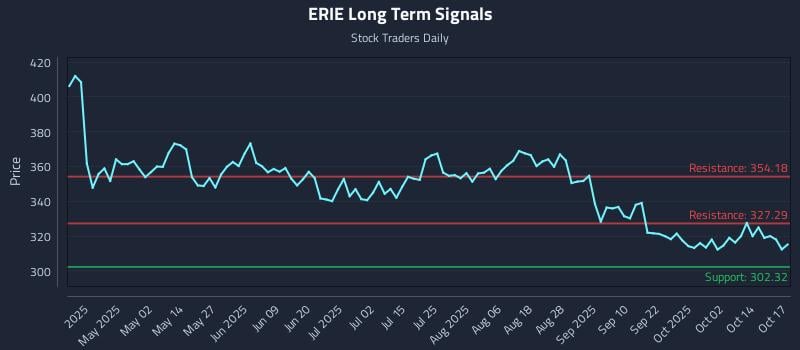

Key findings for Erie Indemnity Company (NASDAQ: ERIE)Near-Term Weak Sentiment May Signal Resumption of Long-Term Weakness After Neutral ShiftA mid-channel oscillation pattern is in play.Exceptional 26.3:1 risk-reward short setup targets 7.6% downside vs 0.3% riskSignals: 302.32 · 316.66 · 327.29 · 354.18 (bold = current price)Weak Sentiment is prevailing thus far — See current SIGNALS for positioning and risk parameters.

Institutional Trading Strategies

Our AI models have generated three distinct trading strategies tailored to different risk profiles and holding periods. Each strategy incorporates sophisticated risk management parameters designed to optimize position sizing and minimize drawdown risk.

Multi-Timeframe Signal AnalysisTime HorizonSignal StrengthSupport SignalResistance SignalNear-term (1-5 days)Weak$308.06$313.50Mid-term (5-20 days)Neutral$313.82$325.55Long-term (20+ days)Weak$327.29$354.18

AI Generated Signals for ERIE

Blue = Current Price

Red = Resistance

Green = Support