need for your business.”

Cline gave an example of a client whose business had an untimely death in its second generation and the third generation was not ready to take the reins.

She said she worked with the business to find employees who had the potential to fill that void, set expectations for their performance and motivate them to stay.

“Sometimes it’s just something as simple as we want to pay competitively,” Cline said. “Or we know we’re going to be not as competitive on base salary, but we’re going to offer people a better variable comp plan or bonus plan.”

A few long-term incentives that employers can offer include stock plans, stock appreciation rights, supplemental executive retirement plans and book value plans.

Legal perspective on business and estate planning

Boland emphasized that when business owners meet with a legal team it’s important to give them the entire story so they can best fine-tune what is right for the business.

Sometimes that means protecting the business assets from those who are not family, Boland said in the release.

He said protective measures might include asking those marrying into, or already married into, a family to sign a prenuptial or postnuptial agreement saying they are not entitled to any company stock.

Attending Family Business Alliance peer groups can be helpful to family business owners who want to discuss more sensitive topics without family around, Boland said.

“You get to toss around some very personal ideas and help each other,” he said in the release. “We may not come up with an answer that first time but help them move along the path that gets them a little closer to an answer that hopefully makes the business a little bit more successful.”

Boland said the attendees were already ahead of the curve by attending the session because many clients come to him and want to make big changes such as offering private equity or an employee stock ownership plan.

He said he often challenges those clients to understand why they want to make that decision and what problem those changes would solve.

Patrick Dolan, president of Dolan Construction, said the presentation helped him look beyond today.

“It had people thinking about their future, their retirement, the implications on the estate plan and just an overall broader picture,” Dolan said in the release.